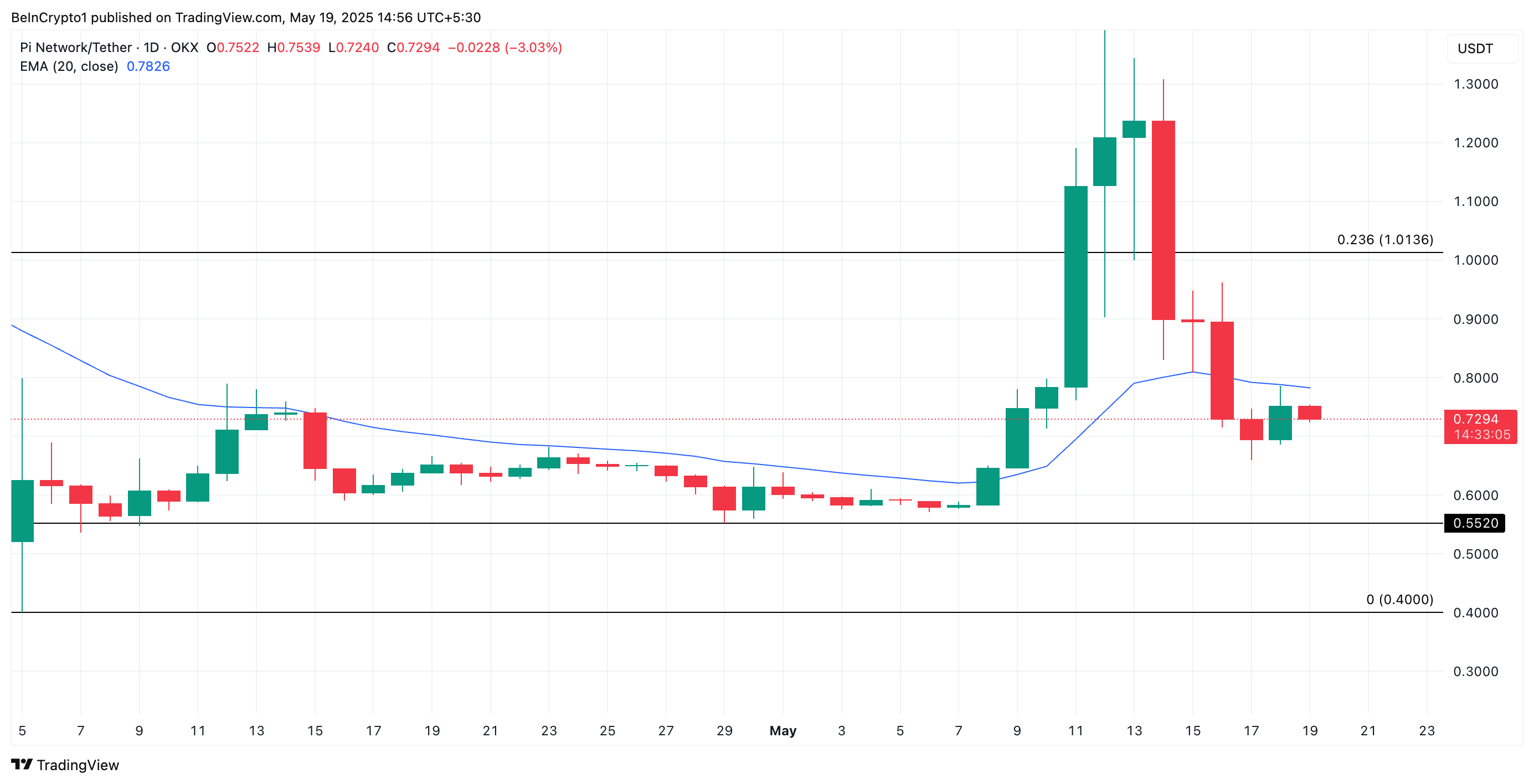

PI has shed half its value over the past seven days, signaling deepening bearish sentiment among its holders. At the time of writing, the altcoin trades at $0.72, marking a steep decline from last week’s price high of $1.67.

Technical indicators suggest that the downtrend may not be over as selling pressure remains significant.

