The crypto market will witness $2.639 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts expire today. This massive expiration could impact short-term price action, especially given the volatility seen in both assets over the past few days.

With Bitcoin options valued at $1.9 billion and Ethereum at $712 million, will crypto markets see volatility extend or witness a steady kickoff to 2025? The following is what these options expiration means for BTC and ETH prices.

First Crypto Options Expiry of 2025: Over $2.6 Options Expire

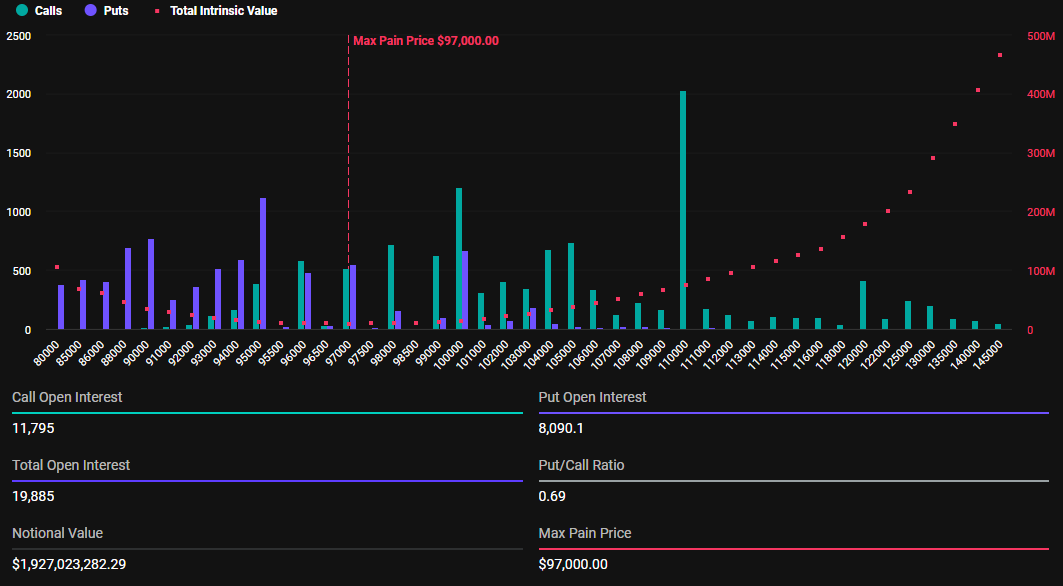

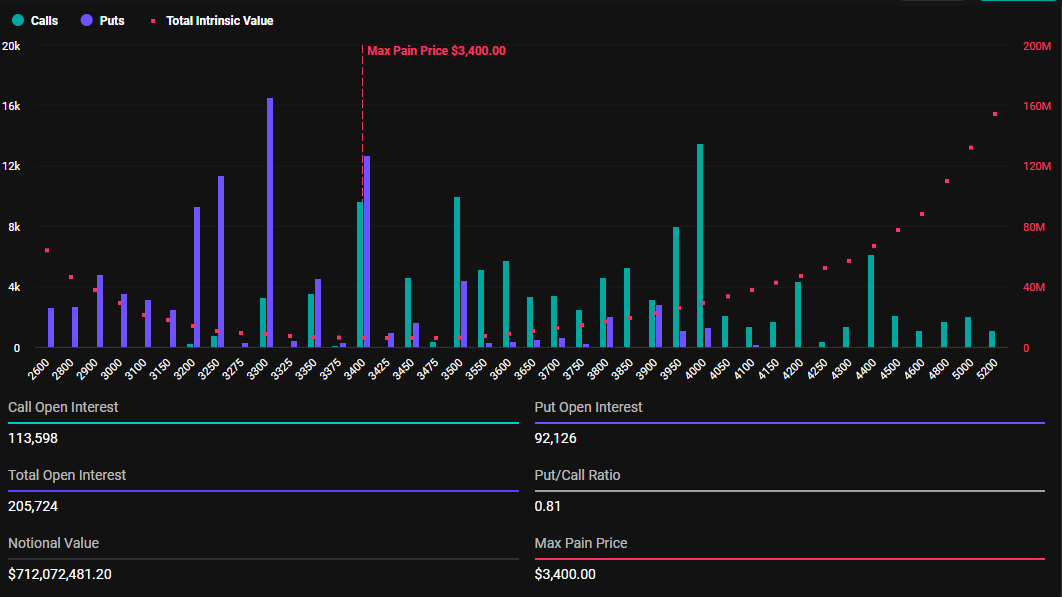

Data on Deribit shows today’s Bitcoin options expiration involves 19,885 contracts, compared to 88,537 contracts last week. Similarly, Ethereum’s expiring options total 205,724 contracts, down from 796,021 contracts the previous week. The disparity stems from last week’s contracts, which marked the end-of-year options expiry.

For Bitcoin, the expiring options have a maximum pain point (strike price) of $97,000 and a put-to-call ratio of 0.69. This indicates a generally bullish sentiment despite the pioneer crypto’s ongoing struggle to reclaim the $100,000 milestone.

In comparison, the Ethereum contracts expiring today have a maximum pain price of $3,400 and a put-to-call ratio of 0.81, reflecting a similar market outlook. When the put-to-call ratio is below 1, more traders are betting on price increases.

In options trading, the strike price is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless, inflicting maximum financial “pain” on traders as options expire worthless.

Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty. Specifically, the asset’s price tends to gravitate toward the price to optimize profits for options sellers, who, in most cases, are large financial institutions of smart money.

According to BeInCrypto data, BTC was trading for $96,912 as of this writing, whereas ETH was exchanging hands for $3,465. Gravitating toward their respective strike prices would, therefore, signify a modest value increase for Bitcoin and a slight drop in Ethereum’s price, hence potential volatility.

“Volatility levels have retained a consistent level and shape throughout the post-Christmas period. December’s end-of-year expiration of a significant proportion of the market’s open interest in options did not result in the fireworks that some expected. Instead, ETH volatility trades more than 5 points lower while BTC displays the same, slightly steeper shape that it has since Christmas day,” Deribit shared.

Even in the face of potential volatility, however, markets usually stabilize soon after as traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing short-term market trends.