Ravencoin Highlights

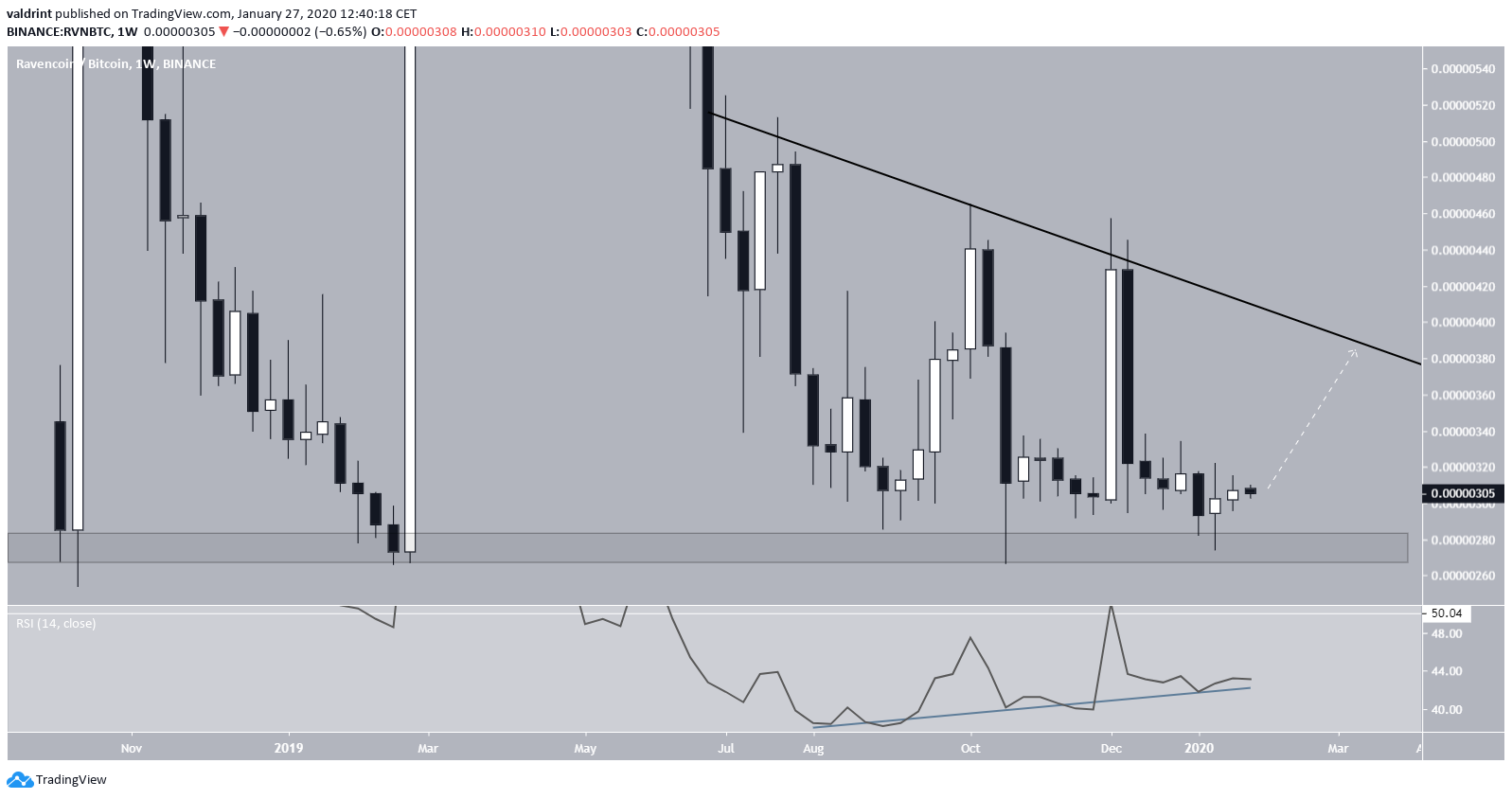

- The price is trading inside a descending wedge.

- There is resistance at 345 satoshis.

- There is support at 280 satoshis.

- RVN is facing resistance from daily moving averages (MA).

How likely is RVN to reach these targets? Keep reading below if you are interested in finding out.$RVN || $BTC Binance X @Altcointraders_

— CryptoAmsterdam (@damskotrades) January 25, 2020

Still in our position with the fam.

Lower time frames starting to shape up slightly bullish.

Expecting a bigger move soon as it's lagging behind $THETA & $ENJ who already had a good move. pic.twitter.com/rUZiMx5Gad

Ravencoin Descending Wedge

The Ravencoin price has been trading inside a descending wedge since October 26, 2019. The top of the wedge and the main resistance area are found at 345 satoshis. While the descending wedge is a bullish pattern, and the price is trading very close to the resistance line, a price breakout does not seem likely. The price is trading below the 50- and 100-day moving averages (MA), which have previously made a bearish cross. RVN is facing very close resistance from the 50-day MA, which has begun to turn downward, a bearish development. However, the longer-term price movement supports a breakout. The weekly RSI has been generating bullish divergence over the past seven months. Also, there is solid support at 280 satoshis.

This suggests a price increase towards the descending resistance line, which is currently near 400 satoshis.

Returning to the daily wedge, this suggests that a breakout will eventually occur. Still, the price might decrease and validate the support area once more before gearing up for another upward move.

A price breakdown below 280 satoshis would invalidate this possibility.

However, the longer-term price movement supports a breakout. The weekly RSI has been generating bullish divergence over the past seven months. Also, there is solid support at 280 satoshis.

This suggests a price increase towards the descending resistance line, which is currently near 400 satoshis.

Returning to the daily wedge, this suggests that a breakout will eventually occur. Still, the price might decrease and validate the support area once more before gearing up for another upward move.

A price breakdown below 280 satoshis would invalidate this possibility.

Future Movement

In the short-term, the Ravencoin price is trading in what looks like a symmetrical triangle. Technical indicators suggest that the price will break down from this triangle. The short-term RSI generated bearish divergence and followed that up with a failure swing top and an RSI movement below 50. This suggests that the price has begun to lose power, and we could see a breakdown soon. To mitigate the effects of this price breakdown, a stop loss could be set at 299 satoshis, with the aim of re-entering the trade at lower prices near 280 sats. To conclude, the Ravencoin price has been trading inside a descending wedge for nearly three months. While we expect a breakout from this wedge, a short-term decrease seems likely to occur prior.

To conclude, the Ravencoin price has been trading inside a descending wedge for nearly three months. While we expect a breakout from this wedge, a short-term decrease seems likely to occur prior.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.