Polygon MATIC price has maintained a relatively stable uptrend despite the larger crypto market’s uncertainty.

As MATIC price keeps up the bullish momentum amid Polygon’s rising adoption, MATIC bulls could be eyeing another breakout.

The global crypto market cap, alongside top cryptocurrencies like BTC, ETH, and ADA, saw a notable price uptick over the last 5-days. Even though MATIC gains weren’t as massive as some of its other counterparts, the coin’s price uptrend made some waves in the market.

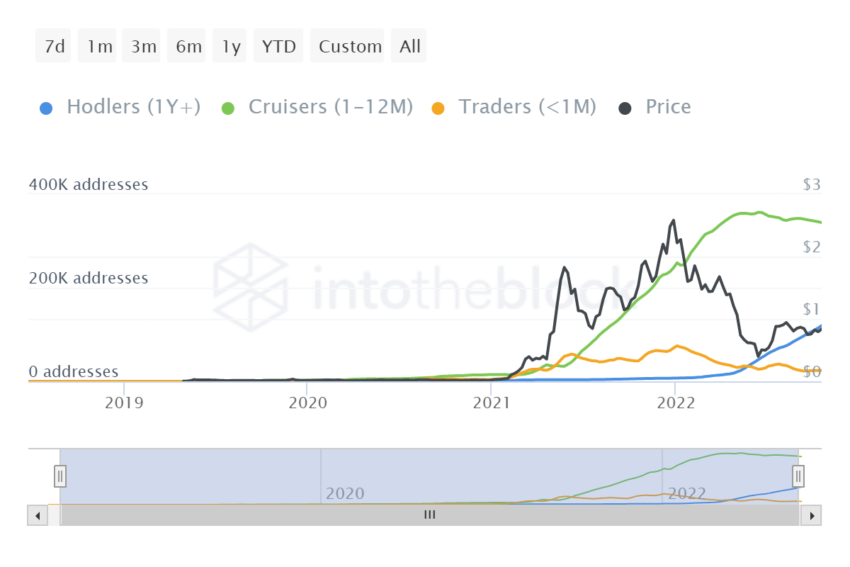

480% Rise in Polygon MATIC Holders

Recent data from IntoTheBlock highlighted that MATIC holders have finally circled back to the market. MATIC HODLer addresses rose from around 20,000 addresses in May 2022 to 113.890 at the time of writing, charting an over 480% growth.

While traders and cruisers continue to be around more or less the same level, a spike in HODLers shows that participants are confident in MATIC price action.

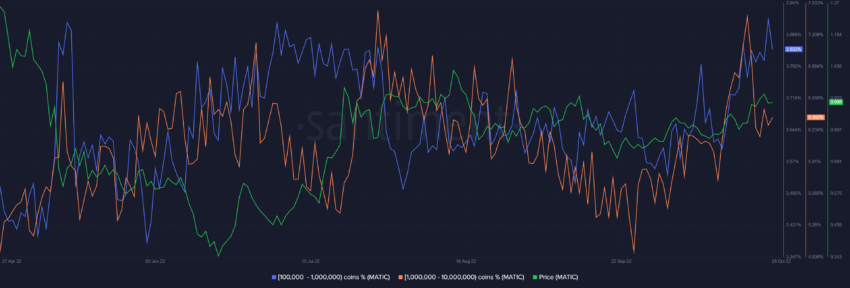

Additionally, MATIC whale addresses also noted a spike as addresses holding a higher number of coins increased their holding throughout September.

MATIC supply distribution by the balance of addresses presented that higher balance addresses saw a sharp rise from Sept. 25 to the time of writing.

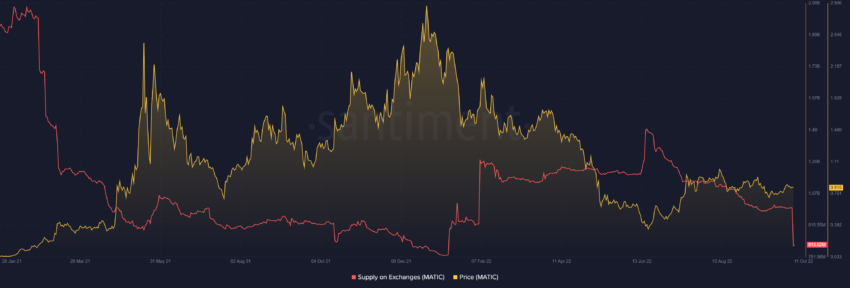

A sharp fall in MATIC supply on exchanges further presented a bullish market sentiment for the coin. A drop in balance across exchanges is considered bullish as traders and investors move their holdings from exchanges to cold wallets for long-term storage.

Ecosystem Looking Healthy

Apart from glimmering on-chain statistics, Polygon has been making strides in terms of larger adoption and ecosystem-centric upgrades. After Polygon made the announcement of partnering with Nubank, the same pushed volumes as well as MATIC price.

NuBank is backed by Warren Buffett’s Berkshire Hathaway and picked Polygon for its journey to transition from Web2 to Web3 ecosystem. News of Polygon adoption by mainstream fintech giants aided its active address growth.

Soon after the NuBank announcement, Polygon surpassed Ethereum in weekly active addresses (WAA), making its third consecutive all-time high.

In addition to that, Polygon saw soaring trade and sales volume of Reddit nonfungible token (NFT) avatars that catered to the larger price hype. Polygon weekly NFT volume skyrocketed to $3.7 Billion over the last week.

Furthermore, 16 of the top 20 dApps on Polygon recorded a positive WoW change, further pointing towards a healthier ecosystem.

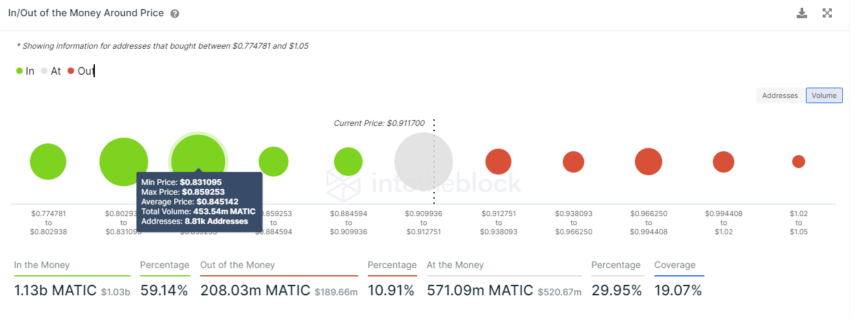

At press time, Polygon price traded at $0.907, noting a 2.30% loss on the daily as the larger market saw a weakening price action. A look at In/Out of Money Around Price indicator presented no major supply barriers for MATIC going forward.

The In/Out of Money around price indicator also presented decent support at the $0.845 mark. While Polygon technicals looked prime for a rise, in case of a bearish turnover, the coin could see a dip to the $0.845 mark.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.