The past month has seen a significant drop in user demand for Polkadot, the leading Layer-0 blockchain. Activity on its Relay Chain and parachains plummeted in June, reaching their lowest levels since the start of the year.

This, combined with the broader market downturn, has caused the value of its native coin, DOT, to drop by nearly 15% over the past 30 days.

Polkadot Users Shun the Network

Polkadot witnessed a significant decline in network activity across its Relay Chain and parachains in June.

The Relay Chain is the central chain of the Polkadot network, handling the coordination and security of the blockchain. Its parachains are individual blockchains that run parallel and are connected to the Relay Chain. They leverage the Relay Chain’s security and interoperability while operating independently.

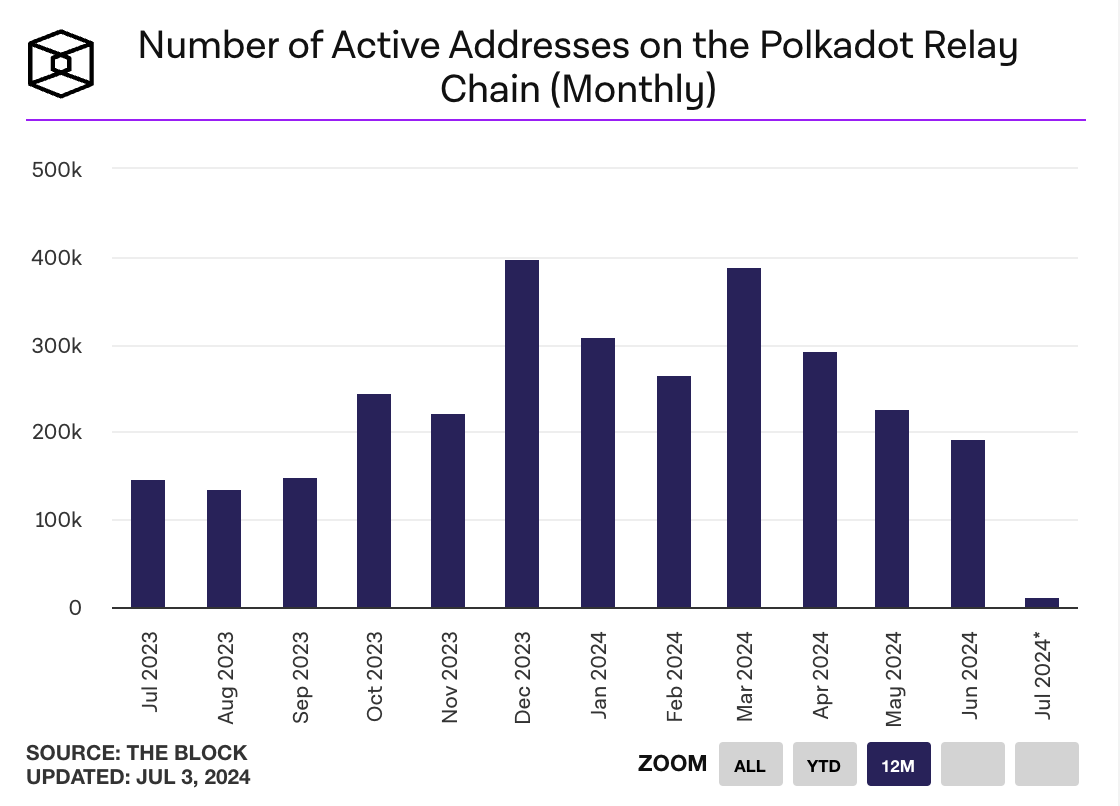

During the 30-day period under review, 192,330 unique addresses were active on the Polkadot Relay Chain, either as senders or receivers.

This marked a 15% month-over-month (MoM) decline from the 225,870 recorded in active addresses in May. Assessed on a year-to-date (YTD) basis, this represented a 37% fall.

Read More: What Is Polkadot (DOT)?

New demand for the network also plummeted. In June, the number of unique addresses that appeared for the first time in a transfer on the Polkadot Relay Chain was 34,370, a 22% MoM decline.

