“Our mission is to democratize access to the financial markets”And they certainly seem to be succeeding. Commentators have speculated that the current response to the Coronavirus pandemic may have played a part in the continued growth of new users. With people stuck at home and with their regular working life disrupted, many have turned to the financial gambling that Robinhood accommodates as a way of generating some side-income.

Stimulus Checks & Wild Speculation

Others have reasoned that the U.S. government checks, paid out to many of the unemployed, may have been used as startup capital. Either way, the company is reaping the benefits. This mass appeal, along with a young user-base, inexperienced in the trading world, has brought with it a range of unforeseen consequences. Users, often communicating on forums online, are likely to be far more ‘flighty’ than institutional and professional investors. Seasoned investors exercise more caution and are less likely to jump around from stock-to-stock. Younger investors don’t have the same level of ‘respect’ that traditional commercial investors have for the ‘old boys.’ They also don’t insist on obeying certain traditions and customs that others would usually follow.Hertz Valuation No Longer Reflects Market Reality

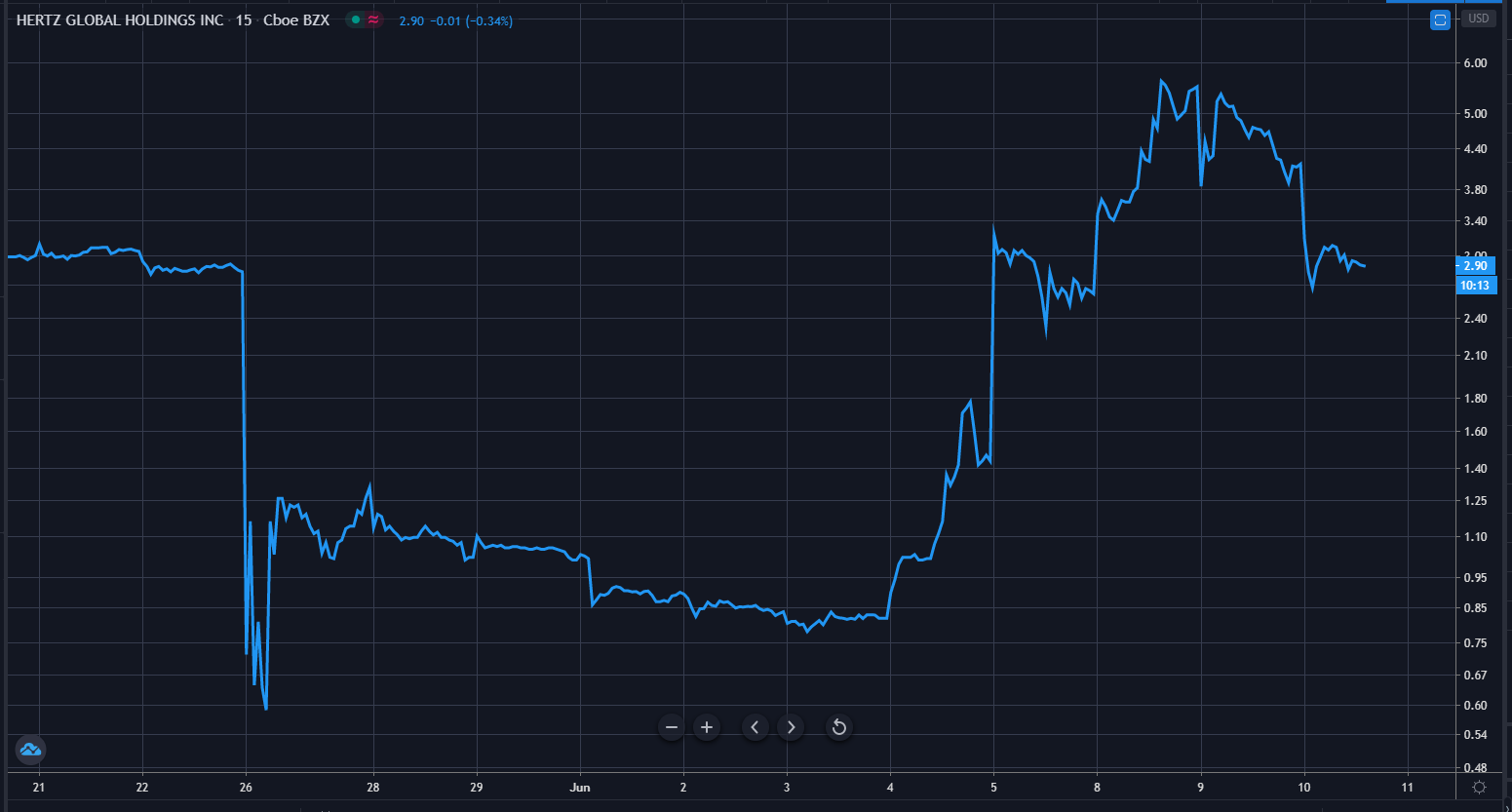

The most visible outcome of this increase in the general Millennial buying of public stocks is that hype can be built up very quickly. Think of social media posts half-jokingly suggesting that they need X-cryptocurrency ‘to moon’ when a particular stock or company (particularly a tech one) starts trending.One recent example is Hertz, the rental car company. In late May, the firm filed for Chapter 11 bankruptcy, following the economic downturn and subsequent revenue collapse. This was perhaps unsurprising, given that travel numbers had been decimated, and the entire industry was battening down the hatches. Hertz is one of the biggest players in the rental car space. The filing was regarded as perhaps the biggest American casualty of the Covid-19 pandemic. Understandably, following this announcement, the share price dropped significantly. At its lowest, Hertz (NYSE: HTZ) was trading around $0.40 per share. Many traditional market investors had bailed before it dropped that low. Eventually, bankruptcy was proof that the future of this rental car company was less than rosy. One such investor, Carl Icahn, had his entire 39% stake in the company following the bankruptcy news. He explained in a Securities and Exchange Commission filing that:$10,000 invested in Hertz the day after it filed for bankruptcy is now worth about $125,000

— Hipster (@Hipster_Trader) June 8, 2020

“Unfortunately because of Covid-19 which has caused an extremely rapid and substantial decrease in travel, Hertz has encountered major financial difficulties and I support the Board in their conclusion to file for bankruptcy protection.”The decision would have resulted in a roughly $1.8bn loss for the serial investor. He clearly felt that holding onto it would have resulted in further losses.

Retail Investors Score a Win Over the Billionaire

Retail investors, mainly within the Robinhood ‘community’ took a different approach. Most likely due to the combination of a big name listing and a very low stock price, many started buying up these shares at rock-bottom levels. As a result, the number of Robinhood investors in the company doubled to almost 73,000 as of last Friday. Hertz’s stock consequently surged 825%, to a high of $3.70. Humorously, this actually wiped out all of Icahn’s losses suffered during the downturn and bankruptcy process. None of this means that Hertz is now a viable company, or a solid investment, of course. While the business may take an upturn due to higher travel numbers and an ease in lockdown restrictions, the nature of the bankruptcy filing means that the actual value of these shares is uncertain. They may be wiped out altogether. For now, however, it has retail investors celebrating victory over an established billionaire investor. Many observers are left questioning whether the stock market actually means anything at all.The Potential to Push Companies Over the Brink

