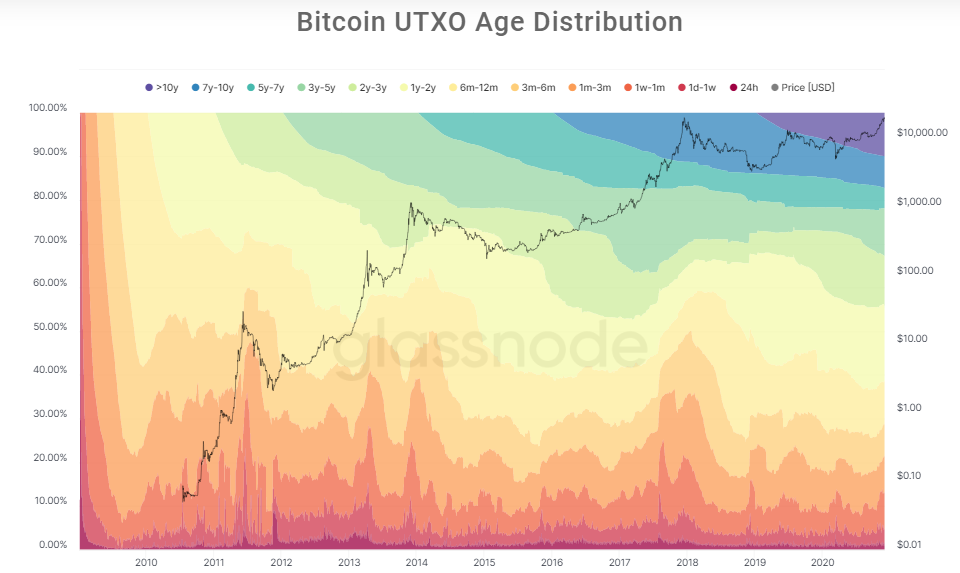

Approximately $4 billion worth of bitcoin which had been inactive for between five and seven years was moved out of long-term storage following November’s massive price rally.

Unchained Capital revealed the news via a data visualization on Dec 3. Unchained’s ‘HODL Waves’ metric measures the activity of bitcoin by the length of storage. The total share of the bitcoin supply locked in storage between five and seven years fell from 5.48% to 4.67% between Nov 1 and Nov 30.

SponsoredSome Long-Term Investors Take Profit

Investors who locked their coins into storage in 2013 did so at a price level that averaged between $134 and $1,151. In 2014 and 2015, the price averaged between $500 and $750.

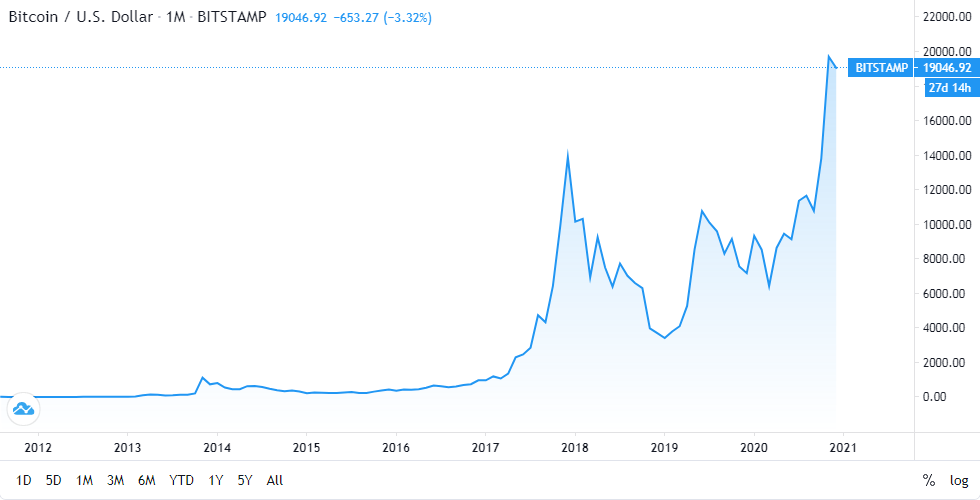

With bitcoin closing at $18,702 on Nov 30, long-term investors would have made anywhere between 1524% and 13,856%.

According to the HODL Waves calculation, 1.19% of the bitcoin total supply left this storage category and became active on-chain.

Given the current total supply of ~18,561,000 BTC at press time, this represents more than 220,000 BTC, currently worth approximately $4.2 billion.

SponsoredBitcoin HODLers Not Relenting

The data reveals a mix of long-term strategies. The vast majority of long-term investors are not only holding, but also increasing their holdings.

Whereas the previous five to seven year long-term storage category fell more than 1%, the over ten-year storage category actually rose 0.19% from 9.73% to 9.92%.

The long-term storage category between seven and ten years also rose 0.2% from 7.08% to 7.28%. Similarly, the three to five year storage category jumped 0.69% from 10.06% to 10.85%.

In fact, the data shows that it’s mostly the shorter-term storage categories that witnessed holding declines. Overall, more than 61% of bitcoin’s total supply has not moved at all in more than a year.

This data, some argue, would seem to validate the position that bitcoin could be viewed more as a store of value asset and an inflation hedge versus just a speculative instrument.

On Nov 19, BeInCrypto reported that Glassnode data had revealed a huge surge in creation of new bitcoin addresses, only bettered in January of 2018.

On-chain analyst Willy Woo predicted that bitcoin’s Network Value Transaction Ratio (NVT) all-time high in mid-November was driven by the presence of “underlying long term investors.” This he said, would drive bitcoin to a new all time high, which subsequently took place on Nov 30.