Render’s (RNDR) price is close to validating the bullish pattern it is currently in. The rally could continue with the altcoin noting higher conviction among its investors.

However, RNDR is close to noting a market top soon, and those looking to jump in now must watch this level.

Render Holders Are Active Again

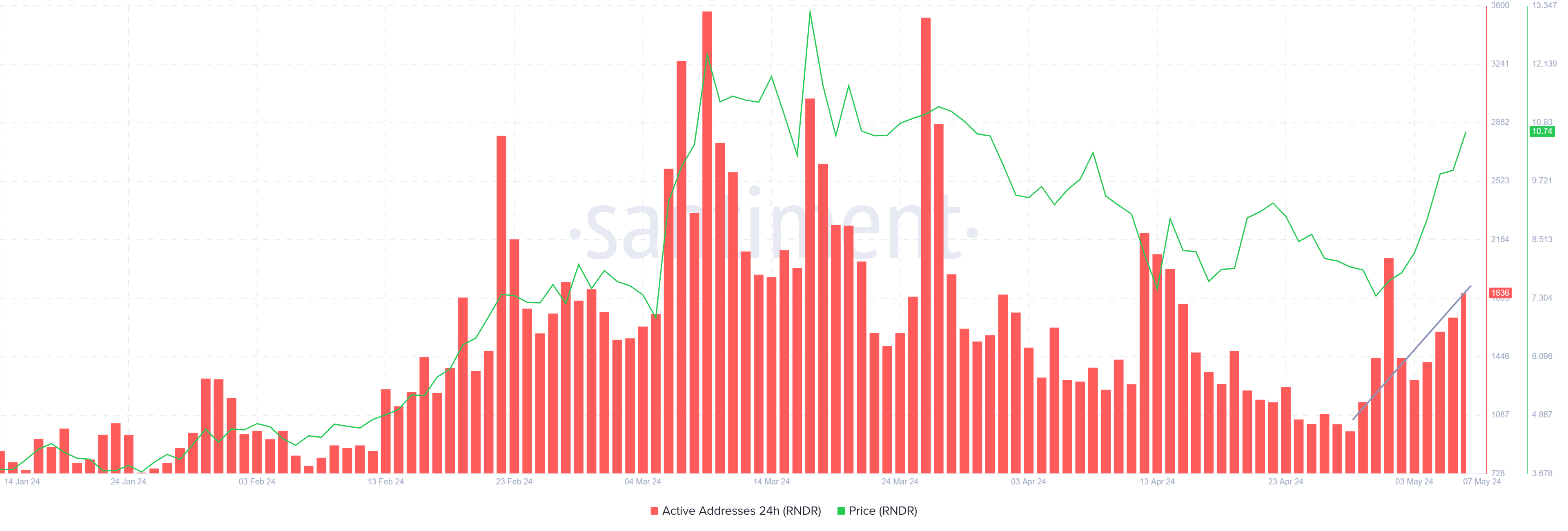

Render’s price could see further upside as the altcoin is flashing a solid buy signal owing to increasing investor participation. The price and daily active addresses are increasing, forming bullish conditions for the asset.

In line with this, cryptocurrency tends to be optimal for accumulation, which, in turn, supports price increases. Should this be the outcome for RNDR as well, the altcoin could rally towards $11 and beyond.

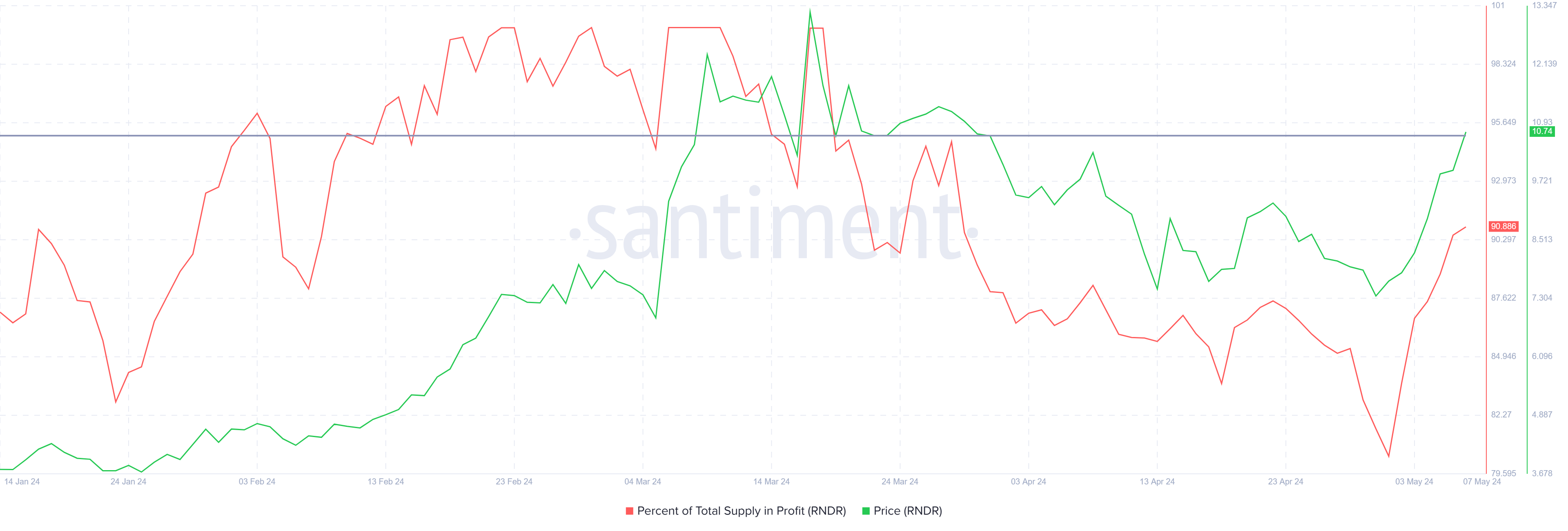

At the moment, Render’s price does have room for growth despite the fact that close to 90% of the supply is in profits. Generally, a market top is formed when about 95% of an asset’s supply becomes profitable. This market top is followed by corrections, which result in the market cooling down.

