Polymarket is recording heightened activity as traders display increasing interest in prevailing market conditions. Participants are betting thousands of dollars in a bold attempt to predict the market.

While the platform’s impartiality has been questioned, especially regarding showing market sentiment, its role in driving crypto adoption cannot be ignored.

Polymarket Traders Bet Big

According to Dune Analytics, Polymarket has seen a significant increase in daily volume and active traders as participants try to predict market outcomes. These metrics have been steadily rising since May.

Narratives such as US elections continue to drive this interest. However, the latest crypto market crash has also contributed to the surges in activity. Different dashboards on Polymarket show participants betting on multiple questions.

Among them, the odds of Bitcoin (BTC) price dipping below $45,000 before September and Ethereum (ETH) reclaiming above $3,000 on August 9. BeInCrypto data shows that at press time, BTC is trading at $53,625, while ETH remains below $2,400.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

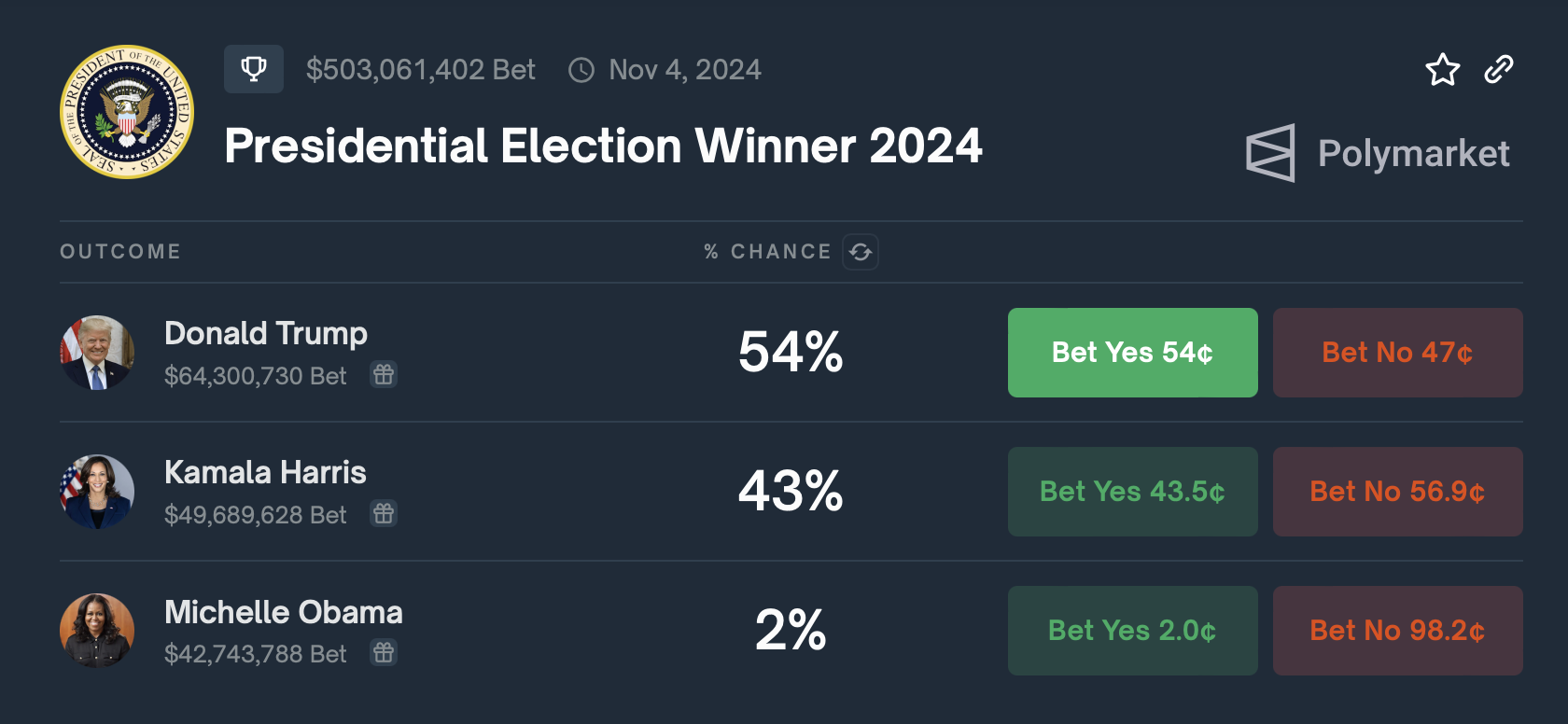

The US presidential race remains one of the favorite topics among Polymarket users. The crypto community is increasingly engaging in predictions, wagering on potential outcomes.

Republican ticket nominee Donald Trump is leading with 54% success odds. In contrast, Kamala Harris stands at 43%, while former US First Lady Michelle Obama has 2% odds.

Read more: How Can Blockchain Be Used for Voting in 2024?

Crypto Community Dives into Macro

Polymarket bets also show traders’ interest in whether there will be an “emergency rate cut in 2024.” This gamble comes as markets decry the latest industry slump.

“Jerome Powell needs to call a meeting now and announce an emergency rate cut,” Bitcoin veteran Kyle Chassé remarked.

In a recent meeting, Federal Reserve chair Jerome Powell hinted at potential policy easing in late 2024. He acknowledged that a rate cut could be on the table in September. Whether an emergency rate cut will come amid remains unknown.

Besides emergency rate cuts, Polymarket participants speculate about a possible recession in 2024. However, this bet could roll over soon as US economic activity challenges recession warning.

As BeInCrypto reported, markets watched Monday’s S&P Final US Services PMI data. The latest data release shows that economic activity in the services sector expanded in July, with the Services PMI registering 51.4%, showing sector expansion for the 47th time in 50 months.

“The recent data suggests a positive short-term outlook for the US economy, indicating a reduced risk of an economic recession. This news is not only beneficial for the US but also for the global economy, as the US represents the largest economy worldwide and has strong links with other economies. A recession in the US could trigger a global economic downturn, similar to the 2008 crisis. Conversely, if the US manages to avoid a recession, it will benefit not just the country but the global economy as well,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The bullish development is helping Bitcoin rebound. It points to higher demand for services and, therefore, increases in inflows to businesses. Positive economic data often influences investor sentiment in the crypto space.

As traditional markets strengthen, investors may become more confident in the economy. This could increase risk appetite and increase interest in alternative assets like cryptocurrencies.