The Origin Protocol (OGN) price has been moving upwards since completing a double bottom pattern in the end of 2020.

As long as Origin Protocol is trading above the current ascending support line, it’s expected to continue moving upwards towards $0.31 and possibly higher.

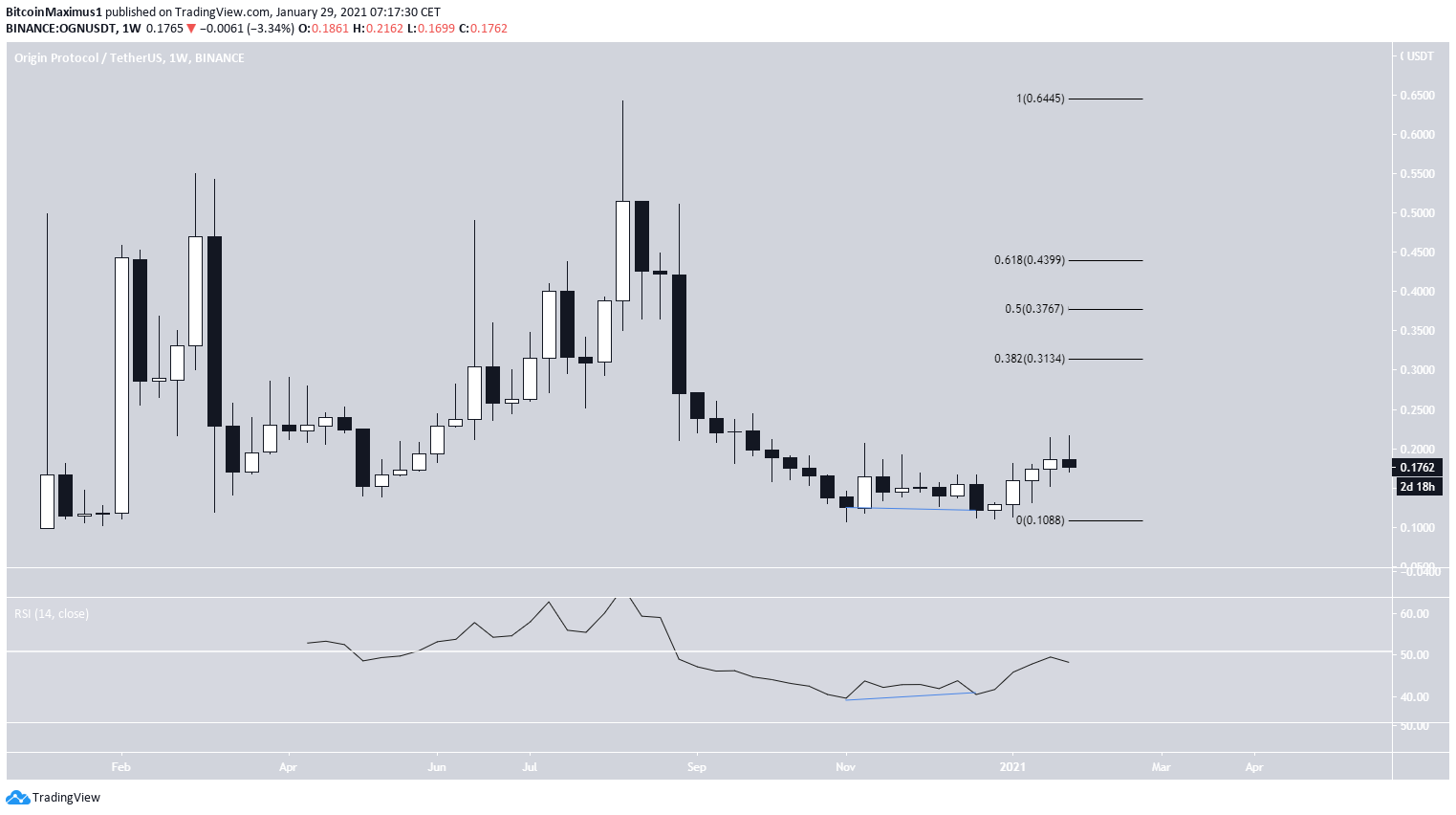

Origin Protocol Makes Double Bottom Pattern

The weekly chart shows a completed long-term double bottom pattern near the $0.105 lows during November-December of 2020.

The pattern was combined with a bullish divergence in the RSI. Both the price and the RSI have been moving upwards since its completion.

The closest resistance areas are found at $0.31, $0.38, and $0.44, (0.382, 0.5, and 0.618 Fib retracement levels).

Cryptocurrency trader @Paynecrypto tweeted a chart showing the double bottom pattern and outlined a possible continuation path for the upward move. A look at lower time-frames is required in order to determine if OGN will continue moving higher.

Retest Leads to Continuation?

The daily chart shows that OGN has broken out from a descending resistance line and validated it as support after. Furthermore, it has continued its ascent since and has reclaimed the $0.0174 area, which now acts as support.

The closest minor resistance area is found at $0.198. If OGN manages to clear it, it would be expected to move higher towards the previously outlined targets.

