The role of Polygon (MATIC) after Ethereum’s transition to Proof of Stake (PoS) is a subject of speculation. This report looks into factors that may help or hurt the scaling solution.

While Polygon (MATIC) has been helping ease congestion on the Ethereum network, Ethereum 2.0 brings its suite of scaling solutions. Polygon’s ambitious plans include solutions aimed at enabling it to continue playing a role in ETH2.

Zooming in a bit, Polygon (MATIC)’s future following the merge presents many questions for the market.

What Role Does Polygon Play?

Polygon (MATIC), a Layer 2 scaling solution for Ethereum, aims to improve the scalability and usability of the Ethereum network. With Ethereum’s Merge; transition to Proof of Stake (PoS), many have wondered about the future of Polygon.

The transition to PoS significantly improves the scalability and efficiency of the Ethereum network, making it more competitive with other blockchain platforms.

However, this does not necessarily mean there will no longer be a need for Layer 2 solutions. Polygon aspires to go beyond just improving Ethereum’s scalability. Its architecture allows for interoperability with other blockchain networks, opening up new possibilities for cross-chain transactions and applications.

Furthermore, Polygon has tried hard to establish itself as a leading Layer 2 solution, with an ecosystem of developers and users. As long as there is demand for fast, low-cost transactions and decentralized applications, there may still be a need for Layer 2 solutions. Therefore, though its future is not set in stone, Polygon may continue to grow and evolve even after Ethereum’s transition to PoS. It might continue to serve as a valuable scaling solution for Ethereum and other blockchain networks while exploring new use cases and applications.

Polygon’s head of strategy, Mihailo Bjelic, shared his hopes in an interview with BeInCrypto. Talking about Polygon’s future, Bjelic asserted, “The merge fixes the massive carbon footprint of Ethereum, arguably beefing up Ethereum’s security and reducing ETH inflation.” He claimed:

“Polygon gains from Ethereum’s improved security and general growth to the ecosystem–even while Ethereum massively gains from the Polygon companies’ suite of scaling solutions, like the recently announced Polygon zkEVM. So proof of stake changes the narrative: Ethereum is now like Polygon, a significantly more environmentally-friendly network.“

How Does Polygon Complement ETH?

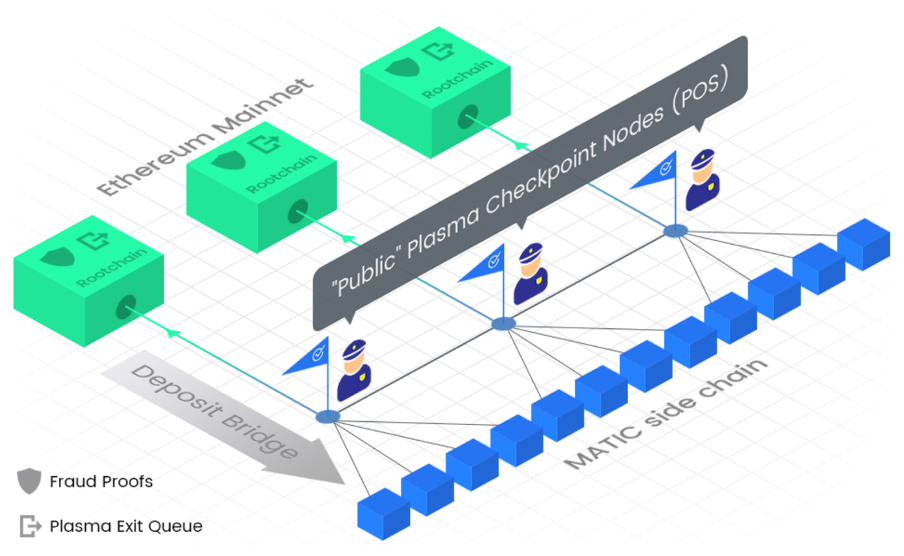

Polygon, also known as Ethereum’s Internet of Blockchains, purportedly exists to improve the efficiency and performance of Ethereum dApps. Thus, making the best aspects of Ethereum widely accessible. The flagship product, Polygon PoS, uses a 3-layer architecture to provide hybrid PoS and Plasma-enabled sidechains (a separate blockchain that runs alongside the primary blockchain, in this case, Ethereum).

Polygon PoS leverages security from Ethereum and offers up to 7,000 TPS using sidechains, compared to Ethereum’s 15 TPS. Moreover, Polygon PoS uses a decentralized set of validators, capped at 100, to verify transactions and create blocks, solving Ethereum’s infamous blockchain trilemma.