PI Faces Heavy Selling Pressure

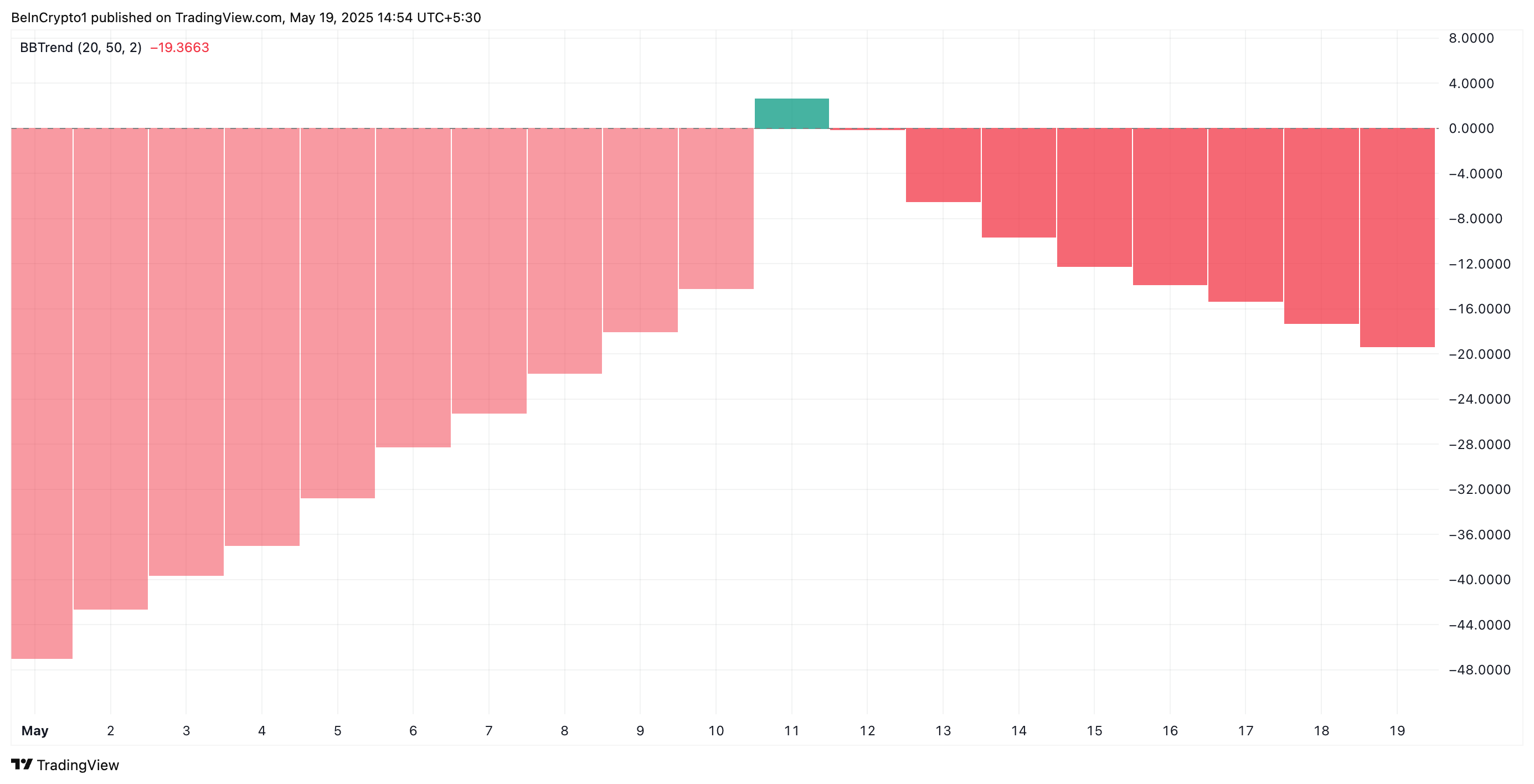

PI’s BBTrend remains in the red on the daily chart, confirming that bearish forces are firmly in control. Observed on a one-day chart, the indicator is currently at -19.36.

The BBTrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger Bands. When BBTrend values are positive, it signals a strong uptrend, while negative values indicate increasing bearish momentum.

PI’s negative BBTrend suggests that its price consistently closes near the lower Bollinger Band, reflecting sustained selling pressure and hinting at the potential for further downside.