Technical indicators are bullish. The MACD and Stochastic oscillator are increasing while the RSI has generated a hidden bullish divergence.

Future Movement

The six-hour chart shows that OGN has been following an ascending support line since reaching a low on Jan. 11.

While the exact slope of the line is uncertain due to numerous long lower wicks, it’s possible that OGN has just bounced or is very close to doing so.

Nevertheless, technical indicators do not yet show any bullish reversal signs.

Similarly, the long-term wave count is not completely clear, but it seems that OGN has completed an A-B-C running flat corrective structure.

Furthermore, the ensuing upward move does look impulsive.

Therefore, as long as OGN is trading above the possible C wave low at $0.1699 and the ascending support line, it’s likely that the trend is bullish.

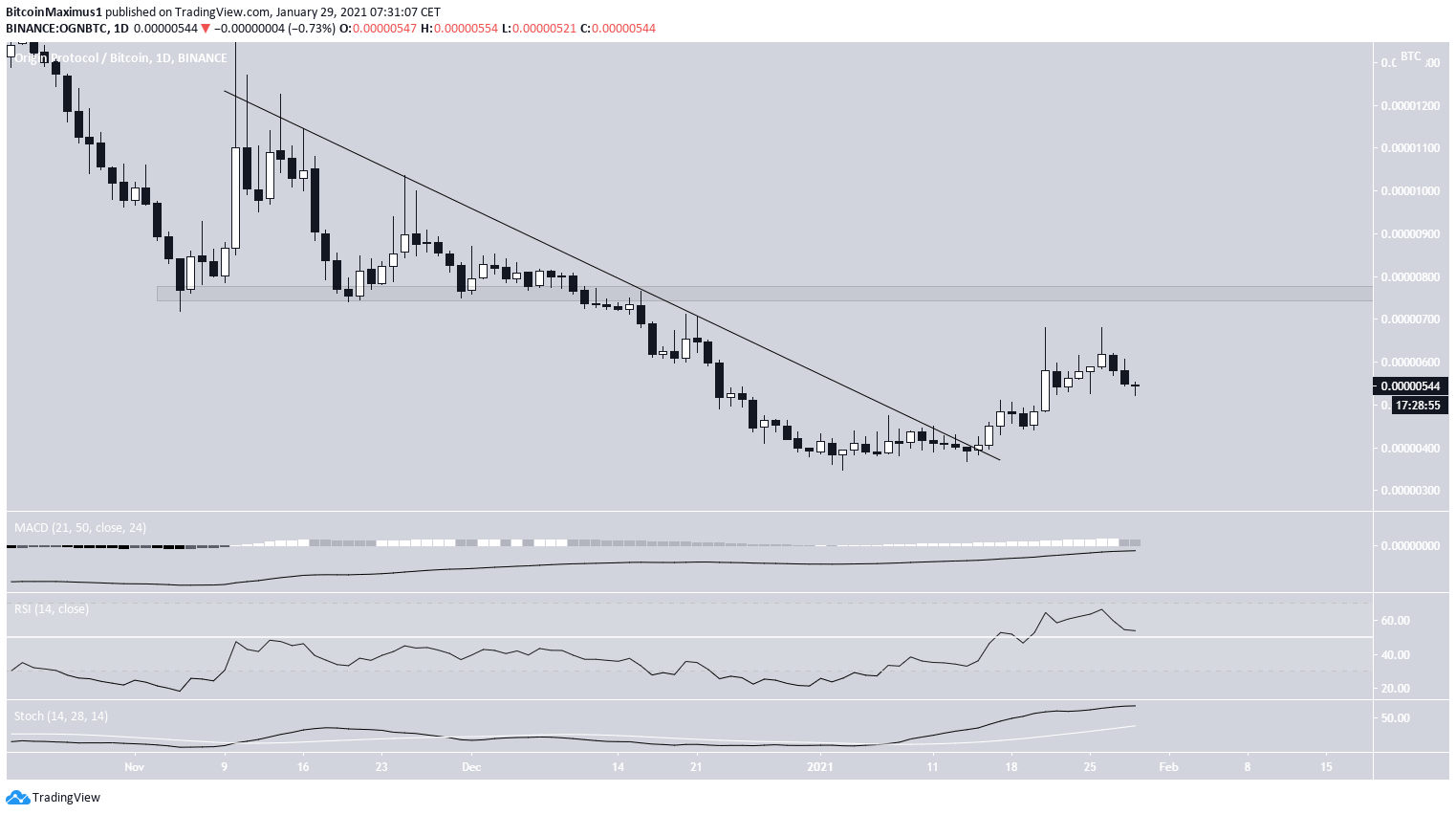

OGN/BTC

The OGN/BTC pair shows a breakout from a long-term descending resistance line that transpired on Jan. 12.

While technical indicators are bullish and OGN is moving higher, the trend cannot be considered bullish until the previous breakdown level at 760 satoshis is reclaimed.

Conclusion

Both the OGN/USD and OGN/BTC pairs are expected to continue moving higher. The increase will likely accelerate once the respective resistances at $0.198 and 760 satoshis are broken.

For BeInCrypto’s latest Bitcoin (BTC) analysis click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.