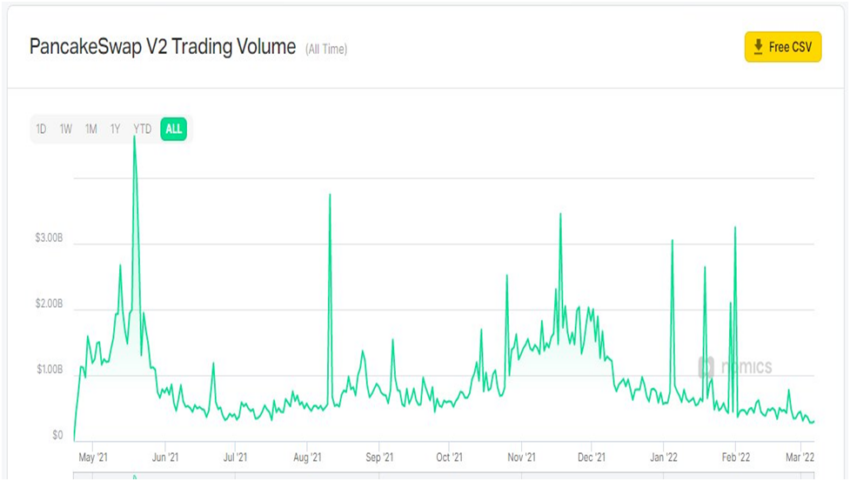

PancakeSwap (CAKE) responded negatively to the bearish outlook of the market in February, as total trading volume fell by 37%.

February proved to be a difficult period for centralized and decentralized exchanges. PancakeSwap recorded approximately $15.73 billion in trading volume during the second month of 2022, according to BeInCrypto Research.

Although such a statistic seems huge due to PancakeSwap’s position in the crypto trading space, the total trading volume for the exchange was down by approximately $9.52 billion from January.

PancakeSwap Volume Still Decreasing from 2021

Since PancakeSwap competes with DEXs such as Uniswap, SushiSwap, Mooniswap, Curve, Balancer, Synthetix, Ox Native, DODO, and 1inch LP, the decrease in volume over the past month could have detrimental effects on the fortunes of Binance’s top decentralized application (DAPP).

PancakeSwap started recording relevant data towards the end of April 2021. The DEX reached an all-time high volume of $51.81 billion in May 2021. With the launch of several DEXs on other blockchains to compete Ethereum’s Uniswap and Binance’s innovation, PancakeSwap experienced a slight dip of 2.69% on May’s high to end November 2021 at $50.42 billion. A negative crypto market sentiment took over the entire industry in December. This resulted in a huge drop in volume to $30.49 billion by the end of the year (a 39% decrease in 31 days).

PancakeSwap’s volume in January and February 2022 was 51% and 69% below May 2021’s figure, respectively.

What caused the volume decline?

