The Thai SEC has tightened rules related to the crypto market, while the central bank is receiving more powers to regulate the market. Meanwhile, the country’s Gulf Energy Development is looking to launch a crypto exchange.

Regulators in Thailand are taking an aggressive stance on the crypto market as authorities are passing into law several new rules. The actions by Thailand’s Securities and Exchange Commission (SEC) have affected trading numbers, as the number of active accounts has dropped to about 33% of what it was at the start of the year.

On Sept. 1, the SEC passed new rules related to crypto advertisements, saying that companies must not present false or misleading information, while also mandating a warning that speaks of the risks of investing in cryptocurrencies. These advertisements must change within 30 days of the announcement of the notice.

The Central Bank of Thailand will also receive more power over the crypto market, with Finance Minister Arkhom Termpittayapaisith saying as much in an interview. So far, the Thai SEC has been in charge of regulating the crypto market, but that responsibility will now be partly divided between the two, and the SEC will be in charge of this change.

Despite the more restrictive rules being implemented, there are still exchanges on breaking into the country. Gulf Energy Development, Thailand’s biggest energy producer, is aiming to invest in blockchain ecosystems and is seeking approval from the SEC to operate an exchange and brokerage. It wants to build these platforms through a partnership with Binance.

Regulators taking stern action against crypto companies

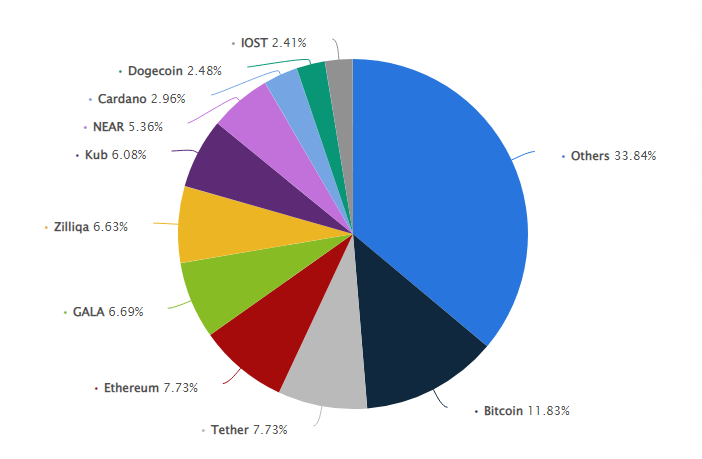

The market share of most cryptocurrencies in Thailand is dominated by Bitcoin at 11.83%. After Bitcoin are Tether, Ethereum, and Gala. The trading volumes on these assets may very well decrease as regulation tightens.

A plan by the Siam Commercial bank to acquire Bitkub has fallen through following the tightened regulations. The bank, Thailand’s lost lender, was set to acquire a 51% stake in the exchange.

Meanwhile, the SEC has also fined a Bitkub executive $235,000 for insider trading. As for Zipmex, which has filed for bankruptcy protection, the regulator has filed a police complaint.

Crypto conviction still exists in Thailand

Thailand is certainly aiming to impose some control over the market after the rout earlier in the year. That hasn’t stopped the CEO of Gulf Energy Development, Sarath Ratanavadi wanting to invest in the blockchain space. The second-richest person in Thailand, Ratanavadi, wants to invest some of the company’s revenue in blockchain companies.

This has led to him wanting to create a crypto exchange and is in a joint venture with Binance for the purpose. The company has also agreed to invest in the Binance Coin and investment in the preferred stock of Binance US.