Read More: Render Token (RNDR): A Guide to What It Is and How It Works

Thus, RNDR could continue its rise for the coming days, during which the bullish double-bottom pattern would be validated. However, following this, the altcoin would be vulnerable to corrections, making it an important level to watch.

RNDR Price Prediction: What After $11?

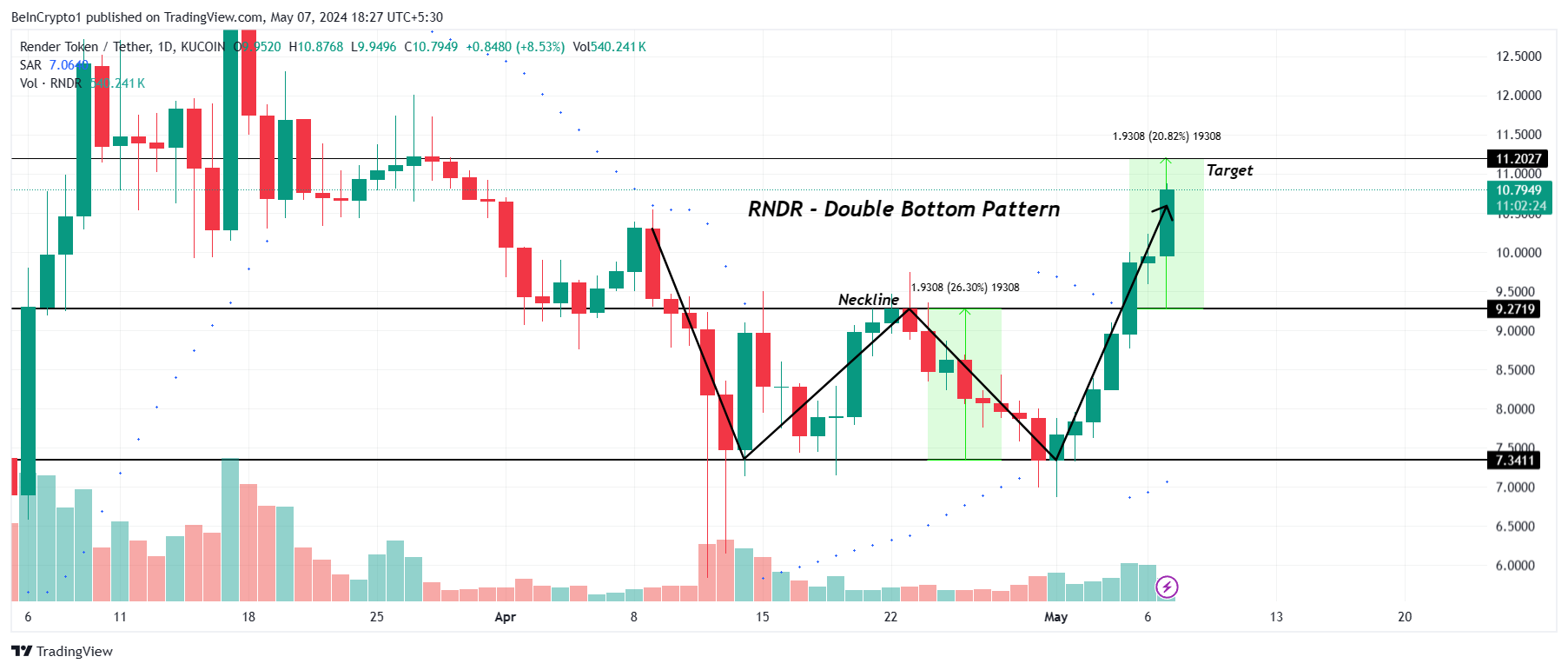

Render’s price is currently at $10.8 after noting an 8.5% rally in the last 24 hours. The cryptocurrency is close to validating a double bottom formation, also known as the “W” pattern.

The double bottom pattern is a bullish technical analysis formation characterized by two consecutive peaks at approximately the same level, indicating a potential trend reversal from uptrend to downtrend when the price breaks below the neckline support level.

RNDR not only broke past the neckline but is close to achieving the 20% rally target set according to the pattern. Once the altcoin crosses the resistance of $11.2, the pattern will be validated. If the bullishness persists after this, Render’s price could rally further towards $11.5 and beyond.

However, if a market top is formed after this and should investors move to sell for profits, further rally could fail.

Read More: Render Token (RNDR) Price Prediction 2024/2025/2030

On the other hand, if RNDR fails even to make it to the $11.2 target and corrects before owing to potential selling, the altcoin would fall to $9.2. This would invalidate the bullish thesis, leaving Render vulnerable to a decline below $9.