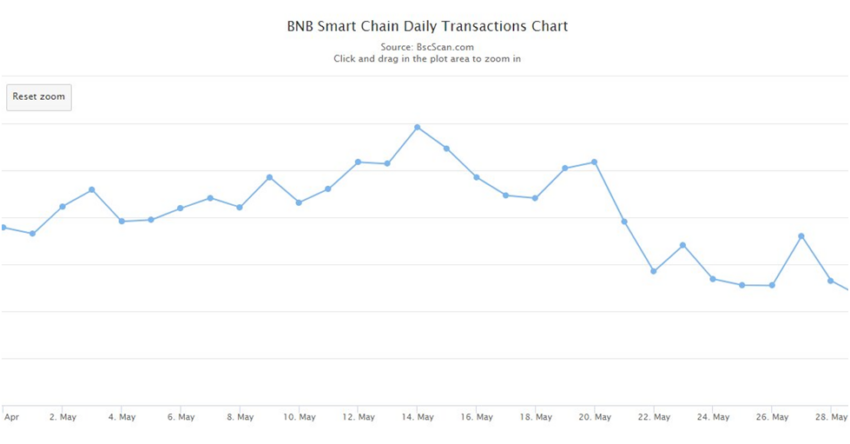

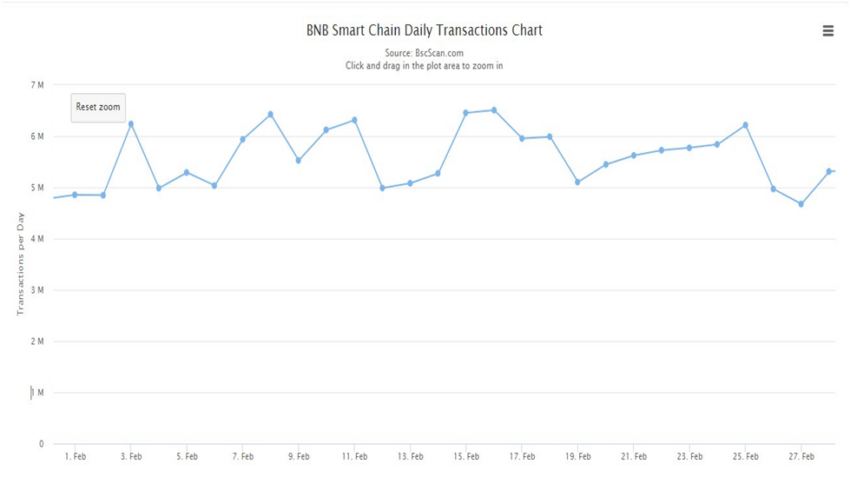

Declining transaction counts on the Binance Smart Chain, buoyed by the Russian/Ukraine Crisis towards the end of February can be attributed to as the primary factor for the fall in total trading volume.

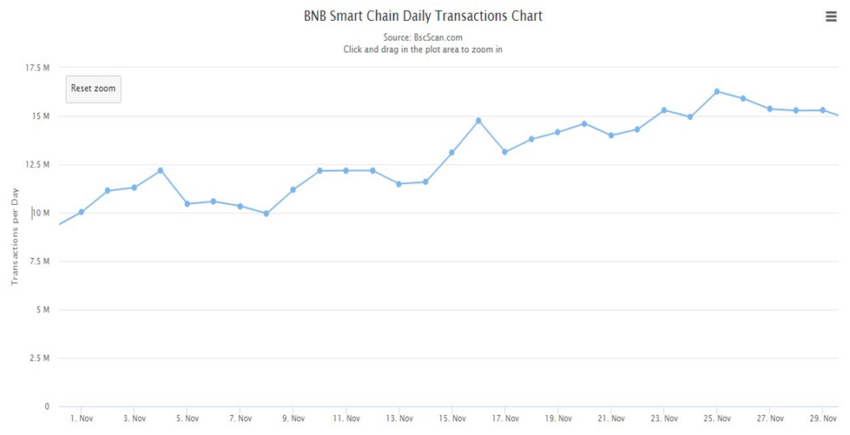

The top ─ performing DAPP in the Binance Smart Chain (BSC) is PancakeSwap. As a result, the DEX is largely responsible for the lion’s share of the total transaction count on the chain. At its peak in May 2021, the total transaction count on the BSC was 247,447,339.

After a spike of 58% towards the last bull cycle of 2021 in November, the total transaction count for the entire month was 391,847,392.

In 2022, the total transaction count (TTC) continues to slide. TTC for January was 196,096,842, a 50% decrease from November’s high.

Unsurprisingly, with several exchanges experiencing new high lows, PancakeSwap plummeted further by 60% of November’s total transaction count to end Feb. 28 with a TTC of 156,512,579.

As of writing, the total volume for March 2022 was $2.78 billion and the total transaction on the Binance Smart Chain (still dominated by PancakeSwap) was 34,305,912.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.