On April 13, the Bitcoin price began to decrease in what initially seemed like a breakdown below the support level at $6,750. However, it quickly reclaimed the lost support and has increased gradually since.

This increase has caused the bearish sentiment to fade to a degree, even though a breakdown was expected yesterday. Full-time trader @Anbessa100 tweeted a bullish Bitcoin chart and stated that it is still not impossible for the price to reach $8,500-$9,000.

$BTC Update 6

$8500 – 9000 still ain't of the table. Manage your stop loss and play some altcoins while it unfolds pic.twitter.com/85n54kz7DO

— ANBESSA (@Anbessa100) April 14, 2020

Let’s take a closer look at the Bitcoin price movement and determine if the two price targets are within reach.

Bullish Case

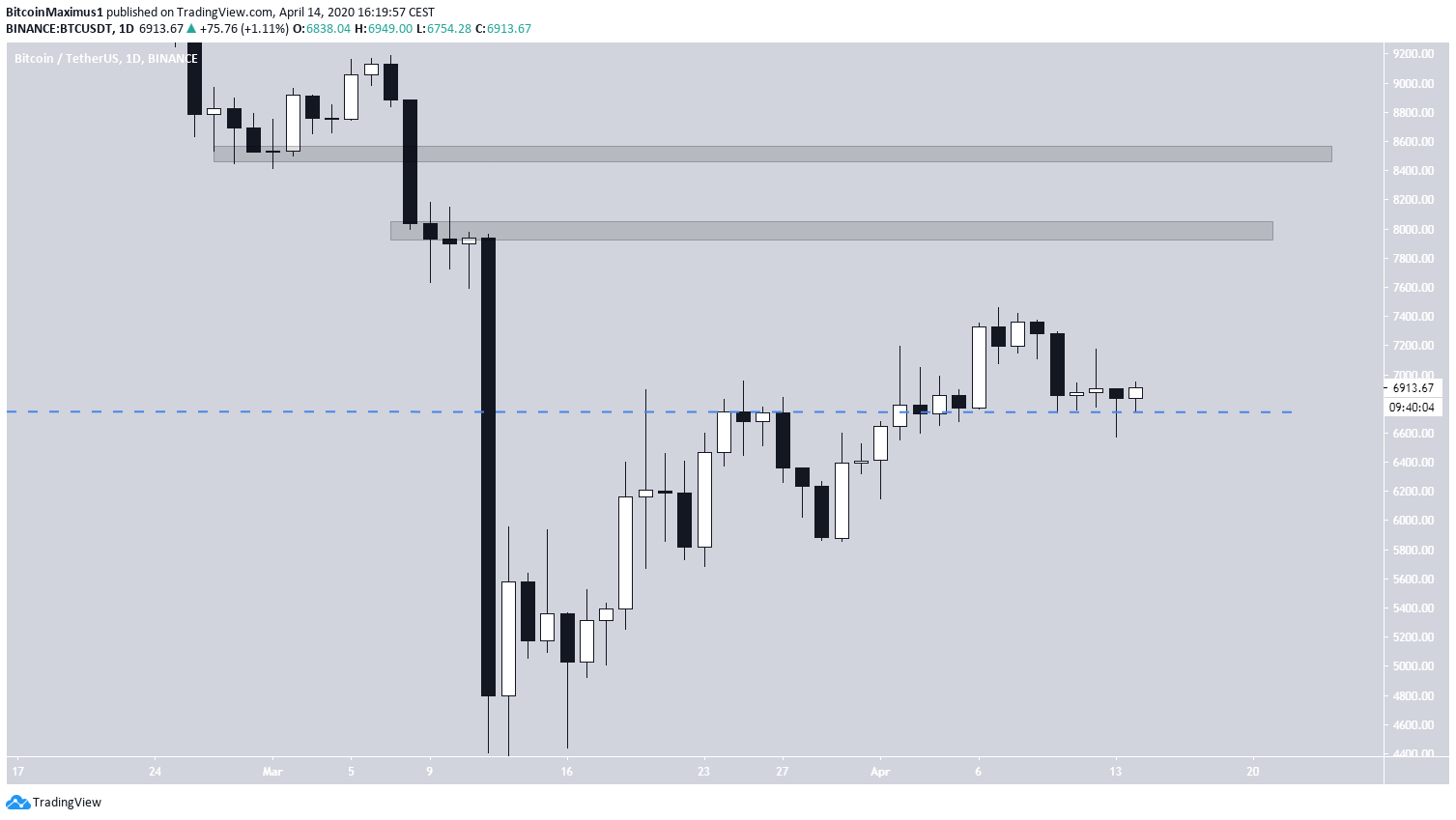

A bullish case for Bitcoin can be made while using the main support level, which is found at $6,750. We have used the closing daily candlestick prices to find this horizontal line.

The area initially acted as resistance until April 2, when the price finally broke out. Since then, the price has validated it thrice as support. On April 13, the price initially dropped sharply below it but recovered and created a long wick and a hammer candlestick. This is considered a failed breakout attempt and often has bullish implications.

As for the main resistance level, that is provided by the 50-day moving average (MA), which strongly rejected the price on April 10. At the time of writing, it was at $7,140. A daily close above this area would likely mean that the price is heading higher.

If it increases above it, it is definitely possible that the price could reach $8,500 due to the lack of resistance until that level, with the exception of a minor resistance area at $8,000.

Descending Resistance Line

In the short-term, the BTC price is following a descending resistance line, currently having begun an upward move towards it. The main area of interest is found around $7,050. It coincides with both the descending resistance line and the 200-hour moving average (MA), which has previously provided resistance to the price.

If the price breaks out, the two resistance areas that could provide a reversal are found at $7,140, which is currently the level of the 50-day MA, and $7,420. As long as BTC stays above $6,750, this scenario remains a possibility.

To conclude, the Bitcoin price has seemingly begun another upward move after a failed breakdown attempt from $6,750. While the rally is expected to fail near $7,050, a breakout could take the price towards $7,400 and possibly all the way to $8,500. The bullish possibilities would be invalidated with a daily close below $6,750.