Ethereum’s highly anticipated Pectra upgrade went live yesterday and is already beginning to impact the network’s supply dynamics. On-chain data reveals a sharp dip in the coin’s circulating supply, now at an 18-day low.

This supply crunch is driven by a surge in user activity in the Layer-1 (L1) network over the past day. If this trend continues, ETH’s price could rocket to new highs.

Ethereum Supply Hits 18-Day Low

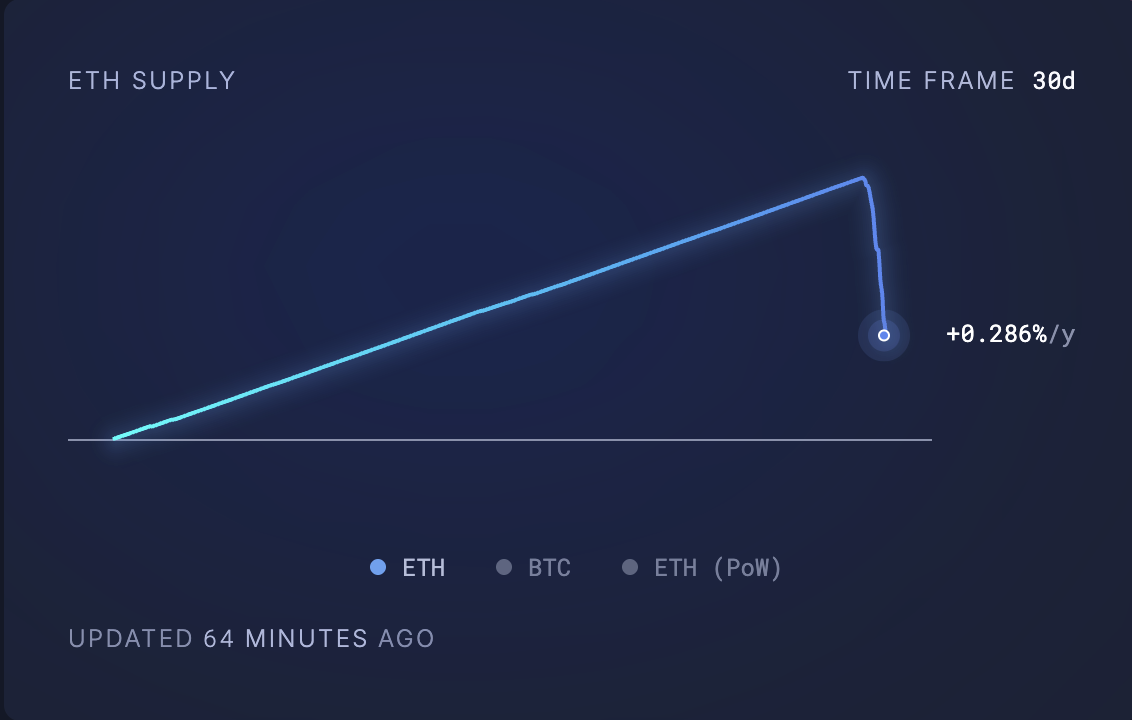

According to Ultrasoundmoney, ETH’s circulating supply has dropped since Ethereum’s Pectra Upgrade was implemented on Wednesday. As of this writing, it stands at an 18-day low of 120.69 million ETH.

This long-awaited network overhaul, which raises validator limits to 2048 ETH, enables smart wallets and boosts network efficiency, has fueled a spike in network activity, tightening ETH’s supply as user demand climbs.