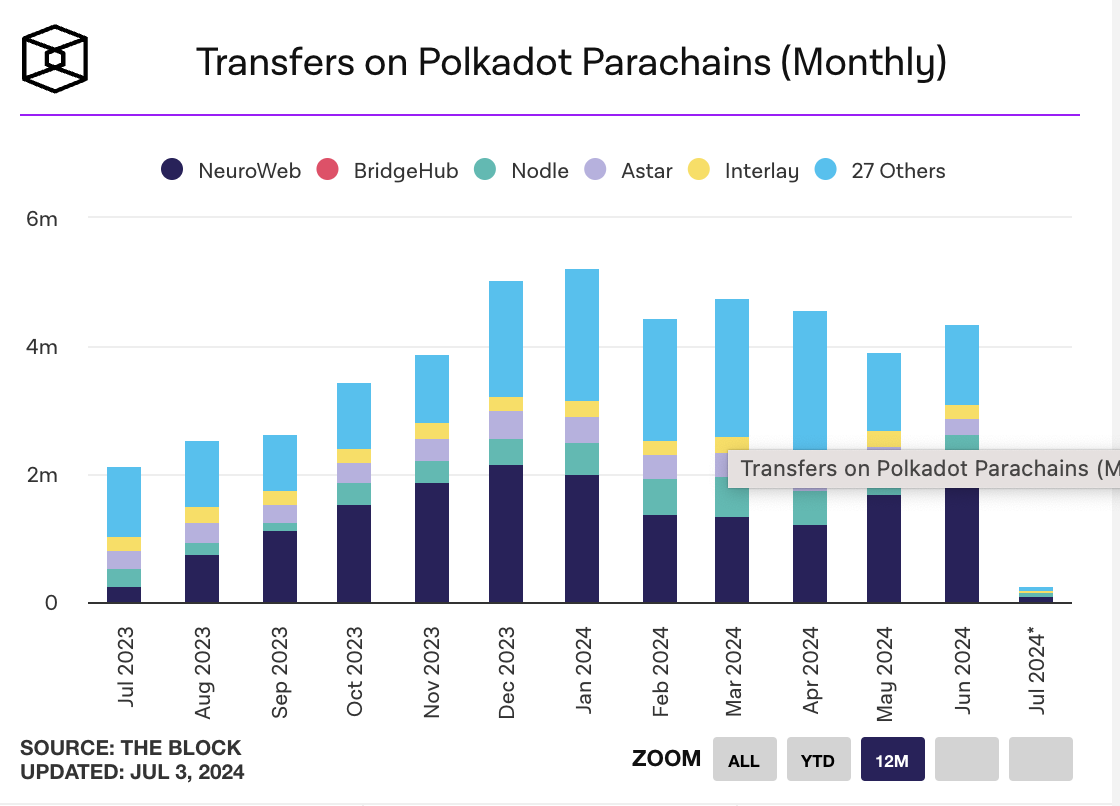

A similar downtrend was observed across Polkadot’s parachains, with total active and new address counts falling by 21% and 25%, respectively, in June.

Interestingly, despite the fall in user count, Polkadot’s parachains recorded more coin transfers in June than they did in May.

During the 30-day period, monthly transfers across the parachains amounted to 4.3 million, a 10% surge from the 3.9 million transfers registered in May.

DOT Price Prediction: Further Declines Lie Ahead

As of this writing, DOT exchanged hands at $5.87. Due to Polkadot’s network activity decline and the general market downturn, the altcoin’s value has dipped by 17% in the past 30 days.

With a sustained decline in DOT’s demand, it might witness a further price drop. According to its Relative Strength Index (RSI), selling activity outweighs accumulation among market participants. At press time, the indicator’s value is 42.32 and declining.

This indicator measures an asset’s oversold and overbought market conditions. At 42.32, DOT’s RSI signals that market participants favored coin distribution.

If selling pressure continues to mount, the altcoin’s value might fall to $5.36.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

However, if the demand for DOT climbs, it may push its price to $5.92.