In the volatile cryptocurrency arena, traders continuously seek platforms that provide robustness against the unpredictability of the market. The decentralized Uniswap exchange has emerged as a frontrunner, overtaking the popular US exchange, Coinbase, in terms of spot trading volume throughout 2023.

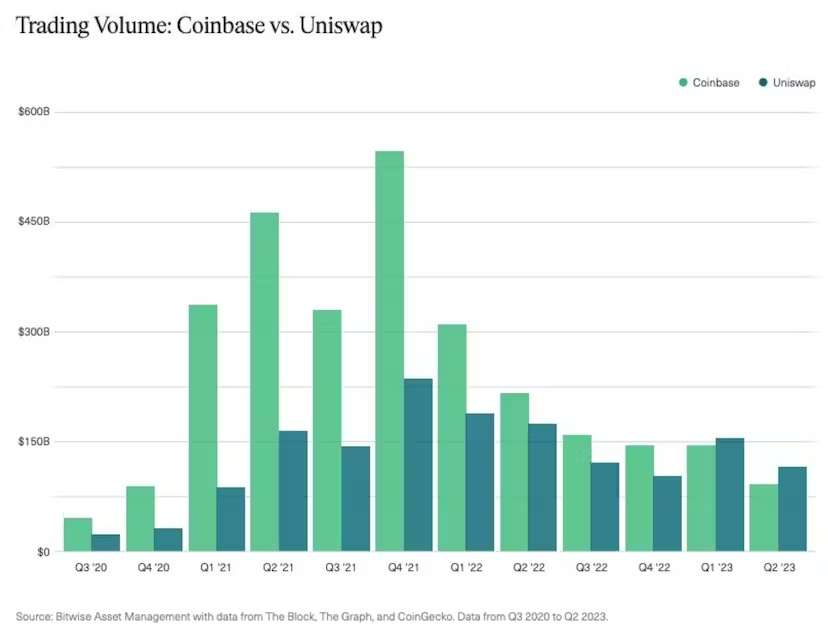

Bitwise’s seasoned researcher, Ryan Rasmussen, reveals startling figures: In Q2 2023, Uniswap facilitated trades worth approximately $110 billion.

Uniswap Decentralized Exchange Gains Momentum Over Centralized Coinbase

In stark contrast, Coinbase trailed with a volume of around $90 billion. This wasn’t an isolated event. In the preceding quarter, Uniswap edged out Coinbase by managing trades of $155 billion versus Coinbase’s $145 billion.

Why this migration to Uniswap? The brutal bear market of 2022 delivered a severe blow to centralized crypto firms like Coinbase, leading to a significant 83% drop in its Q4 2021 spot trading volume.

In comparison, Uniswap, a decentralized protocol, witnessed only a 50% reduction. This indicates a growing trader preference for platforms operating autonomously based on the immutable laws of code.

Interestingly, despite Uniswap’s rising dominance in trading volume, its native token, UNI, took a hit, decreasing by 10% in 2023. It remains a staggering 90% below its 2021 peak.

Uniswap Leading the DEX Race

Innovation remains at the heart of Uniswap’s strategy. June saw the unveiling of v4, a protocol promising enhanced trading features such as limit orders and automated fee revenue compounding.

Not to be outdone, Uniswap introduced UniswapX, a DEX aggregation protocol, just last month. Designed to streamline trading further, it guarantees traders the best possible prices.

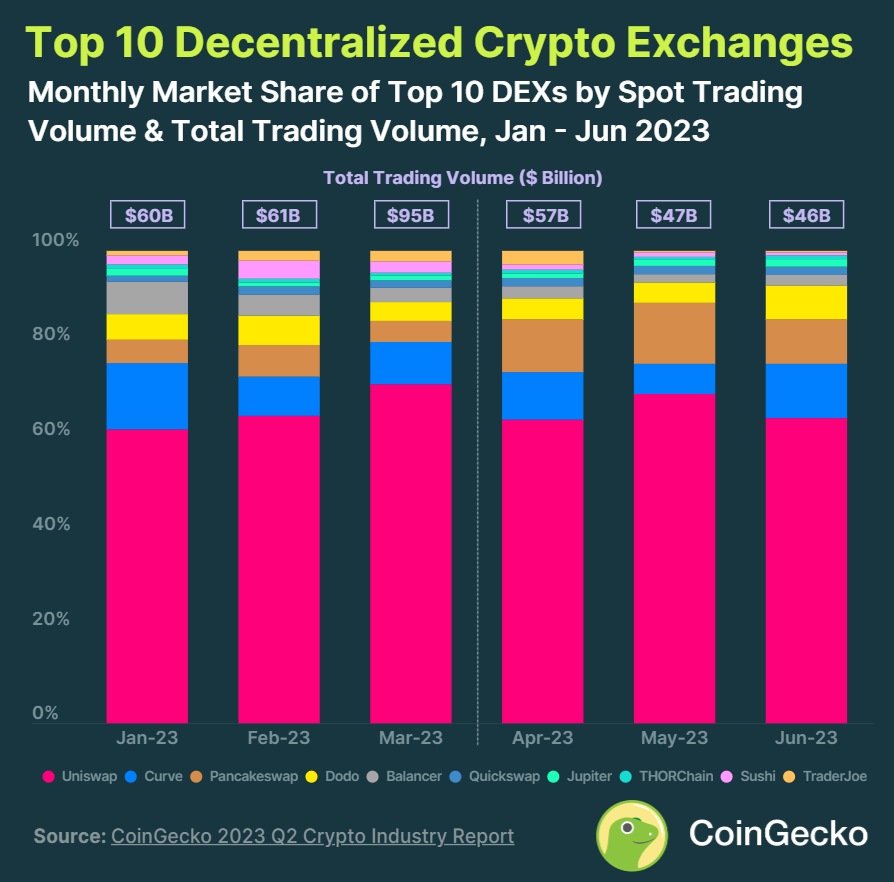

When looking at the broader DEX ecosystem, Uniswap, with a commanding 64.6% market share, is the undisputed leader. However, competition is fierce.

Curve was second in line, boasting an 11.5% share, recording a trading volume of $5.2 billion in June 2023. Following closely are PancakeSwap and Dodo, with market shares of 9.5% and 7.2% respectively.

It should be noted that since this data was released, Curve suffered a reentrancy attack and lost $62 million on July 30. PancakeSwap has since usurped the second-place rank, pushing Curve to third place.

One of the most noteworthy stories from Q2 2023 is that of PancakeSwap. Despite a general downtrend in the DEX trading volume, PancakeSwap recorded a commendable 48.1% quarter-on-quarter growth.

Its volume surged from $11.3 billion in Q1 to $16.8 billion in Q2, making it the only DEX to witness such growth in these challenging times.