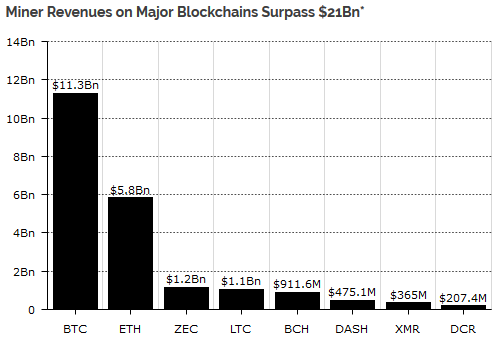

Ever since the first blockchain was launched ten years ago, cryptocurrency miners have managed to earn over $21 billion by participating in the consensus protocol. Interestingly enough, around 16 percent of the total reward is based on mining empty blocks and bringing no real value to the network.

Once upon a time, a simple laptop was more than enough to mine on the Bitcoin (BTC) blockchain and earn the reward of 50 BTC per block. However, as more and more joined the decentralized network, the mining difficulty adjusted and an average CPU wasn’t enough anymore.

On Oct 1, 2010, Bitcointalk user ‘m0mchil’ released the code for mining BTC using a video card (GPU). As the difficulty level and power requirements continued to rise, the need for more advanced mining hardware became evident and, by June 2011, Field-Programmable Gate Arrays (FPGAs) were becoming quite popular.

The biggest advantage of FPGAs was the fact that they used three times less energy than GPUs. Nevertheless, they would give way to Application Specific Integrated Circuit (ASIC) machines that moved mining Bitcoin from being a hobby to a true industrial activity. To date, ASICs remain the standard, as they are created for the sole purpose of mining cryptocurrencies. They are expensive and represent the only profitable way to mine Bitcoin.

How profitable? According to Diar – a weekly newsletter analyzing the world’s digital assets industry – the business is booming, with over $11.3 billion in rewards earned by miners in the last ten years.

#Cryptocurrency miners have earned north of $21Bn since the start of major #blockchain networks. More in this week's Diar: https://t.co/iCPahR6qv9 pic.twitter.com/Ur1XMJSSei

— Diar (@DiarNewsletter) February 26, 2019

Bitcoin Mining Dominates Ethereum Mining

In total, cryptocurrency miners from around the world earned over $21 billion in rewards, as per Diar’s report. Bitcoin miners have earned more than half of the total mining rewards ($11.3 billion), followed by Ethereum (ETH) with $5.8 billion. Currently, Ethereum is based on Satoshi Nakamoto’s patented Proof-of-Work (PoW), just like Bitcoin.

Proof-Of-Nothing (Or, How To Mine Empty Blocks For A Profit)

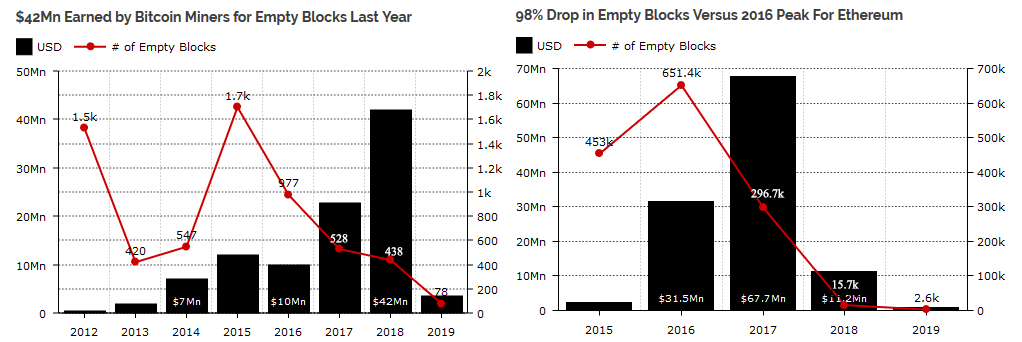

The report also analyzes the Proof-of-Nothing (PoN) effect. PoN is the practice of mining empty blocks. Indeed, miners are rewarded for such an activity that basically brings no real value to the blockchain. The reward is consistent, with over $335 million earned over the years — the equivalent of $5 million per month. Litecoin (LTC) is the big ‘winner’ in this category. The solution to add empty blocks into the blockchain brought the miners a hefty $125 million in profits. Ethereum is not far behind, with $113 million worth of PoN. Bitcoin follows with just over $100 million. Luckily, the amount of empty-block mining has been declining steadily every year. Ethereum has managed to record the most progress with a 95 percent drop in 2018, compared to the peak initial coin offering (ICO) spam figures of 2017 — from $67.7 million to a little over $11 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Florian Gheorghe

I started out in print journalism in 2008 and switched to freelancing two years later. Afterward, I covered the poker and gambling scene for several years before getting into sports and motivational stories.

Crypto-wise, I first learned about Bitcoin just months after the Mt. Gox event. I’ve been riding the bulls and the bears ever since.

I started out in print journalism in 2008 and switched to freelancing two years later. Afterward, I covered the poker and gambling scene for several years before getting into sports and motivational stories.

Crypto-wise, I first learned about Bitcoin just months after the Mt. Gox event. I’ve been riding the bulls and the bears ever since.

READ FULL BIO

Sponsored

Sponsored