Central Bank Digital Currencies, or CBDCs, aim to help the unbanked. Their role in Peru is making headlines. But concerns about privacy remain. Can Bitcoin come to the rescue?

Countries and central banks are exploring the development of Central Bank Digital Currencies (CBDCs). A digital form of central bank money accessible to all individuals and businesses, including those who are unbanked or underbanked. CBDCs show potential for improving financial inclusion and curbing reliance on cash.

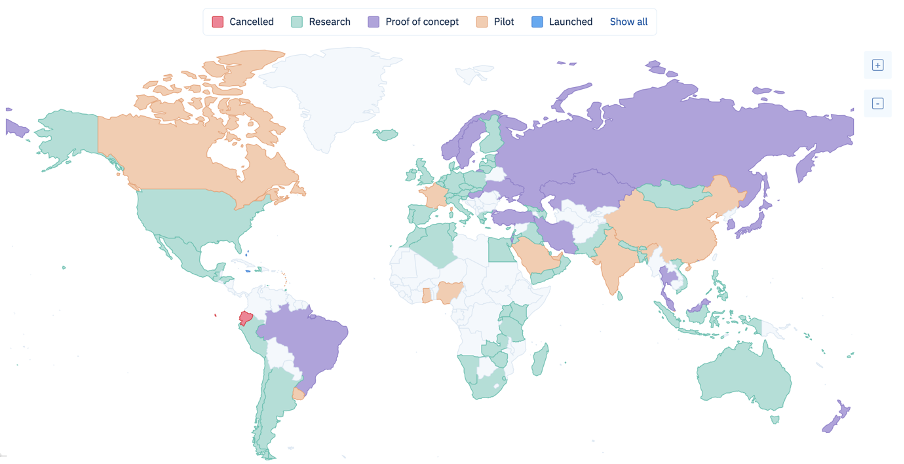

CBDCs can also offer benefits such as faster and more efficient payments, increased security and transparency, and improved monetary policy transmission. In collaboration with banking institutions, some regions have already launched pilot programs or plan to launch CBDCs shortly. Examples of countries that have launched CBDC pilot programs include China, Sweden, and the Bahamas. Other countries like the United States, the European Union, and Japan are still in the exploration/research phase.

Understanding the Need

The nation of Peru lacks a digital payment gateway. In May 2021, the Central Reserve Bank of Peru (BCRP) requested CBDC technical assistance from the International Monetary Fund (IMF). The response has facilitated progress during the research phase. But it is crucial to understand the demand.

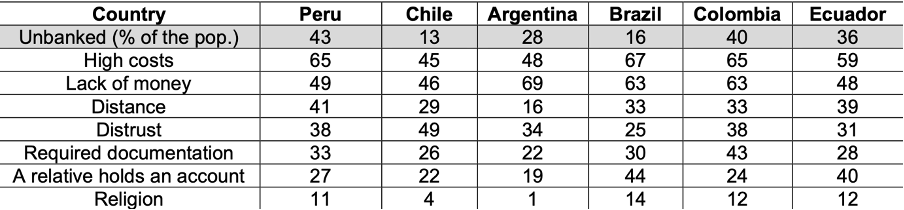

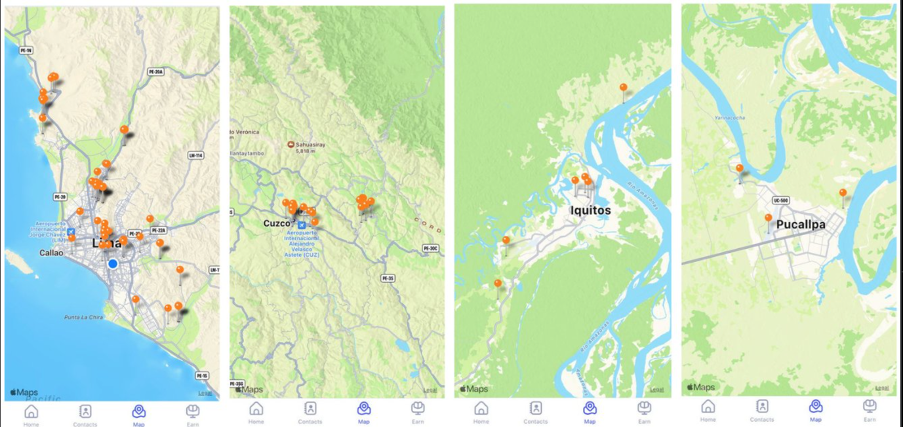

Peru faces significant challenges in achieving financial inclusion, with most of its population unbanked. There are several reasons why a bulk of the populace falls into this category.

