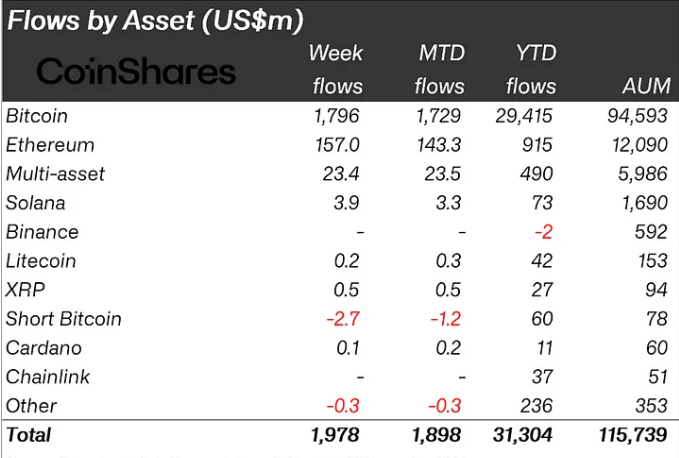

Crypto investment inflows soared to $1.98 billion in a post-election surge, as markets remain euphoric about Donald Trump’s victory. It marks a five-week streak of inflows, pushing year-to-date (YTD) totals to an unprecedented $31.3 billion.

The successive all-time highs in Bitcoin prices following the US presidential outcome have been a critical factor in this post-election investment boost.

Crypto Inflows Near $2 Billion After US Elections

The positive crypto investment flows point to increased investor confidence in digital assets as trading volume soared to $20 billion. Similarly, global assets under management (AuM) also achieved a new high, climbing to $116 billion.

Bitcoin led the post-election rally with nearly $1.8 billion in inflows. Bullish price movements supported this across key digital assets. For starters, Bitcoin reached its initial peak in the immediate aftermath of the US presidential elections. Donald Trump’s electoral victory, bringing a conservative economic stance back to the White House, appears to have further intensified Bitcoin’s appeal among risk-on investors.

“A combination of a bullish macro environment and seismic shifts in the US political system being the likely reason for such supportive investor sentiment,” CoinShares’ latest report read.

The broader sentiment shift reflects a renewed interest in assets outside traditional finance (TradFi). This is especially in response to inflation fears and interest rate cuts by the US Federal Reserve. Since September, the Federal Reserve has adopted a dovish approach, and Bitcoin has attracted more than $9 billion in inflows.

Market optimism over Trump’s economic policies has also sparked a risk-on shift. It amplified the demand for Bitcoin and other high-risk assets in the cryptocurrency space. Specifically, blockchain-related equities saw $61 million in inflows. This interest in blockchain equities, which represent shares in companies involved in the blockchain and cryptocurrency sectors, highlights investors’ appetite for a more diversified exposure to the growing crypto market.

With Trump’s return to office, many analysts expect his administration to be more accommodating to financial innovation. This would encourage further growth in blockchain-based financial services and products.

“DeFi will get better regulatory treatment — no more harassment and potentially even enabling things like fee switches or network-based dividends,” Pahueg, a popular voice on social media platform X, stated.

The post-election period has also seen notable inflows into Bitcoin ETFs (exchange-traded funds), adding momentum to the financial instrument’s overall growth. Spot Bitcoin ETFs, which provide direct exposure to BTC, experienced a record level of inflows. This is as investors increasingly seek regulated pathways to invest in the pioneer crypto.

Risk-on ETFs, which typically see growth in more adventurous market climates, have similarly benefited from the election results. The Trump victory has bolstered these funds, which aim to capitalize on higher returns in volatile environments. The influx of investment into these ETFs highlights the heightened risk tolerance among investors.

With mainstream investors gaining more access to the digital asset market, crypto ETFs have become a cornerstone of Bitcoin’s recent surge. The inflows suggest heightened confidence in Bitcoin’s long-term viability. The belief that BTC can perform as a store of value amidst economic uncertainty is also growing.

This post-election period, marked by a dramatic influx of capital, signals a potential inflection point for cryptocurrency markets. The return of a conservative administration, coupled with supportive macroeconomic policies, is fostering a risk-tolerant environment conducive to digital asset growth.

The record-breaking inflows into Bitcoin, Ethereum, altcoins, and related ETFs indicate that investors are increasingly willing to explore alternative assets that protect from traditional market uncertainties.

As of this writing, Bitcoin is trading for $82,376, having risen by almost 4% since the Monday session opened. As the king of crypto looks poised for more gains, positive US economic data this week could send BTC to unchartered territory.

“We anticipate a slightly higher CPI reading; however, we expect Bitcoin to remain resilient, given that the Fed is already moving toward rate cuts. Retail sales are likely to show strength, driven by Amazon’s recent sales event, signaling a robust economy that could further support crypto markets. Overall, macro data should point to stronger economic growth, which Bitcoin is likely to view favorably,” Markus Thielen, Founder & CEO at 10x Research, told BeInCrypto.