Pepe (PEPE), like many other cryptocurrencies, is experiencing intense volatility in the market. Without a clear direction yet, on-chain data provides vital information about the price action of the memecoin.

PEPE’s price changes hands at $0.000011 as of this writing. But before that, the price almost fell below the $0.000010 psychological support. The question is whether PEPE will eventually slip below the price mentioned above or if bullish elements will move the needle in favor of an increase.

PEPE’s Next Move Depends on Holders

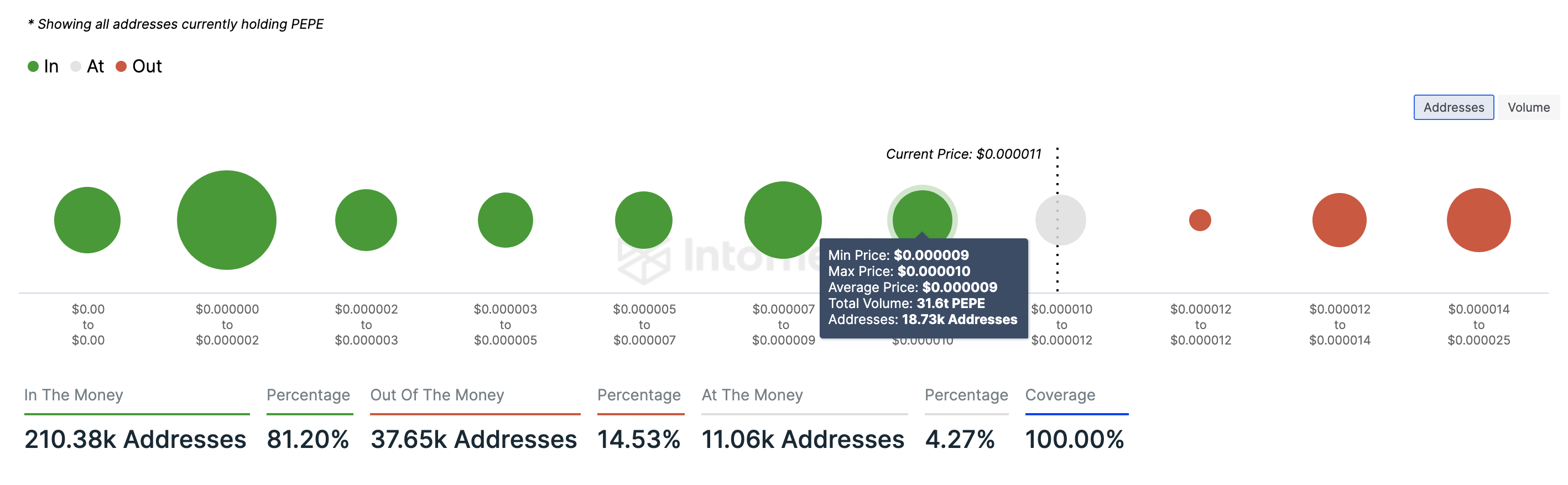

According to the Global In and Out of Money (GIOM) indicator, PEPE is in a crucial spot. This position may either lead the token higher or reduce the number of holders in profits.

- Global In and Out of Money (GIOM): It groups addresses based on the number of participants making money, losing money, or at a breakeven point at the current price. By providing this information, traders can gain insight into possible support and resistance zones.

At press time, IntoTheBlock data showed that 18,730 addresses bought 31.60 trillion tokens at a maximum price of $0.000010. This group is making money at the current price of the memecoin.

On the other hand, BeInCrypto noticed that 13,340 addresses accumulated 37.07 trillion tokens at a weighted purchase price of $0.0000013. This cohort is out of the money.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

Notably, a situation where more addresses are out of the money leads to selling pressure. However, the data above shows that the number of addresses out of the money is lower than those in the money despite purchasing more tokens.

Therefore, if they do not realize profits, the addresses in the money can act as support for the token. If validated, the cryptocurrency’s price may resist falling below $0.000010. However, if profit-booking increases, PEPE may have no option but to slide.

Apart from the broader market downturn, PEPE’s inability to recover can be linked to a major sale that happened three days ago. On June 15, on-chain smart money tracking handle Lookonchan revealed that a trader who has been holding the token since May 14 sold 11.4 billion PEPE for $1.27 million.

Time Has Come to Accumulate

Given the token’s current condition, checking whether it is time to position for entries is important. The price DAA Divergence analyzes this potential.

- Price DAA Divergence: The DAA acronym stands for Daily Active Addresses. It is a key indicator of user activity and shows the number of unique transaction addresses. When combined with the price, it becomes the price DAA divergence. With the indicator, traders can spot buy or sell signals.

According to Santiment, PEPE’s price DAA divergence is 41.39%. Historically, an increase in price accompanied by decreasing network participation is a sell signal.

However, for PEPE, it is the other way around, as active addresses on the network have been increasing. Thus, this is a buy signal, and accumulating the token before a rally appears may be profitable in the mid-term.

PEPE Price Prediction: How Long Before Recovery?

The market structure on the daily PEPE/USD chart looks close to forming a double bottom. A double bottom is a technical analysis pattern that indicates a trend reversal. Instances like this halt a downtrend and lead to a significant bounce.

As it stands, PEPE’s price may need to decline to $0.0000096 for the prediction to play out. However, it also has to be accompanied by buying pressure. Currently, the Relative Strength Index (RSI) is falling.

The RSI is an oscillator that measures a cryptocurrency’s momentum using the size and speed of price changes. When the indicator’s reading is above 70, an asset is overbought. Conversely, readings below 30 mean an asset is oversold.

In PEPE’s situation, the RSI is below the 50.00 neutral point, which indicates that the momentum is bearish. Therefore, PEPE may eventually fall to $0.0000096. However, it might not take an extended period for the memecoin to rebound, with possible targets at $0.000014.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

Irrespective of the outlook, traders need to monitor the rising volatility in the market. Should Bitcoin’s (BTC) price fall lower than it did on June 17, PEPE may drop as low as $0.0000079.