PEPE price, a popular meme coin, has been struggling to secure a crucial support level that could potentially trigger a rise to its all-time high of $0.00001725. However, the coin faces significant resistance and the threat of profit-taking, which could hamper its upward momentum.

The meme coin is currently hovering near critical levels, with the possibility of either a breakout or a continued struggle beneath its resistance points.

SponsoredPEPE Faces Profit-Taking

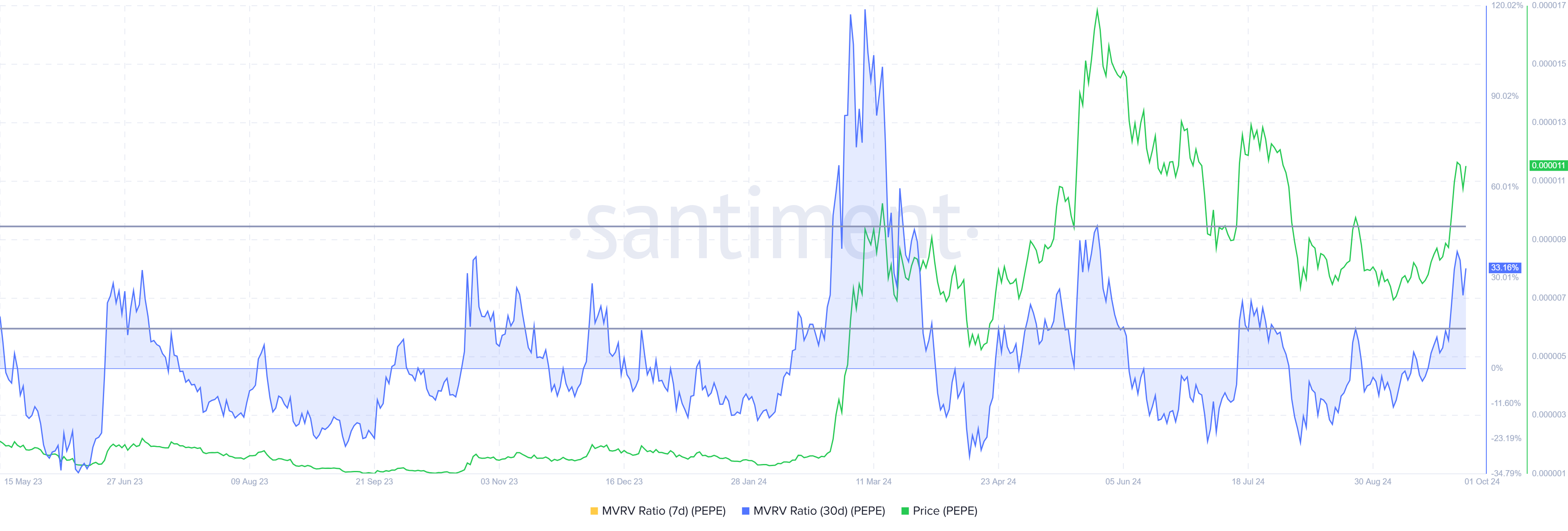

PEPE’s Market Value to Realized Value (MVRV) Ratio at 33% currently sits in the danger zone. The area between 13% and 47% typically signals a heightened risk of corrections. This is because, at these levels, a large number of investors are in profit, which could lead to widespread selling. When profits become abundant, investors often move to lock in gains, putting downward pressure on the price.

This potential selling pressure is something PEPE investors should keep in mind, as corrections become more likely when the MVRV ratio reaches these levels. If profit-taking accelerates, it could further solidify the resistance, making it harder for the meme coin to break through.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