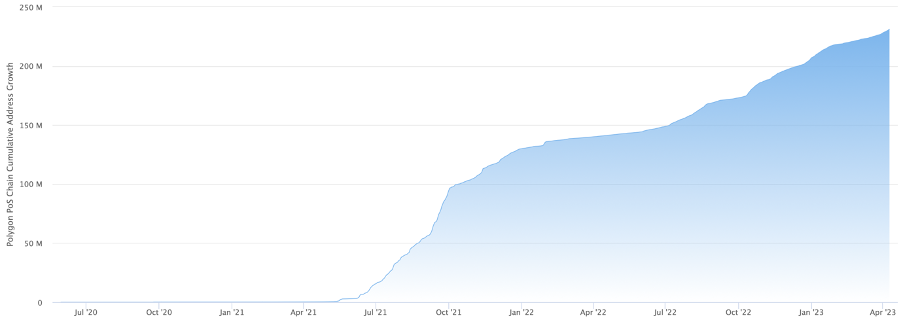

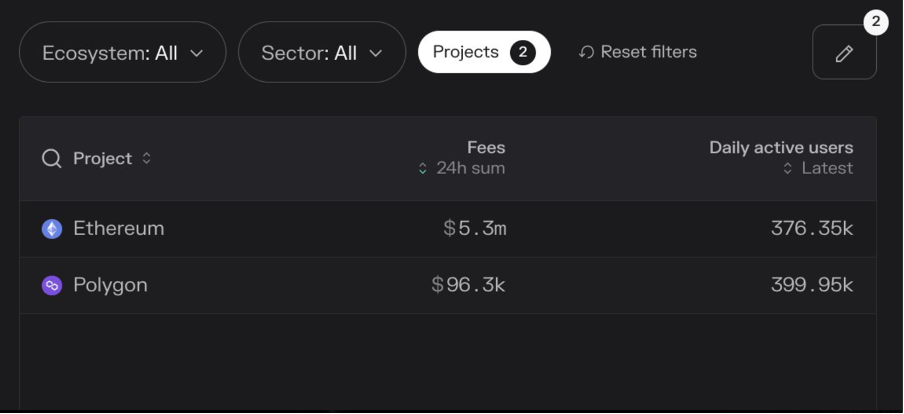

The traction for Polygon continues to surge as Polygon surpassed Ethereum in daily active addresses. Several catalysts, such as partnerships and an influx of NFT migrations, contributed to its ability to remain competitive with other solutions.

Within the mentioned period, the count of daily active addresses on the Polygon network stood at 399,950, while Ethereum recorded 376,350 users.

“Gaming” Traction Going Strong

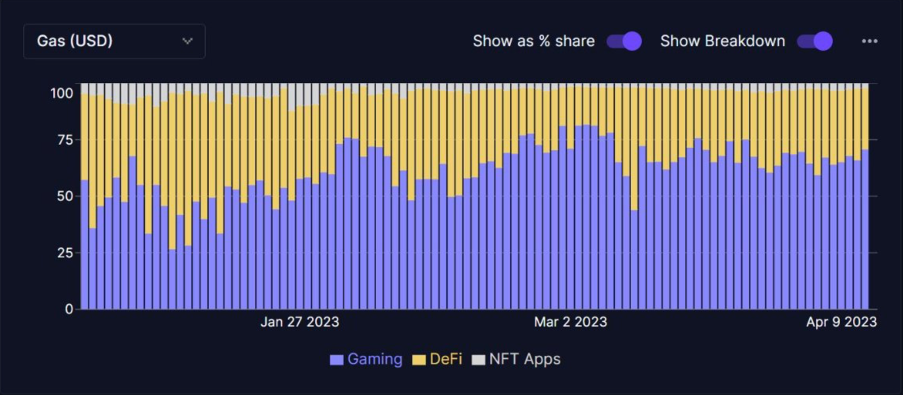

Another insight comes from the blockchain gaming domain. On-chain data shows that most fees are generated by gaming smart contracts deployed on Polygon.