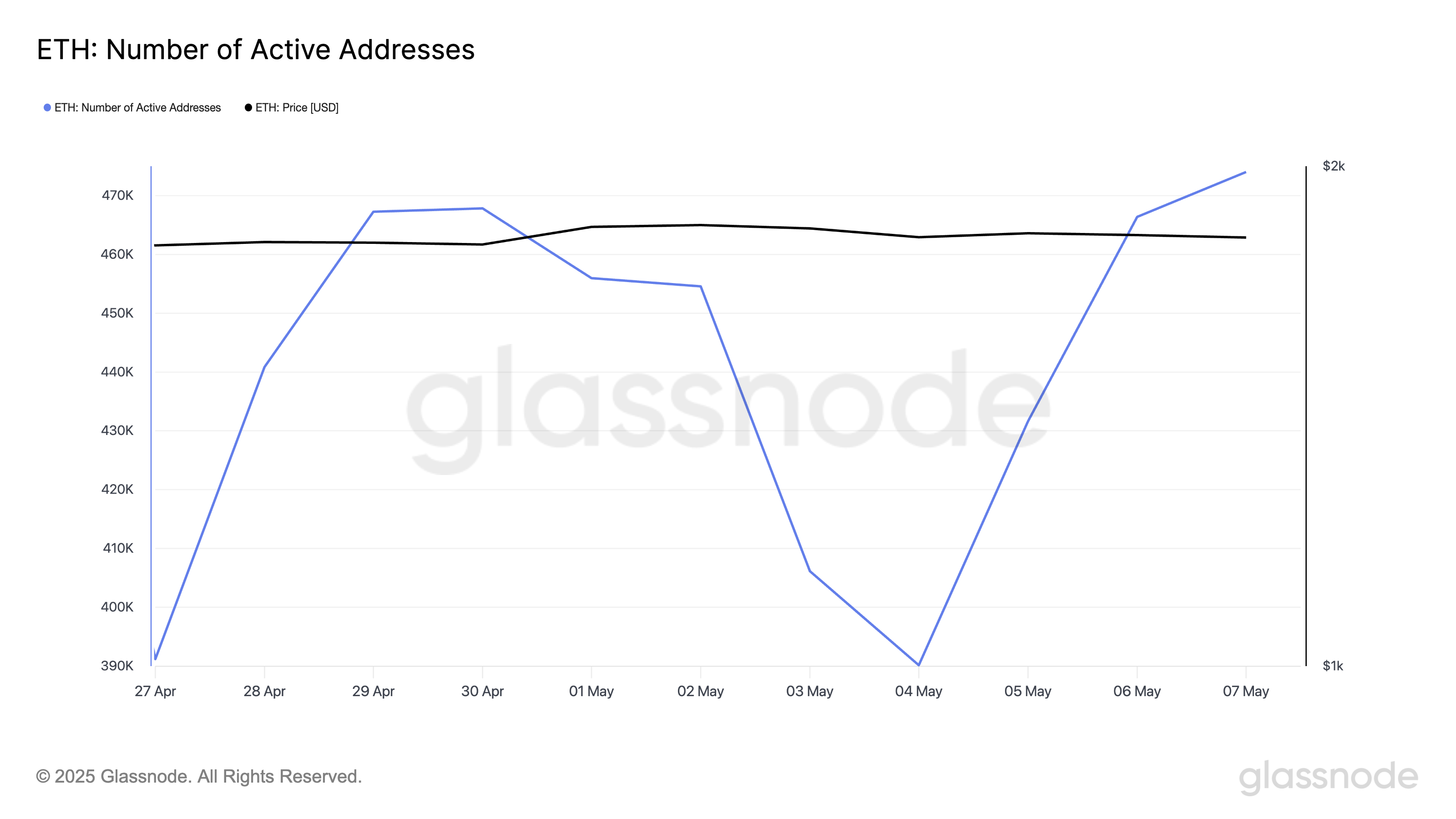

Glassnode data shows Ethereum’s active address count has climbed to a 30-day high, signaling renewed user engagement. According to the data provider, on May 7, the number of unique addresses active in the network, either as a sender or receiver, totaled 474,044.

When Ethereum’s active address count increases, more unique wallets interact with the network. The surge in user activity signals growing demand and network usage, and it often correlates with higher gas fees and increased ETH burning.

