Central Bank Digital Currencies (CBDCs) continue to grow. The Reserve Bank of Australia (RBA) is the latest entrant to delve into CBDCs’ real-life utility.

Central banks worldwide have explored the possibility of issuing Central Bank Digital Currencies (CBDCs). Some have already launched pilot programs to test their feasibility. A CBDC is a digital currency issued and backed by a central bank designed to function as a digital equivalent of physical cash.

Of late, The Reserve Bank of Australia (RBA) has announced its plans to launch a “live pilot” of a Central Bank Digital Currency (CBDC). The move is in response to the growing interest in digital currencies and the need for a more efficient payment system.

Use Cases for CBDC in Australia

The RBA collaborated with the Digital Finance Cooperative Research Centre (DFCRC) on a research project to explore CBDC’s utility and economic benefits.

The CBDC research project received submissions from different participants. The project ‘involves selected industry participants demonstrating potential use cases for a CBDC using a limited-scale pilot CBDC that is a real digital claim on the Reserve Bank,’ the report added.

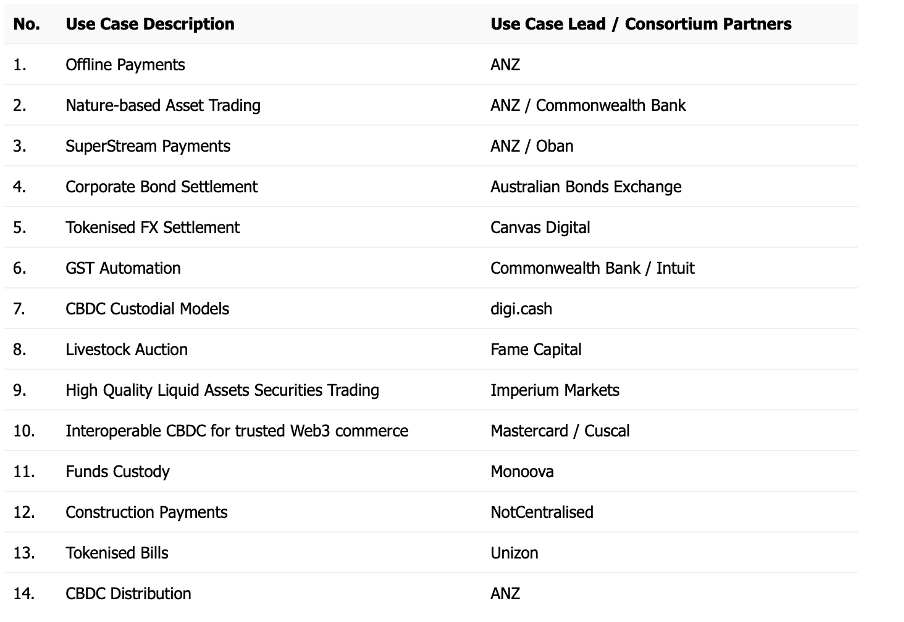

The RBA’s partners for the pilot projects include the Australia and New Zealand Banking Group Limited (ANZ), Mastercard, Monoova, the Australian Bond Exchange, DigiCash, Commonwealth Bank, and others. Utility varies from offline payments to “trusted Web3 commerce” and several more, as shown in the table below.

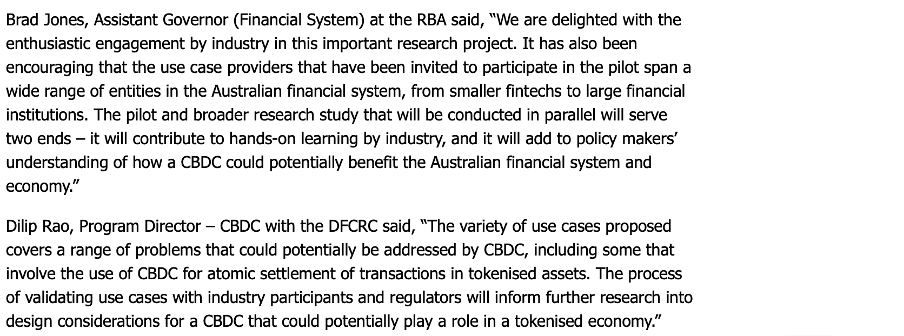

Two key representatives gave their narratives around the critical development, as shared in the screenshot below.

Other Banks Working on the CBDC Pilot Mode

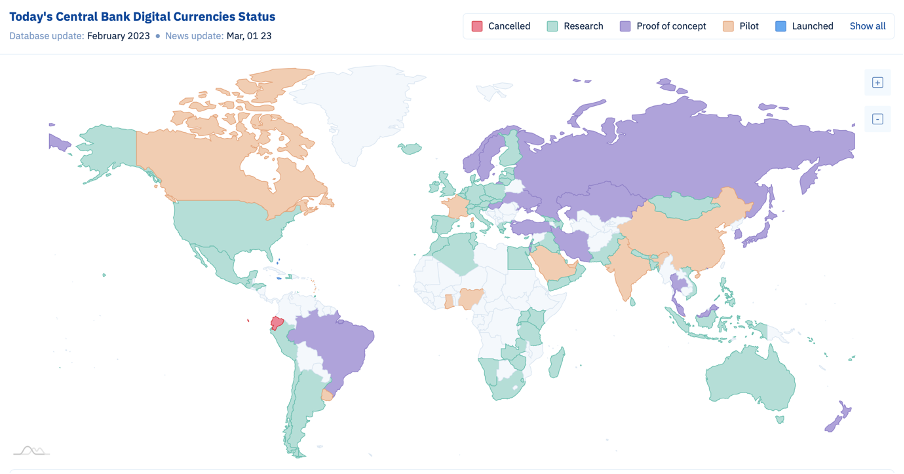

Some of the countries that have launched or are in transit to launch pilot programs for CBDCs include:

China: The People’s Bank of China has been testing its digital currency, Digital Currency Electronic Payment (DCEP) since 2020. The pilot program has been rolled out in several cities across China. Across Sweden, the Riksbank, Sweden’s central bank, ran the e-krona pilot program until 2022. In the Bahamas, the Central Bank of The Bahamas launched the Sand Dollar in 2020, becoming one of the first countries to issue a CBDC.

The Eastern Caribbean Currency Union (ECCU): The Eastern Caribbean Central Bank (ECCB) launched the DCash pilot program in March 2021. This allowed users to make digital payments using a mobile wallet. In the United States, the Federal Reserve (Fed) explored the possibility of issuing a digital dollar. The Fed launched a research program to study the potential benefits and risks of a CBDC. Japan, the latest entrant also rode the same bandwagon.

Overall, these pilot programs are aimed at testing the technical and operational feasibility of CBDCs, as well as evaluating their potential benefits and risks. CBDCs could significantly impact the global financial system and potentially reshape narratives around money. But CBDCs are not without their pitfalls.