Polkadot has just flipped the “scarcity switch,” as the community voted 81% to cap the total DOT supply at 2.1 billion, effectively turning DOT into a truly deflationary asset.

This could catalyze an entirely new narrative, potentially setting the stage for a price breakout if demand rises.

New Tokenomics

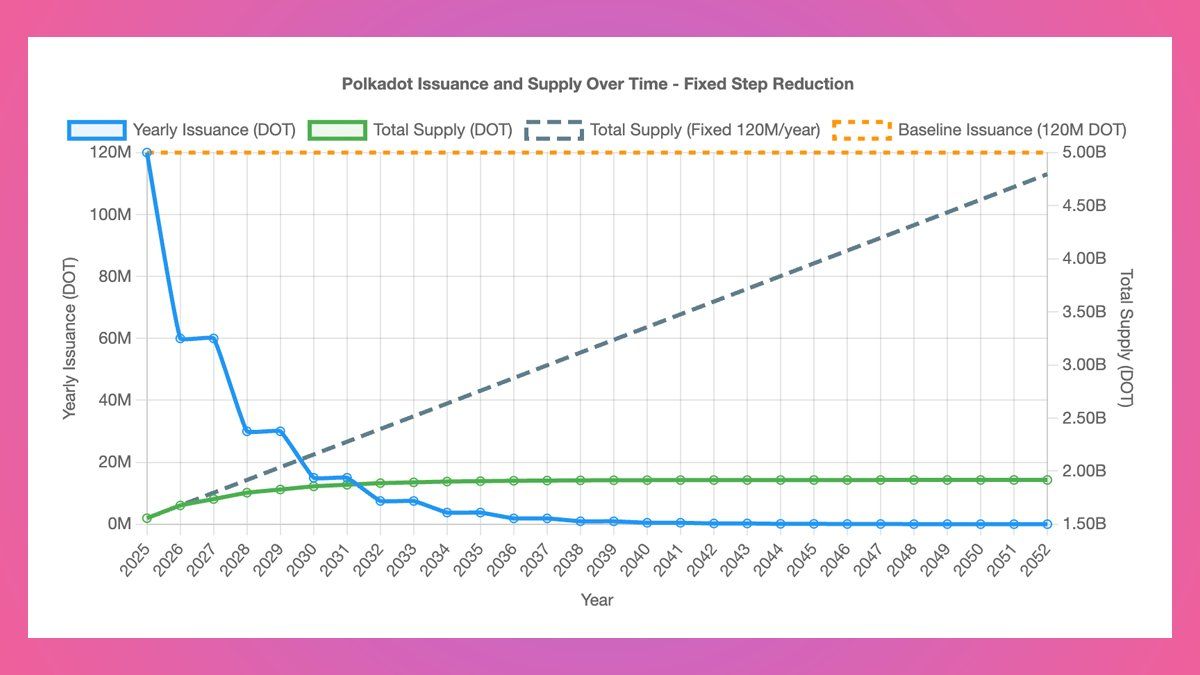

Polkadot has locked in a key monetary policy shift. The DAO community approved Referendum 1710 with 81% support, capping DOT’s supply at 2.1 billion. This change eliminates the unlimited issuance model of 120 million DOT per year and introduces a deflationary schedule, where new issuance will gradually decrease every two years on March 14.

Currently, about 1.6 billion DOT are in circulation, and under the new tokenomics, the total supply by 2040 will reach approximately 1.91 billion DOT. This compares to nearly 3.4 billion DOT if the previous issuance pace had been maintained.

Most community members appear optimistic about this new tokenomics model. Essentially, the expectation is that scarcity will positively affect DOT’s price in the future.

“Interesting tokenomics play, curious to see how it impacts $DOT,” one X user shared.