The same also applies the other way around. When people start placing numerous put options and selling stocks en-masse, this can cause a bearish run on said company’s stocks, driving down the price. Of course, this may be the exact thing these retail Robinhood investors want. This particular situation would allow them to hoover up all this stock on the cheap. Unfortunately, however, such a slump could also push an already-struggling company over the edge. This phenomenon, where investor positions have increasing influence over a company, is not necessarily new. We can look to the currency markets for one of the most famous examples. Before he was a philanthropist, and figure of hate for the far-right, George Soros earned himself the title of the ‘man who broke the Bank of England’. In 1992 Soros shorted the British pound after Britain struggled to maintain its place in the European Exchange Rate Mechanism (ERM). Soros profited a cool $1bn when the pound and the UK eventually left the ERM. The massive loss of value in the pound and billions of losses at the UK Treasury gave Soros the dubious reputation and the infamous label.More Power to the People?

Today’s efforts in both of these approaches are made easier, with groups collaborating and communicating in real-time over the internet. This, combined with the international nature of users means that it’s all happening almost 24/7.There is also something to be said about the more nefarious practice known as the ‘pump & dump’. These schemes are becoming more commonplace. Notably visible in cryptocurrency markets, a pump and dump, simply put, is where investors buy a stock at a low price, spread positive rumors and speculation in order to artificially ‘pump’ the share price. They then quickly sell (dump) at a profit to new investors wanting to get in on the hype. Of course, without any real reason for this increased share price, these fresh investors are then essentially scammed, suffering losses on their positions.Robinhood App chat rooms are discussing the next stock to pump ‘n dump to add to their #Bitcoin positions. (Also mass-shorting vulnerable companies).

— Max Keiser, Sex Symbol (@realmaxkeiser) June 8, 2020

This is generational, financial warfare

GenZ will win, I predict.

You can draw parallels between the way people are acting on Robinhood and how people were responding during the intense 2017 ICO bubble. Citigroup has likened these current trends to the ‘dot.com bubble’ era. The firm’s euphoria model shows sentiment as the most “euphoric” since 2002:In 2000, companies would randomly add 'dot com' to their name to pump their stock. Then 2017 saw them adding 'blockchain' for same. Filing chapter 11 gives you the share price rally in 2020. Because everything is okay, all makes sense.

— Stacy Herbert (@stacyherbert) June 8, 2020

“We are concerned that thoughtful approaches are being overwhelmed by the need to at least keep pace with price moves […] People are ignoring joblessness, trade friction, social unrest, and risks that loom including possible Covid-19 reinfections, the end of bonus supplemental unemployment checks and the upcoming elections.”This attitude has caused a lot of harm towards cryptocurrency’s quest of becoming legitimate money. And perhaps it raises more questions than it answers. Is it going to ruin the stock market? Which company will Robinhood retail investors target next? And if the trend continues, will it change how the stock markets operate in the foreseeable future?

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.