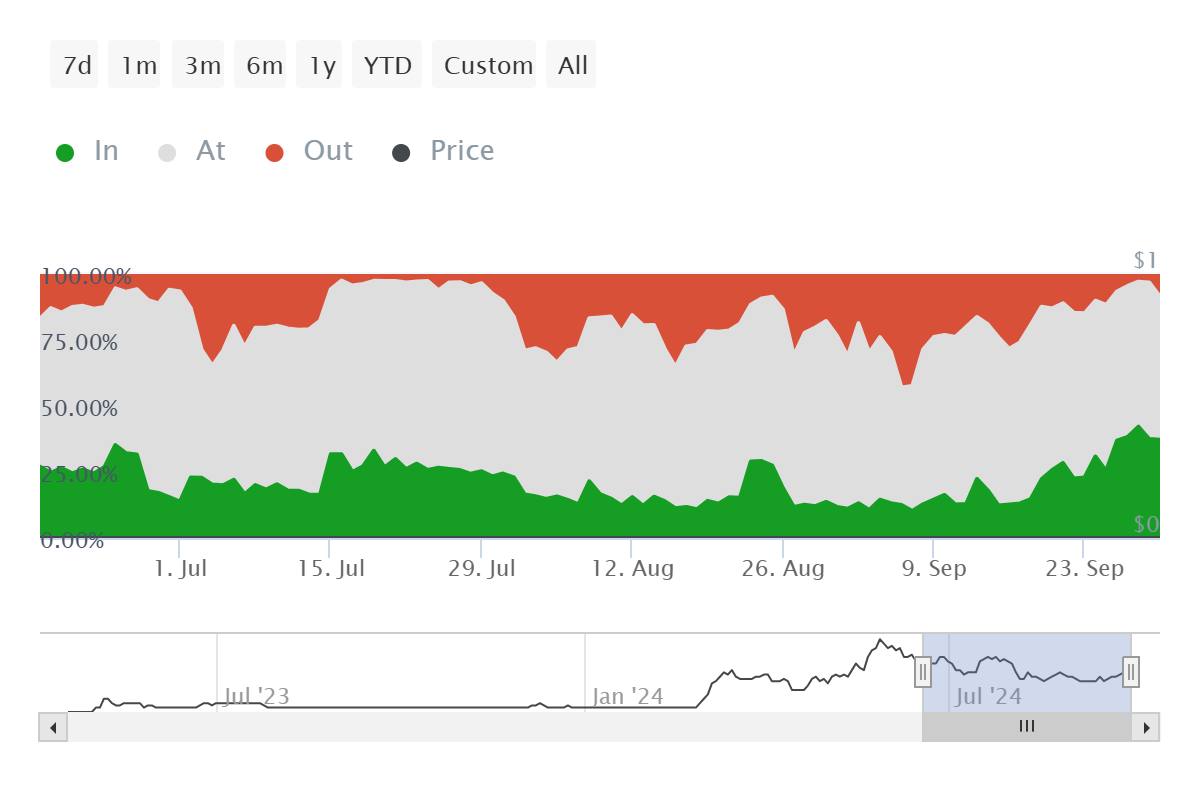

PEPE’s macro momentum also shows concerning signals. Historical data on active addresses indicates that 37% of participating investors are currently in profit. This percentage is worrisome because when more than 25% of investors are in the green, the chances of profit-taking rise sharply. These conditions, combined with the MVRV ratio, suggest that a significant portion of the market may be preparing to sell, limiting PEPE’s ability to gain ground.

SponsoredThis strong presence of profitable investors reinforces the likelihood of short-term corrections. If enough holders choose to sell, PEPE could face consolidation instead of the breakout many investors are hoping for.

PEPE Price Prediction: All-Time High Is Away

PEPE is currently trading at $0.00001118, sitting just under a local resistance level of $0.00001146. While breaking this resistance is possible, a rise beyond $0.00001369 appears unlikely, given current market conditions. PEPE’s struggle against this resistance has persisted for four months, and overcoming it will be no easy feat.

The resistance at $0.00001369 is the key level preventing PEPE from forming a new all-time high above $0.00001725. With numerous investors positioned to take profits, breaking through this barrier will be a challenge. If PEPE fails to surpass $0.00001369, it will likely remain consolidated between this resistance and $0.00000989 for the foreseeable future.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

However, a rally could follow if PEPE manages to breach $0.00001369 under bullish circumstances. This breakout would invalidate the current bearish outlook and potentially reignite optimism among investors.