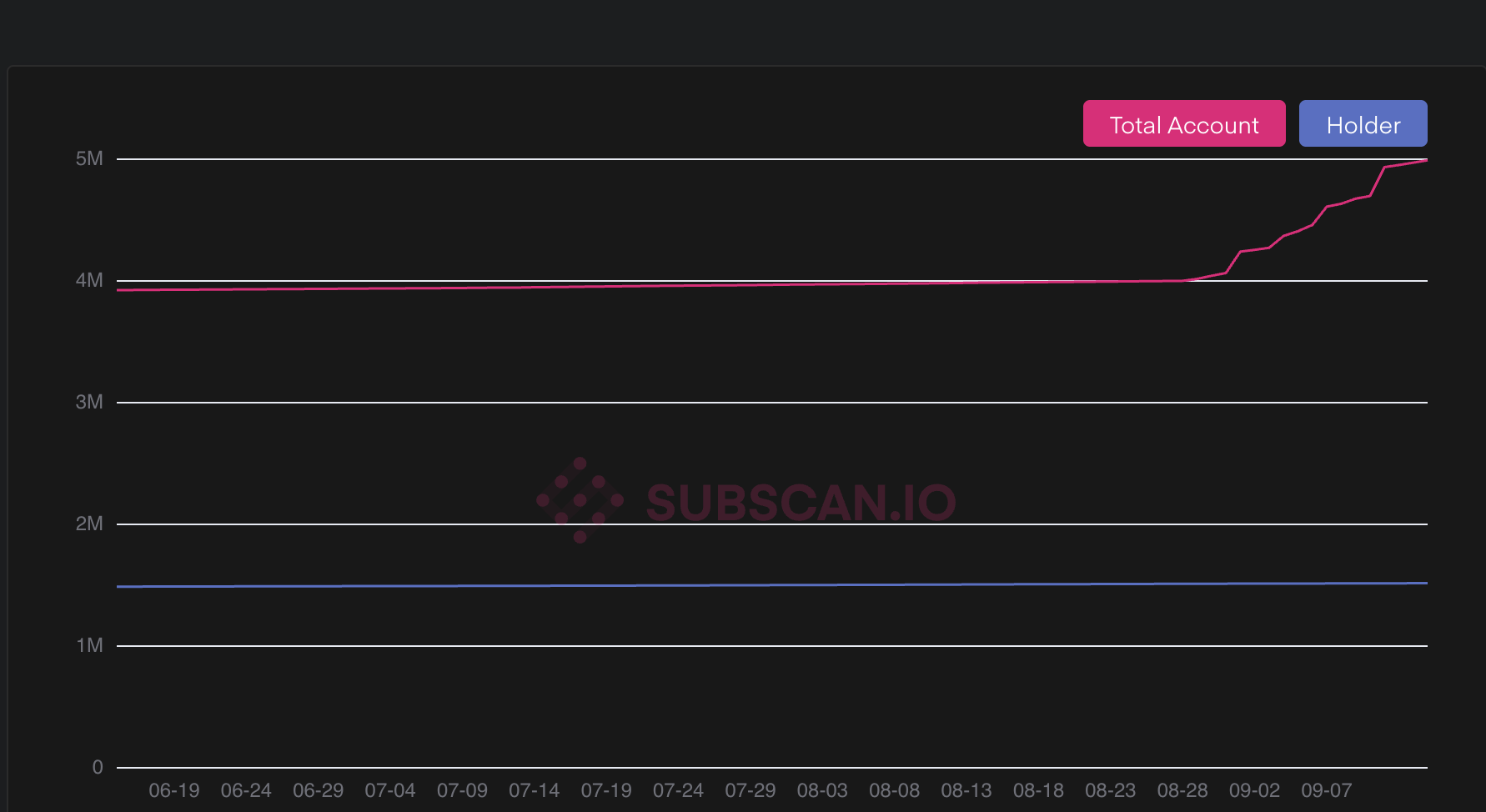

At the same time, on-chain data shows the number of DOT-holding addresses just hit 5 million in September — the highest level ever. This highlights growing user adoption and expectations, despite DOT’s underperformance relative to similarly capitalized altcoins.

New Prices?

Capping the total supply shifts DOT from an “inflationary currency” to a “fixed-supply currency.” This change could create the scarcity narrative historically favored by the digital asset market. Deflationary pressure may build as supply growth slows while demand remains steady or increases through staking, parachain applications, and institutional accumulation. This deflationary pressure could support Polkadot prices over time.

However, the real impact will depend on several factors: the rate of issuance reduction, staking/nominating behavior, the amount of DOT locked in parachains, and the liquidity of DOT on exchanges.

One key factor to watch is the reward mechanism for validators and nominators. Lower issuance means staking rewards could decline if DOT’s price does not rise quickly enough to compensate, which may lead to changes in staking behavior. The governance community must carefully balance network security incentives with reducing issuance. This balance is crucial to avoid weakening the security of the Polkadot chain.

The 81% approval of the new DOT tokenomics reflects strong governance consensus and signals Polkadot’s growing maturity as a decentralized network. The increase in holders to 5 million reinforces the view that the community remains bullish on the ecosystem. Investors should remain cautious as the “supply squeeze” effect may already be partially priced in. Short-term price action is still vulnerable to liquidity conditions and macroeconomic factors.

At the time of writing, DOT is trading at $4.19, 92% below its ATH.