Optimism’s (OP) price is at a multi-month low after the broader market cues sent the altcoin falling by 41%.

The OP investors could be boosting the price by focusing on accumulation over selling.

Optimism Investors Hold the Key

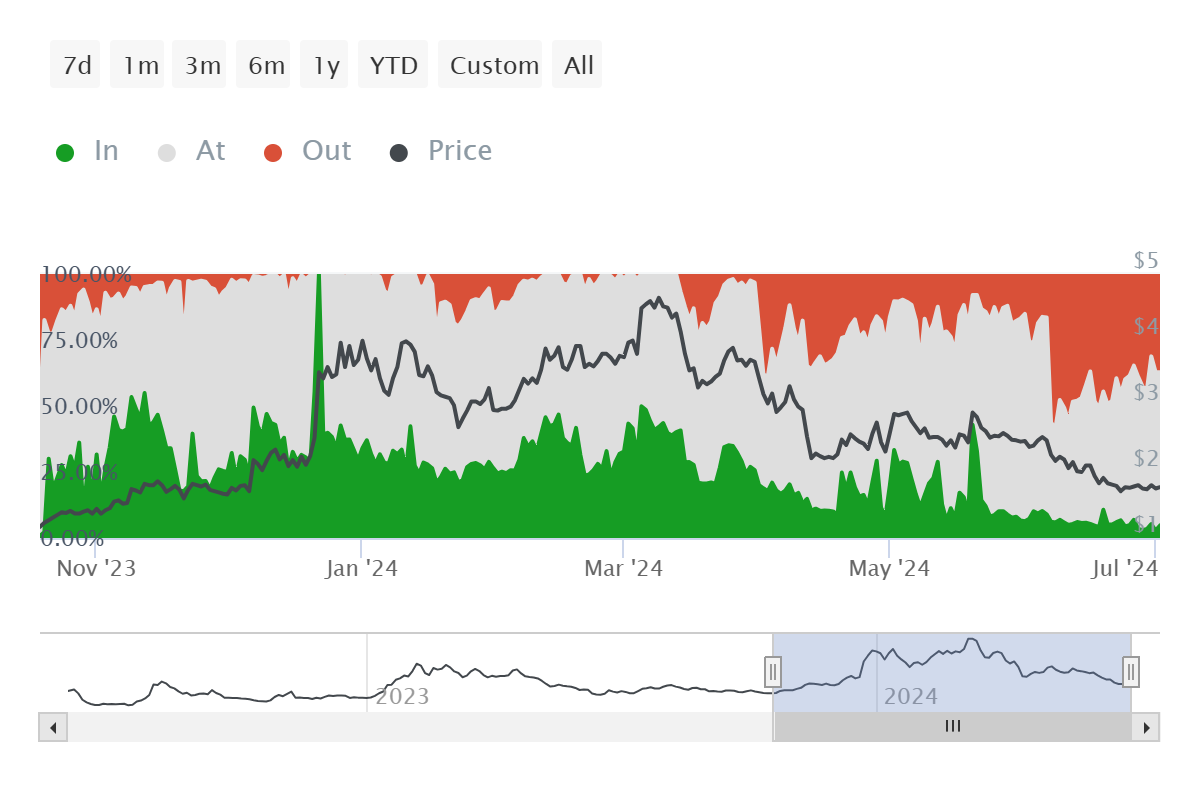

Optimism’s price could be looking at recovery given the investors are changing their tones, shifting from selling to potentially accumulating. Signs of the same can be seen upon observing active addresses by profitability.

The profit investors make up only 4.7% of all the investors participating on the network. These investors tend to be active on the network only to sell their holdings in an attempt to book profits.

Thus, their presence being less is a good sign.

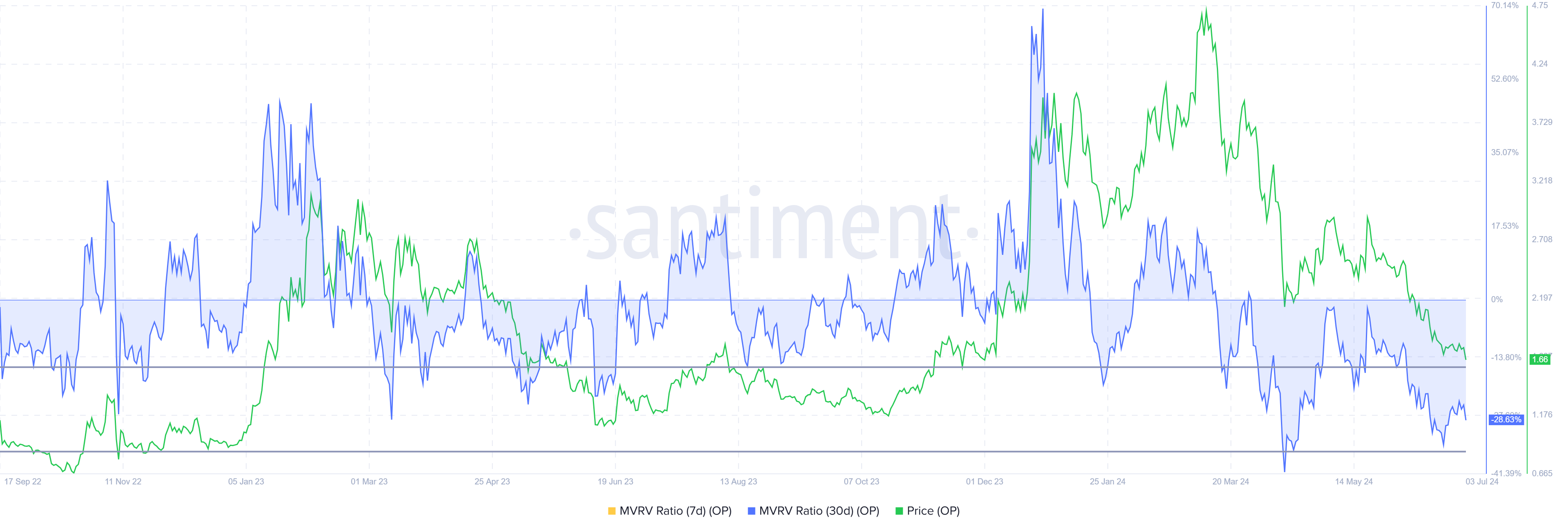

Additionally, the Market Value to Realized Value (MVRV) ratio is also supporting a bullish outcome. The MVRV ratio assesses investor profit and loss. Currently, Optimism’s 30-day MVRV stands at -28%, indicating losses, which may lead to buying pressure.

Historically, OP MVRV between -15% and -30% usually signals the start of recoveries and rallies, marking an opportunity zone for accumulation.

Read More: What Is Optimism?

If OP holders take advantage of this situation to add more tokens to their wallets, the price could recover, too.

Optimism Investors Hold the Key

Optimism’s price at $1.68 is down by more than 6% on the daily chart after the market witnessed minor correction due to macro-financial developments. Based on the aforementioned factors, the altcoin seems to be due for recovery.

The likely bounce back could send OP towards $2.00 or higher. However, in order to recover all of the 41% losses noted in the last few weeks, the altcoin would need to reclaim $2.82 as support.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

However, a decline below $1.66 could send the altcoin falling further, potentially slipping to $1.55. This would completely invalidate the bullish thesis.