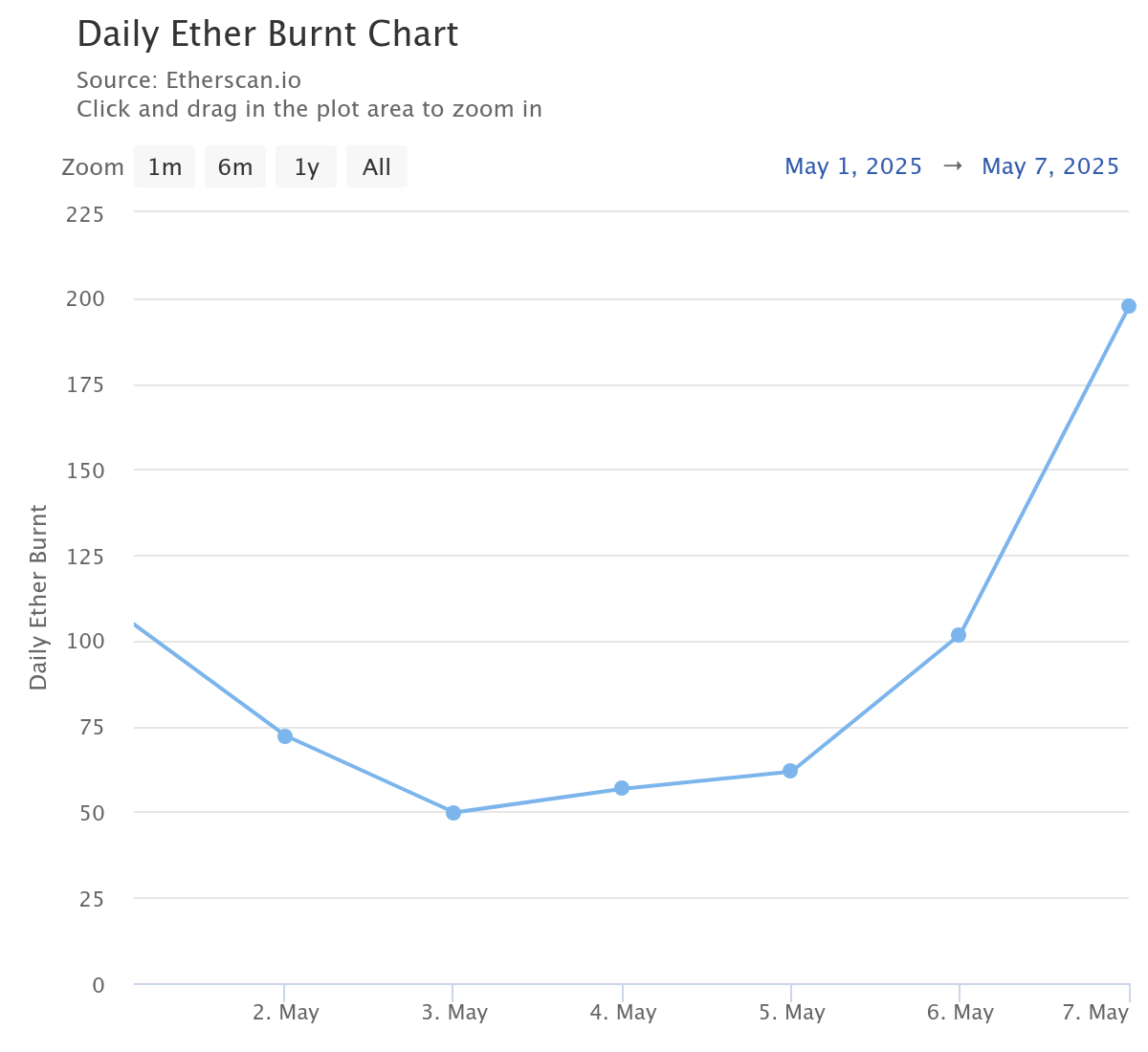

This is because with more users on the network, more transactions flow through the network, triggering higher gas fees and accelerating the ETH burn rate. According to Etherscan, ETH’s burn rate is at its highest level since May began.

As more ETH coins are burned, the circulating supply lessens, increasing the upward pressure on the altcoin’s price.

ETH Hits $2,000, But Will it Retreat?

On the daily chart, ETH trades above the horizontal channel, which kept its price within a range between April 23 and May 7. The altcoin faced resistance at $1,872 during that period and found support at $1,744.

If the breakout continues, ETH could hold the psychological level $2,000 and continue its rally toward $2,235.

However, the breakout doesn’t hold; it could cause ETH’s price to fall to $1,744 or even to $1,564.