Price prediction for Bitcoin: Technical Analysis by Julius de Kempenaer, Senior Technical Analyst at StockCharts.com, signals downside risk for Bitcoin (BTC). Here’s how it works.

Free Market

Bitcoin, or better, the entire cryptocurrency market is the perfect example of a “free market” that is driven by supply and demand. Access to the market is easy and information is widely available. As a result, human emotions like “Fear and Greed” are unrestricted. All in all, that combination of factors makes cryptocurrencies well suited for the use of technical analysis.

Fundamental analysis looks at external factors that can influence the price. In the stock market analysts look at revenue (growth), sales prices, cost of goods etc. Based on all that information they come up with a “fair value” for the company. If the company’s stock trades below what the fundamental analyst thinks is fair value, it would be interesting to buy that stock.

In case the stock price lies above that fair value it would obviously be better to sell.

In the crypto market factors like the number of new coins being mined, the amount of freely traded coins, the background of a specific project related to a cryptocurrency etc. are used by fundamental analysts to determine the intrinsic value of a coin and decide whether to buy or sell.

Technical Analysis takes a different approach. A Technical Analyst ONLY looks at the price. At the end of the day the price, at which an investor buys and sells, is what determines profit and loss. And prices are determined by the buying and selling activity of investors in the market.

Fear and Greed drive herd behavior

Clearly, investors are influenced by a lot of (external) factors, news being the most important one. Every time some news on a market or security is published, investors will review the price of the associated or related security.

Over the years, crypto had popped up in the news many times. Sometimes it was incredibly positive, which caused prices to skyrocket and create a group feeling known as FOMO. Fear of Missing Out – “everybody is making money in crypto, and I am not, I need to participate.” And on the other hand, there were also stories about regulation, or about countries banning mining and trading in crypto. This negatively affected prices.

Clearly, these events create a lot of emotions, and they are driving investors’ decisions to buy and sell.

Because herd behavior is no stranger to human nature, all this buying and selling will create “trends” that can be spotted on charts. And that is where technical analysis comes in.

Price prediction for Bitcoin: Technical Analysis and Charts

Technical Analysts use charts to find trends in price and try to gauge whether that trend is more likely to continue or will potentially reverse. Our toolbox at Stockcharts.com is filled with a variety of metrics derived from price. But we also use more subjective interpretations of specific trends and patterns as they are forming on charts. This is based on extensive historical studies showing that markets tend to respond in similar manners in specific situations.

Charts help to show trends in supply and demand

In the analysis of price trends, the peaks and troughs that are visible on a chart hold crucial information. They tend to serve as “support” or “resistance” levels after they have formed, and markets return to these old levels.

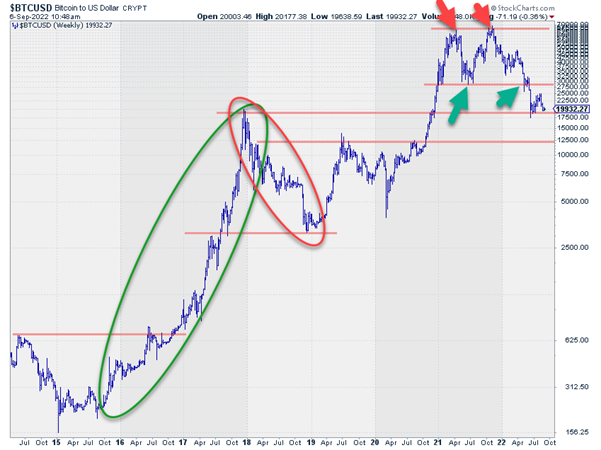

Translate “support” with “demand” and “resistance” with “supply” and reading a chart will suddenly become much easier and make more sense. In the BTC chart above I have highlighted one big uptrend starting at the end of 2015 and ending at the end of 2017. And one downtrend starting at the end of 2017 and ending at the end of 2018.

Technicians define an Uptrend as a series of “higher highs” and “higher lows.” A DOWNtrend is the reverse, a series of lower highs and lower lows. The two highlighted examples are a good example of each.

More towards the right of the chart we find some good examples of old peaks and troughs acting as support (always below the current market price) or resistance (always above the current market price). It never ceases to amaze me how these old tops and bottoms seem to act like magnets.

Price prediction for Bitcoin

In March-April 2021 the price of BTC reached a high in the 65k area before dropping back to just below $30k. The rally out of the July-21 low took BTC back up again and reached that 65k area again at the end of the year (see red arrows).

At around $65k, sellers (=supply) dominated the market and demand was simply not strong enough to push BTC beyond $65k. That additional supply in the $65k area created a lot of resistance and caused a new peak at the same level. Sellers than started to push BTC down again until it reached the areas of its previous low, just below $30k.

A small hesitation is visible as that old low started to function as support, attracting buyers. But that did not last long as BTC broke below its support level around $30k in June of this year.

Price prediction for Bitcoin: Pushing through the brakes

Breaking a support level, very often, also in this case, causes an acceleration of the move. Within 3-4 weeks BTC dropped back to the level of the late 2017 peak around $20k and a new low formed at that level.

When buyers are not strong enough to keep the price at or above its support level, that is a sign of weakness. It indicates that sellers (supply) are still in control. After a brief rally BTC has now, once again, arrived in the area around $20k and is hovering around that level.

The price behavior in coming weeks will be crucial for the near-term development of BTC. The prevailing trend is down. A clear rhythm of lower highs and lower lows is visible from the November-21 top down. This means that the upside potential for BTC is limited now as every former peak will attract new selling activity making it hard for BTC to push higher.

About the author

Julius de Kempenaer is a Senior Technical Analyst at StockCharts.com, a financial charting platform for online retail investors.

Got something to say about this bitcoin price prediction or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.