Polygon (MATIC) was one of the best performing cryptocurrencies by market cap, but bearish blues haven’t spared its price entirely.

After charting notable weekend gains, the cryptocurrency market recorded one of its biggest pullbacks. MATIC, much like the rest of the market, couldn’t hold its recently made double digit gains as market news turned negative.

Over the last week, MATIC price appreciated by over 40%. But at the time of writing, the bear market has brought down the coin’s price by almost 12.56% on the daily chart. Even so, MATIC held its weekly gains with over 11% growth in the past seven days.

So, with the global crypto market turning red, can MATIC price sustain the gains charted over the last week?

MATIC Price at Crossroads

The price of Polygon was impacted by the recent crypto market washout amid uncertainties surrounding the news of Binance acquiring cryptocurrency exchange FTX.

Polygon price, after charting a multi-month high of $1.30, gave in to the bearish pressure from the market. From a technical point of view, analysts had expected MATIC price to face considerable resistance around the $0.98 mark.

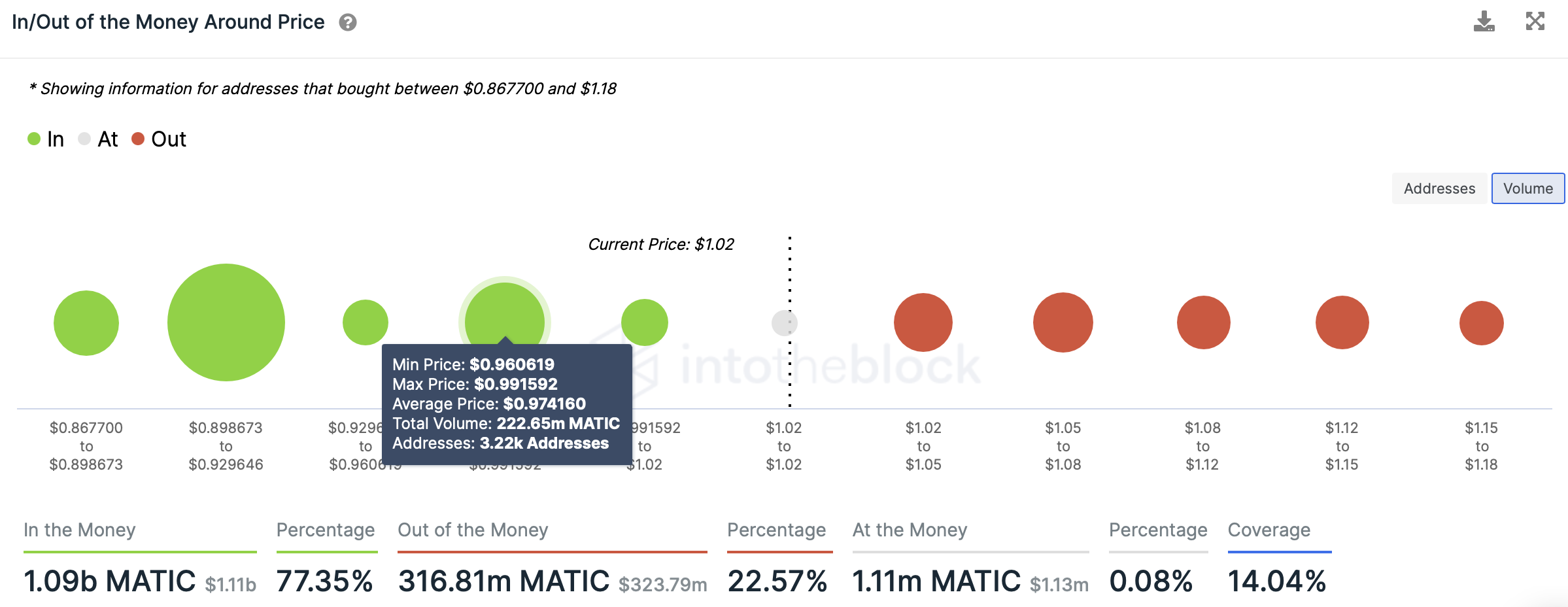

Interestingly, at press time, MATIC traded at $0.97, with bulls trying to keep price action above the key resistance at the $0.98 mark. Data from IntoTheBlock’s In and Out of Money around price Indicator suggested that the $0.97 mark could act as a key support as 3,220 addresses held 222.65 million MATIC around that price.

At press time, with MATIC testing the $0.97 mark, a fall below the same could lead to further price downfall towards the $0.91 mark where 17,280 addresses held over 678 million MATIC.

With the market looking down, the question remained whether MATIC too would succumb to the bearish pressure or recover from the pullback?

Polygon: What Are the Chances of a Recovery?

The recent pump in MATIC price was accompanied by a solid recovery of daily active addresses. IntoTheBlock data suggested that new addresses and active addresses spiked by 93.44% and 90.47% respectively on a weekly basis.