One of the issues here is the need for access to financial services in rural and remote areas, which comprise a large part of the country. High poverty levels and informal employment can make it difficult for people to establish financial relationships with banking institutions.

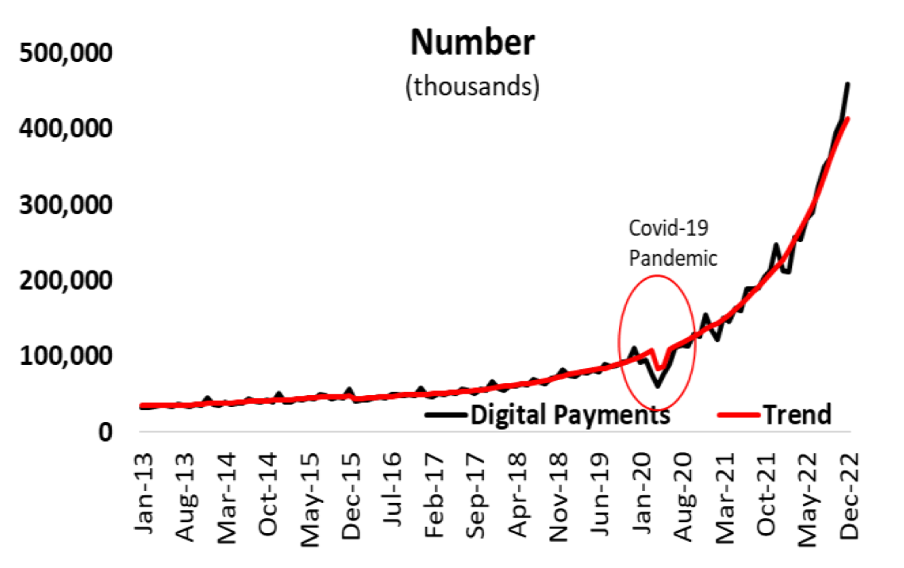

Nevertheless, the appetite for incorporating digital payments has significantly increased. The global pandemic and medium retail innovations triggered the change, and since then, the use of digital payments in Peru has grown fivefold. The Digital Payments Indicators below depict a hike in the value and number of such payments.

Zooming out, it’s clear that the demand is there, but can supply meet it halfway?

Can Innovation Help the Unbanked?

The document “CBDC: Promoting digital payments in Peru” showcased work carried out by the BCRP on the possible implementation of a CBDC. It aims to promote access and use of digital payments and strengthen the monetary and financial stability and the security and efficiency of payment systems. Undertaking CBDC on a “public retail payment platform would allow all retail payment service providers would be interconnected,” it states.

“The objective of a CBDC within the framework of the payment system in Peru is to give the unbanked population access to digital payments, so it is important to know their characteristics to prepare an implementation strategy.”

Per the report, CBDCs combined with new policies can improve the access and interoperability of existing systems. The real-life utility can contribute to having an ecosystem involving all agents in the payments chain: customers, merchants, wholesale goods distributors, government, financial institutions, and payment service providers.

The current report marked the end of the first out of five steps in the potential production of a CBDC, the report states. But there is no mention of a timeline for CBDC development. Other countries suffering from similar conditions are riding the same bandwagon.

However, there are also potential risks and challenges associated with CBDCs, such as privacy concerns, cybersecurity risks, and the need to ensure interoperability with existing payment systems.

Threatening the Core Freedom

A report from the Cato Institute shared with BeInCrypto highlights some of the critical concerns. While the report’s focus is on America, the idea holds globally. CBDCs are digital versions of traditional currencies issued and backed by central banks. They are designed for use as a means of payment and can be stored and transferred electronically. Unlike cryptocurrencies, CBDCs are centralized and their issuer is a government or central bank.

One concern about CBDCs is that they could potentially threaten citizens’ privacy. Because CBDCs are digital, the central bank can track and monitor every transaction. This could give governments unprecedented insight into their citizens’ financial behavior, possibly for use in surveillance, law enforcement, and taxation.

Another concern is that CBDCs could potentially usurp the role of the private sector in the financial system. If people begin using CBDCs instead of traditional bank accounts, it could curb demand for traditional banking services. This could lead to the banking sector’s consolidation and reduced competition, ultimately harming consumers.

