Pantera Capital is raising funds to invest in The Open Network’s (TON) Toncoin, signaling strong confidence in the token’s future.

The new initiative seeks to attract substantial investments and expand Pantera’s holdings of TON tokens.

Pantera Capital to Increase Toncoin Holdings

An email from Pantera Capital to potential investors outlines the specifics. It invites them to participate in the Pantera “TON Investment Opportunity” by June 21, with a minimum commitment of $250,000 per investor.

This move comes after Pantera’s largest-ever investment in TON, which was executed in March at a significant discount. The firm’s decision to double down on Toncoin reflects its bullish stance on the token’s potential growth.

“We believe the TON network is still in its early stages, and we are excited to witness the adoption of its ecosystem and new features by the Telegram user base. At its core, Telegram embodies the ethos of crypto: an open, free network accessible to all. With TON, Telegram achieves a symbiotic relationship where scalable smart contract functionality and a robust payments network enable groundbreaking capabilities that were unattainable in the Web2 environment,” said Ryan Barney, a partner at Pantera, last month.

Likewise, crypto analyst Marteen believes The Open Network has seen impressive growth, with several key metrics highlighting its increasing popularity.

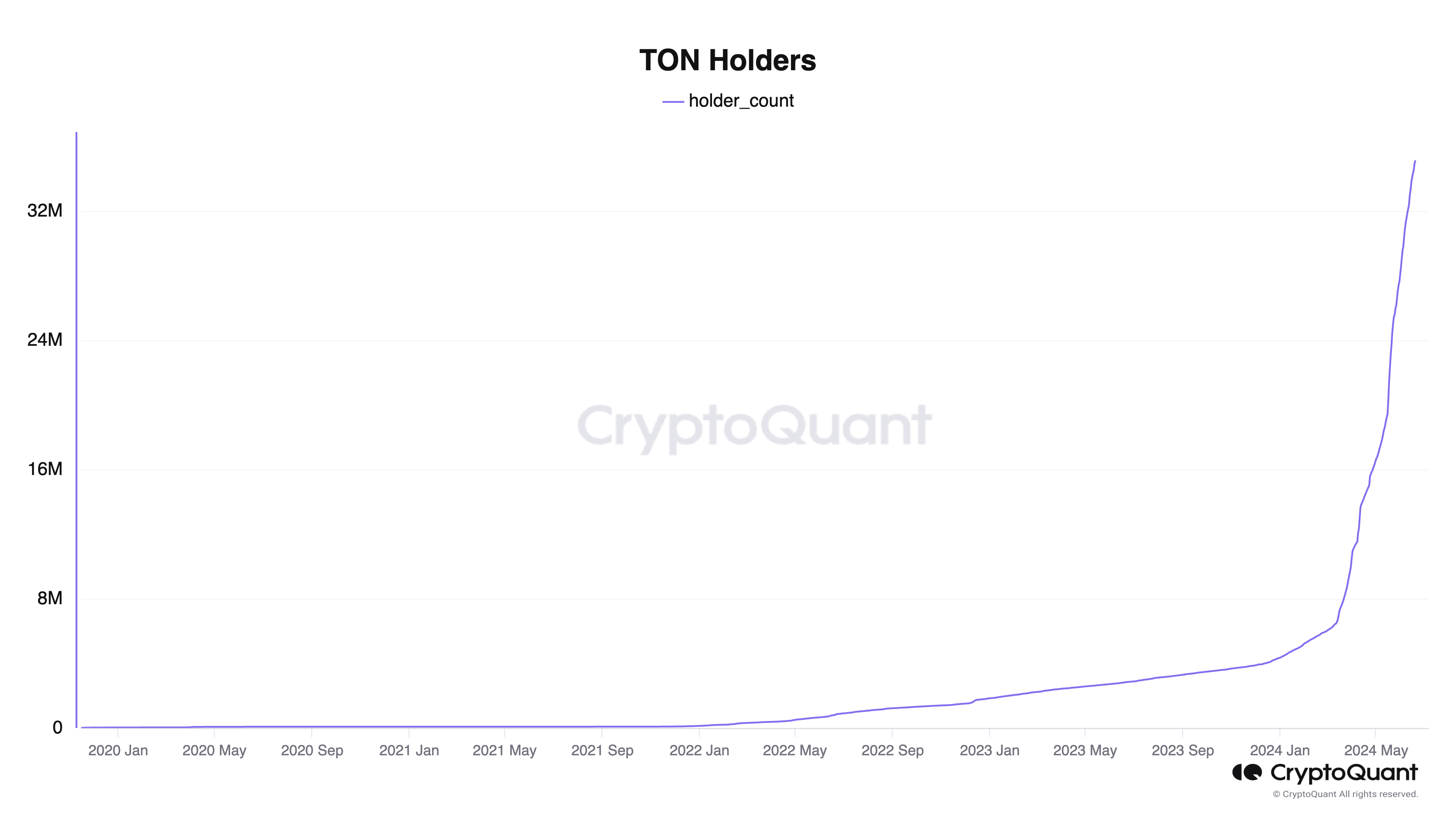

For instance, the TON transfer volume, ranging between $5 billion and $10 billion, indicates that the network has achieved about 10% of Bitcoin’s capacity, a remarkable feat for a four-year-old cryptocurrency. Furthermore, the number of on-chain TON holders has surged from 2.9 million to 32 million over the past year.

“On-chain metrics of TON are going parabolic!… Currently, there are 32 million holders, up from 2.9 million a year ago. This represents a 10x increase in just one year, underscoring the growing popularity of the TON-Token,” Marteen wrote.

The recent surge in activity on the TON network is also noteworthy. Toncoin has outpaced Ethereum in daily active addresses for 10 of the last 11 days. This surge is partly attributed to Telegram’s vast user base of 900 million, which has been a crucial factor in TON’s increased user engagement.

Despite these promising developments, some analysts debate the long-term sustainability of TON’s growth compared to Ethereum’s established ecosystem and scaling solutions. Ethereum’s network remains strong with extensive infrastructure and a strong user base, posing a challenge to TON’s continued expansion.