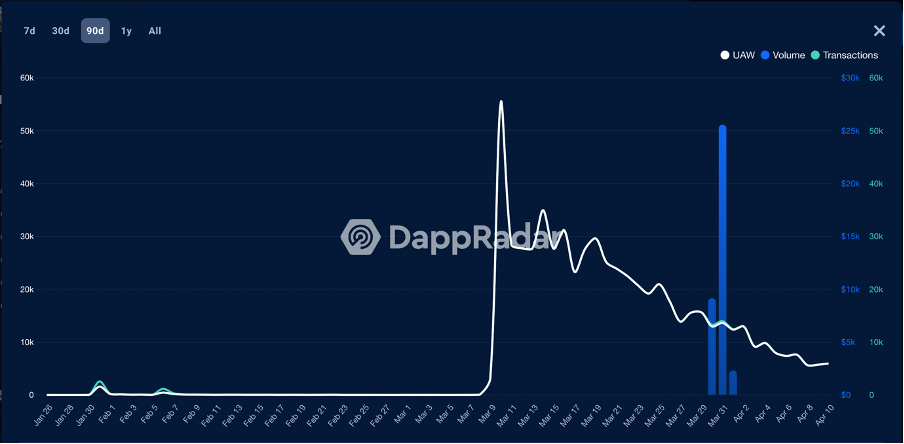

Herein, the percentage share of YTD rose from 57% to 71%. Meanwhile, active addresses within Polygon’s gaming domain averaged 50,000 users from March 12 to April 11. Overall, Polygon’s low gas fee was critical in achieving the status. In fact, Polygon became the second-largest gaming blockchain after user activity skyrocketed in March. The surge in unique active wallets (UAWs) was triggered mainly by the Hunters On-Chain game by BoomLand.

On March 9, the game saw an all-time high UAW count of more than 55,000. The unprecedented increase and Polygon’s favorable factors can help it become a gaming hub.

Challenges Loom

While Polygon has seen rapid growth and adoption, there are serious challenges and risks that the network may face in the future:

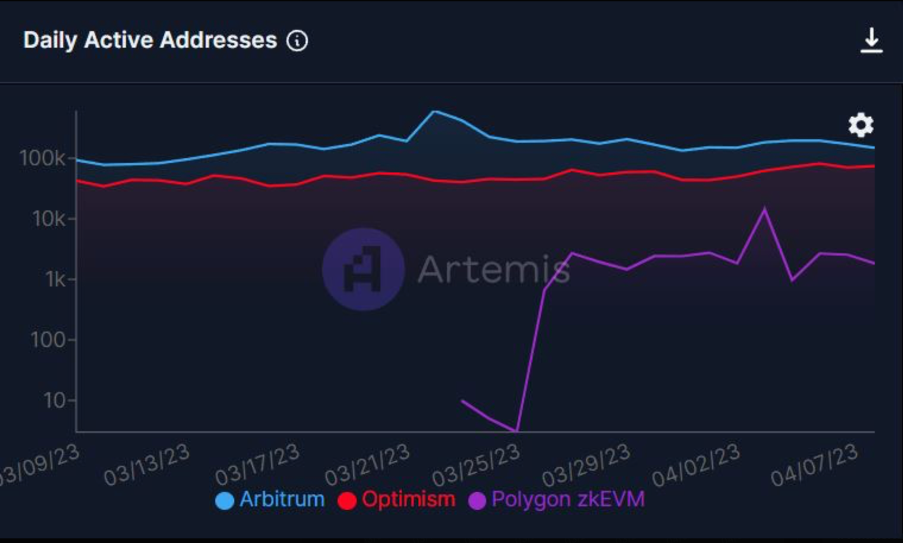

Competition from other Layer 2 solutions: As Ethereum faces scalability issues, more Layer 2 scaling solutions are emerging, such as Optimism and Arbitrum. These solutions compete with Polygon for market share and user adoption, which could limit Polygon’s growth.

Regulatory concerns: As the cryptocurrency market continues to grow and mature, there is an increasing risk of regulatory scrutiny. Any adverse regulatory action against cryptocurrency, including Layer 2 scaling solutions like Polygon, could negatively impact its adoption and overall success.

Security risks: Polygon is built on top of Ethereum, a decentralized network. While Ethereum has a strong security track record, any vulnerabilities or hacks could also impact Polygon. Moreover, the increased complexity of Layer 2 solutions can also introduce new security risks, potentially harming Polygon’s reputation and adoption.

Governance challenges: As Polygon grows, it may face challenges related to governance and decision-making. Ensuring that all stakeholders have a say in the network’s direction and development can be difficult, especially as the network becomes more complex and decentralized.

These are some of the concerns that the makers will need to face in the months to come.