In addition, CBDCs could threaten core freedoms, such as the freedom to transact anonymously and use alternative currencies. If CBDCs become the dominant means of payment, it will be more difficult for individuals to use alternative currencies. Or even to engage in transactions without tracking by the government.

Recommendations for Lawmakers

The Cato report urges Congress to “explicitly prohibit the Federal Reserve and Treasury from issuing a CBDC in any form.” The reasons mentioned above militate against developing a government-issued CBDC.

“A U.S. CBDC poses substantial risks to financial privacy, financial freedom, free markets, and cybersecurity. Yet the purported benefits fail to stand up to scrutiny. There is no reason for the U.S. government to issue a CBDC when the costs are so high, and the benefits are so low.”

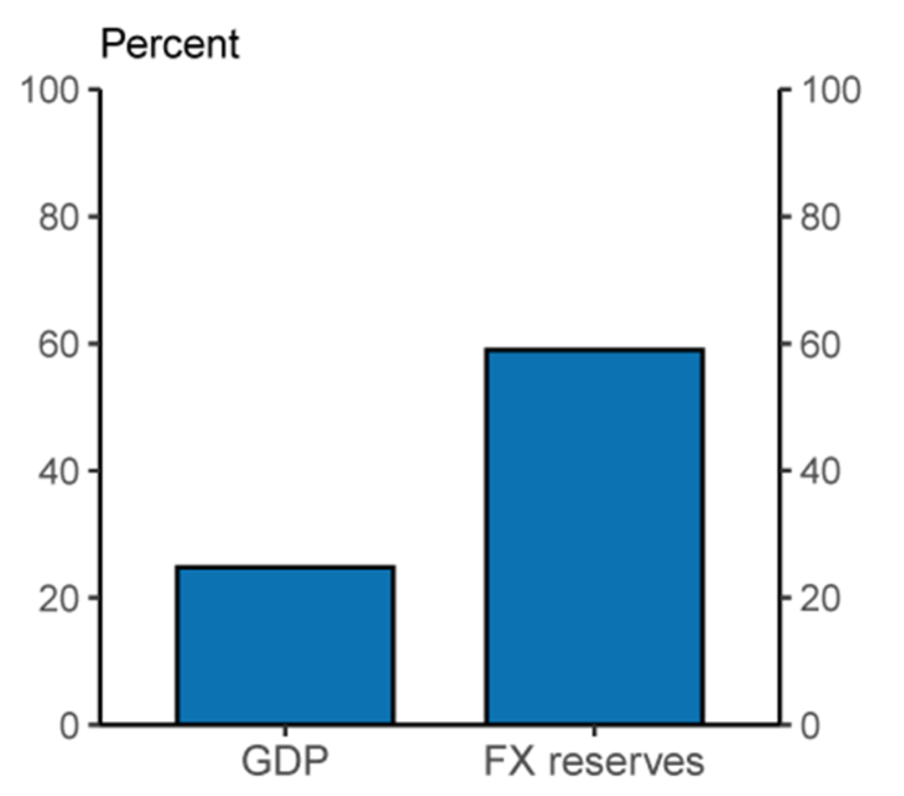

Such fears are not restricted to just the American boundaries. According to the Federal Reserve, some 60% of global financial liabilities and claims are denominated in U.S. dollars.

Despite these concerns, developments around FedNow continue in full swing. Per reports, the instant payments will go public in July.

Can Bitcoin Come to Rescue?

There are many pros and cons associated with CBDCs. So, finding a balanced approach is critical. This begs the adoption of cryptocurrencies such as Bitcoin.

Bitcoin, unlike CBDCs, has a decentralized character, free of any government or central authority. It has the potential to facilitate fast and low-cost cross-border transactions, with a degree of anonymity and privacy.

Motiv Inc. is a non-governmental organization (NGO) dedicated to developing Bitcoin circular economies. Richard Swisher, CEO and co-founder of Motiv, told BeInCrypto,

“As Bitcoin gains a toehold in impoverished communities, we are pleased to see the increase of adoption and excitement emerge from its citizens as new businesses are formed using Bitcoin, and more people become engaged with the currency by using it in their daily lives.”

But again, crypto as a whole possesses a volatile nature. There’s a long journey ahead to reach its full potential and compete with other asset classes.