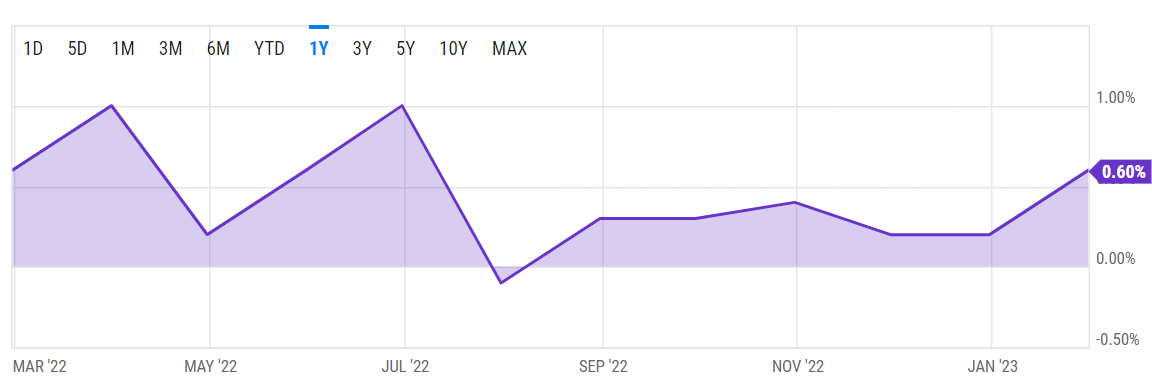

Month-on-month core Personal Consumption Expenditure rose 0.6% in Jan. 2023, higher than analysts’ 0.4% prediction and December’s 0.3% rise.

The latest spending data affirmed earlier fears of a booming job market as personal income rose 0.6% after a 0.2% gain in December 2022, while personal spending increased 1.8%.

Stocks and Bitcoin Fall as Both Core and Headline PCE Rises

Headline PCE, which includes food and energy, rose 5% year-on-year, up slightly from 4.9% in December 2022.

The U.S. Bureau of Economic Analysis reports personal income, personal spending, and PCE Price Index monthly in its Personal Income and Outlays Report.

After the news, stock markets took a hit, with the Dow Jones falling 300 points and more pain expected for growth stocks. Nasdaq 100 futures fell 1.7%, while the S&P 500 Futures was down 1.2%. Market strategist Sven Henrich noted that PCE numbers likely present stock buying opportunities.

Bitcoin tracked stock markets downward, dropping 0.6% to $23,751 and falling further to $23,106 at press time. Ethereum dropped from $1,639 to $1,592 at press time, a decline of over 3.4%.

Unlike the popular Consumer Price Index, which measures granular price changes for everyday items like cereal, Personal Consumption Expenditure captures broad shifts in consumer behavior based on price; for example, if consumers choose a cheaper cereal because the price of their preferred brand has gone up. In the medical sector, CPI tracks changes in the price the end user pays, while PCE measures what medical insurance firms pay out for treatment.

Fed Places More Weight on PCE Than CPI

The Federal Reserve, responsible for price stability and maximum employment in the U.S., is expected to announce an increase in interest rates at its next meeting, which starts on March 22, 2023.

The central bank has been increasing the cost of borrowing rate since March 2022 to tame U.S. inflation, which reached decade-high proportions in the wake of Covid-19 stimulus checks and low-interest rates.

Its Open Markets Committee gives greater weight to the PCE than the CPI in determining monetary policy changes. Hot PCE numbers point to the policymakers increasing rates at the March meeting, though markets and analysts are divided on the size of the rate hikes.

Analysts Agree on Future Increases While Markets Price in 50 Basis Points

Data from the CME Group indicated that futures markets are already pricing in a 50-basis point increase after the news, double the previous general market consensus of 25 basis points.

Analysts and markets agree that the Fed will likely continue raising rates at its next three meetings. Fed Chair Jerome Powell said earlier this year that the Federal Reserve is unlikely to end rate hikes before the end of the year to reach its inflation target of 2%.

“The Fed has much more work to do, and even if they only raise rates a couple more times, it is extremely unlikely that they will be cutting rates this year—as was consensus and in market-based pricing as recently as a few weeks ago,” noted Chris Zaccarelli, the Independent Advisor Alliance’s Chief Investment Officer.

Cleveland Fed president Loretta Mester concurred that the Fed “needs to do a little more” to continue pushing inflation down, expecting interest rates to reach a little over 5% and stay there.

Minutes from the last FOMC meeting indicate that most committee members favored reducing the pace of 25 basis point increases.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.