The Pi Network token endured a brutal selloff this week, losing nearly half its value in a matter of hours.

Analysts point to a mix of structural weaknesses, leveraged trading liquidations, and shaken community confidence as key factors behind the drop.

Pi Network Liquidations Spark a Domino Effect

According to Pi Network Update, the collapse was triggered by leveraged futures liquidations that set off a cascade of forced sales.

The initial selloff may have begun with only a few thousand PI coins changing hands on a smaller exchange. However, the thin liquidity proved enough to tip the market into freefall.

“The Pi Crash on a 1-minute chart. It’s never one thing. Leveraged futures get liquidated, causing a cascade of sales. The initial drop could have been caused by the sale of only thousands of Pi on a small exchange. Until the system shakes out OG miners and billions of unmigrated Pi, the long-term trend is down,” the network shared.

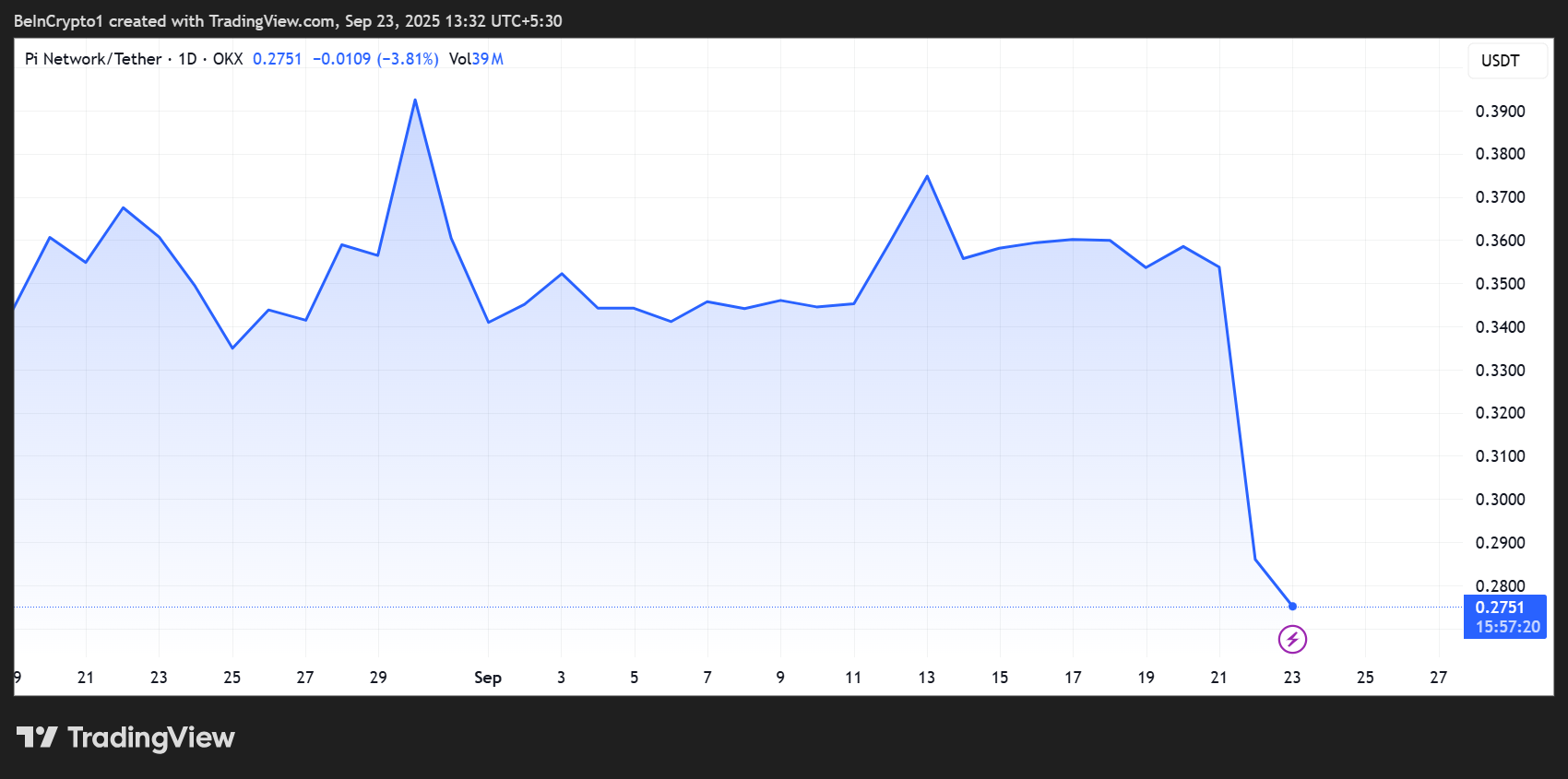

As of this writing, the PI coin price was $0.2751, down over 5% in the last 24 hours.

The commentary highlights a persistent issue facing Pi coin. A vast supply of tokens remains locked or unmigrated.

This overhang continues to pressure sentiment, leaving the project more vulnerable to sudden price shocks.

Some analysts also compared Pi to Bitcoin, with Jatin Gupta, a builder and pioneer, acknowledging that Pi coin price tends to mirror Bitcoin’s corrections. However, Gupta warned that its drawdowns are typically far sharper.

“What the F*** is wrong with Pi. I understand there’ll be a correction in Bitcoin, and it’ll drop below, but while following Bitcoin, Pi would fall to $0.18!! Damn, that’s horrible,” wrote Gupta.

The remarks mirror a growing concern among traders that Pi lacks the resilience of more established assets, often falling faster and harder during downturns.

Pi Network Founders Debut, But Fail to Reassure Pioneers

Ironically, the crash occurred the same day Pi Network’s two founders made their first public appearance at a community event in Seoul.

While some attendees expressed optimism about the gathering, it failed to generate any positive momentum for the token’s price.

Critics like Mr. Spock emphasized the deeper issue, highlighting a disconnect between Pi’s community narrative and trading activity.

“This is why Pi Network is failing. It’s a community project, yet the community doesn’t believe that Pi on exchanges is real. That’s why Pi could crash to zero. The majority of the Pi community isn’t buying Pi, and that’s why I’ve stopped promoting Pi Network as much as I used to,” wrote Mr. Spock.

The episode highlights Pi Network’s fragile position. Despite an active community and a now public visibility of its leadership, the token remains exposed to thin liquidity, speculative trading, and doubts about real adoption.

The challenge for long-time miners and holders is whether Pi can transition from hype to substance, and based on social media sentiment, the market verdict is harsh.

Until the network addresses structural issues, the long-term trend remains tilted downward, but investors should also conduct their own research.