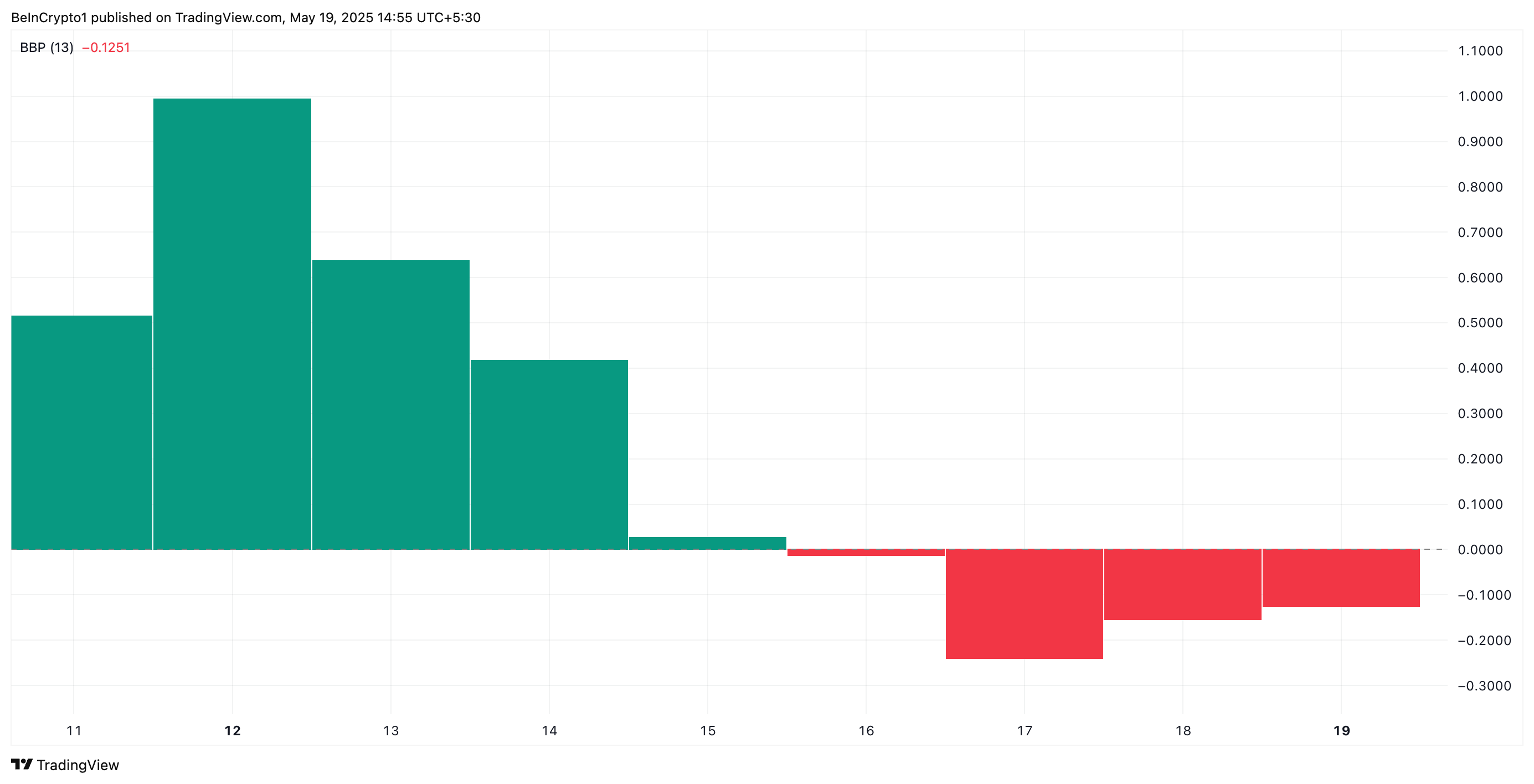

Furthermore, the token’s Elder-Ray Index supports this bearish outlook. At press time, the indicator returns a negative value of -0.12.

The Elder Ray Index measures the strength of buying and selling pressure in the market, using two key components: Bull Power and Bear Power.

When the index is negative, sellers dominate the market. This signals a bearish trend and hints at a continued downward momentum for PI.

Resistance at 20-Day EMA Caps Recovery Hopes

The PI token trades below its 20-day exponential moving average (EMA), which forms dynamic resistance above it. The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices.

When an asset trades below its 20-day EMA, recent price action is weaker than the short-term trend. This is a bearish signal indicating a lack of buying momentum.

If the trend continues, PI could fall to $0.55.

On the other hand, if buying pressure spikes, the PI token could rebound and climb to $1.01.