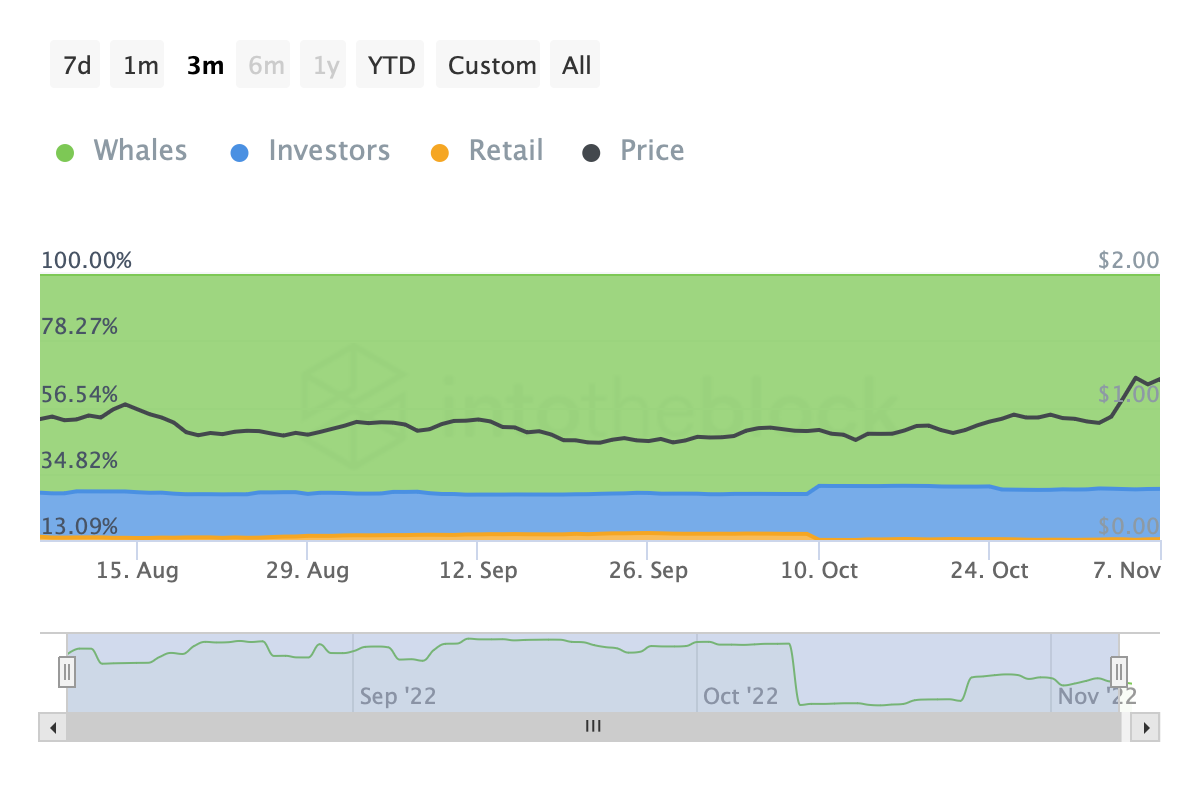

Furthermore, the Polygon network surpassed 188 million unique addresses on Nov. 7 itself. Even though MATIC network seemed secure, a worrying trend was MATIC whales fleeing the boat.

Over the last 30-days whale addresses dropped by 7.69%, while investors saw a 32.81% spike and retailers maintained a moderate stance appreciating by a mere 2.96%

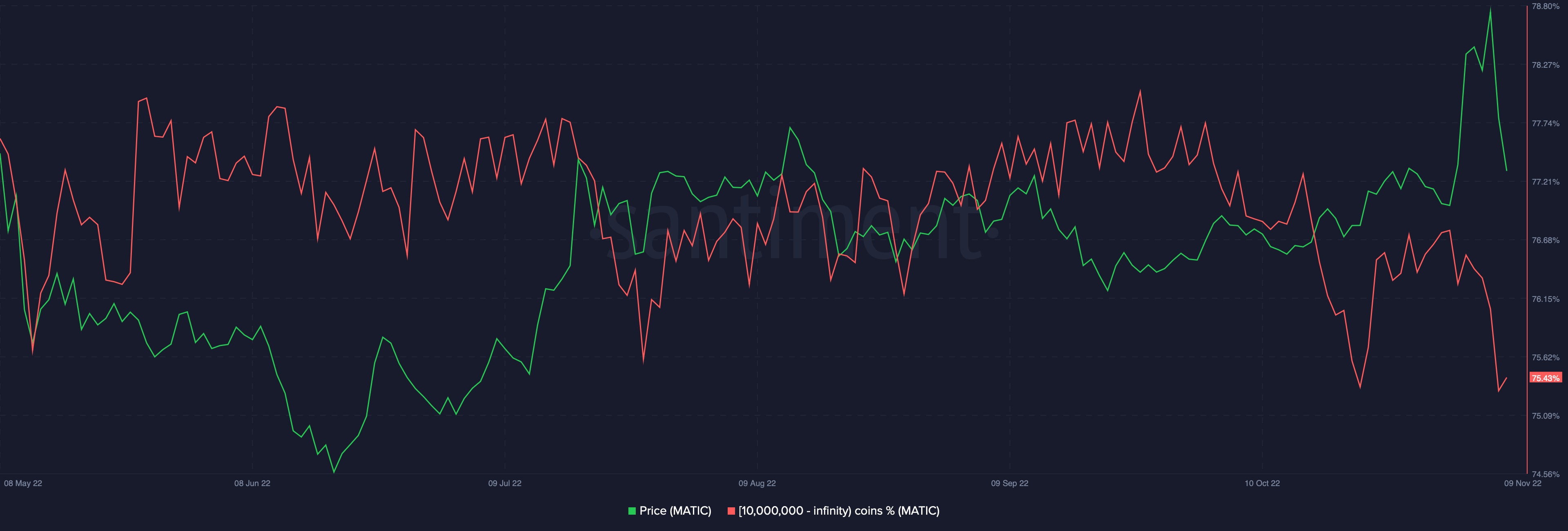

Data from Santiment further suggested that MATIC addresses holding 10 million – infinity coins (%) had reduced their holding from 78% in September-end to around 74% at press time.

Despite retailers and investors holding tight, whales seem to be skeptical. A return of whales to the scene could aid some bullish momentum for MATIC. However, going forward, since MATIC price was below the $0.97 support, a fall to the $0.91 mark wouldn’t come as a surprise.

In case of the bearish invalidation, MATIC price could rise to $1.00, if the market starts to recover that is.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.