Raoul Pal, CEO of Real Vision and a prominent financial analyst has drastically altered his investment strategy. Known for popularising the term “Banana Zone,” Pal shifted from Bitcoin (BTC) and other altcoins, reallocating a staggering 90% of his liquid assets into Solana (SOL).

This move illuminates a broader trend in which investors seek assets with high growth potential and good user experiences.

Raoul Pal Reveals His Crypto Portfolio

During a recent video address, Pal explained his significant portfolio adjustment.

“90% of my liquid network is basically allocated right now to Solana. I dont have much Bitcoin right now. It doesn’t mean that I dont like like Bitcoin, I think the others go up more, simple as that,” Pal said.

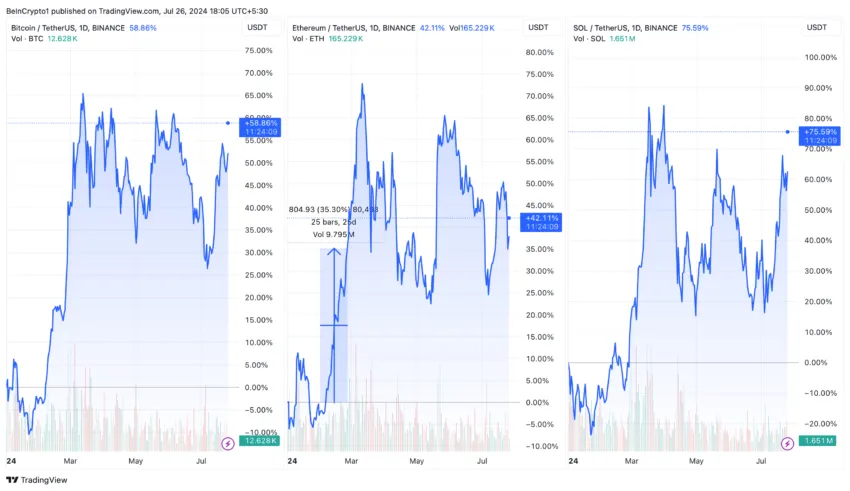

Solana’s impressive market performance supports Pal’s optimistic outlook. Year-to-date, Solana has surged approximately 75%, outstripping both Bitcoin and Ethereum (ETH), which posted gains of 58% and 42%, respectively.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Previously, Pal drew parallels between Solana’s trajectory and Ethereum’s historical chart from 2018. He predicted that Solana could potentially emulate Ethereum’s explosive growth, which saw a 47-fold increase from its lows.

Furthermore, Pal pointed to Solana’s user experience, which he favorably compares to Apple’s ecosystem, noting its sleek design and efficient, closed system.

“The comparison is like Android versus Apple. It’s like Solana feels like Apple; its a closed system, but it is very slick, very good, will create great loyalty. [But] Ethereum is much broader, much more open in terms of other things that can be built on top of it,” Pal said.

Pal’s strategic shift comes at a crucial time when the crypto markets are bracing for a new phase. He calls the parabolic crypto rally, the “Banana Zone,” expected to trigger widespread mania.

Moreover, the excitement around Solana has been amplified by a recent endorsement from Franklin Templeton, a global asset management giant with over $1.64 trillion under management.

The firm’s interest in Solana fuels speculation about a potential spot exchange-traded fund (ETF). Such a development could impact Solana’s price, as ETFs provide a regulated pathway for institutional investors to gain exposure to crypto.

Read more: Solana ETF Explained: What It Is and How It Works

However, various regulatory challenges might prove to be a roadblock for Solana ETFs. For instance, the CME futures market is absent for Solana, which the US Securities and Exchange Commission (SEC) typically requires.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.