BeInCrypto is back with the third installment in this review-series covering some of the world’s most popular destinations for online CFD trading. Today we are going to closely examine some key details about T1Markets.

For those out of the loop, T1Markets is a licensed brokerage platform offering online CFDs on cryptocurrencies, forex, stocks, indices, commodities, and metals.

But, before we start with this review, here’s a word of caution for readers who are new to CFD trading. CFDs are inherently complex and high-risk financial instruments. These are best-suited for serious traders who know their ways around the market. Due to high leverages on offer and other associated factors, it is easy to quickly lose money if you’re not careful.

To their credit, T1Markets does offer a dedicated section to educate traders about CFDs, and trading in general. However, we highly recommend that you expand your research on the topic to other neutral sources as well before making your first CFD trade.

Now, coming back to the topic at hand, let’s start this review with a basic overview of T1Markets.

T1Markets: The Brand

T1Markets is owned and operated by the parent company, General Capital Brokers (GCB) Ltd. GCB is a licensed financial services provider regulated by CySEC.

GCB is also a member of the Investor Compensation Fund. This gives T1Markets users an added layer of protection by assuring guaranteed compensation if necessary pre-conditions are fulfilled.

This way, T1Markets establishes itself as one of the more reliable brands offering online CFDs to retail and professional traders.

It is worth noting here that T1Markets has also won several awards in recent times. These include the title of the Best CFD Broker at the World Forex Award 2020 and the Most Trusted Forex Broker 2020 award at the World Financial Award, just to name a couple.

Availability

Being a CySEC- regulated broker, T1Market is legally required to meet the standards set by the European Union’s Markets in Financial Instruments Directive II (MiFID II) and the Markets in Financial Instruments Regulation (MiFIR).

This also means that as a platform, T1Markets primarily focuses on the EU member states. Switzerland is by far the only non-EU country where the platform continues to operate.

T1Markets has “temporary permission” to offer select few services in the UK. However, the country’s financial regulatory body, the FCA, advises traders “to check the full record for what activities this firm can do in the UK.”

As of March 2021, T1Markets is offering online CFD trading in the following countries:

Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, UK.

Online CFD Trading With T1Markets: The Instruments

As of March 2021, T1Markets offers more than 350 tradeable CFDs in the following asset classes:

- Cryptocurrencies: More than 30 crypto CFD pairs are available. These include the likes of BTC/USD, XRP/EUR, and ETH/GBP, just to name a few.

- Forex: CFDs for most popular forex pairs such as AUD/CAD, EUR/USD, GBP/USD, EUR/NZD, CHF/JPY. In total, T1Markets lists 40+ CFDs on forex pairs.

- Stocks: CFDs on a wide variety of popular stocks including stocks of tech giants and Fortune 500 companies, as well as promising startups are available. As of this writing, the platform lists 45+ stocks including those from Apple, Amazon, Google, Facebook, Netflix, Budweiser, and Tesla.

- Indices: The platform lists Online CFD on 20+ of the world’s top indices including DOW 30, Nasdaq 100, AEX, Nikkei 225, DAX 30, etc.

- Commodities: CFDs on Brent oil, corn, cocoa, cotton, and other commodities.

- Metal: CFDs on precious metals including platinum, gold, silver, and copper, among others.

To sum it up, T1Markets gives you a practically endless list of CFD instruments to choose from. Although, many of its competitors in the EU also offer more or less similar packages — both in terms of the number and types of instruments on offer. So the contest is pretty even-steven on that front.

T1Markets: Trading Terminal and Account Types

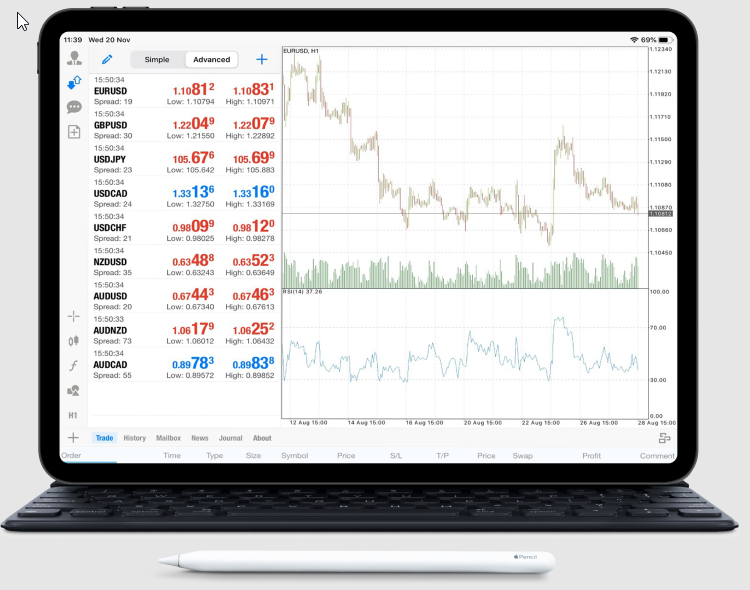

Trading Terminals

You can access the T1Markets trading terminal using WebTrader or the platform’s native mobile apps, available on Google Play (Android) and the Apple App Store (iOS).

WebTrader is a browser-based terminal that packs in several handy features such as in-platform price alerts, real-time balance level, and a robust mechanism to manage charts and compare different assets.

Additionally, it also offers one-tap account switching, instant and customized synchronization with other Metaquotes software, and so on.

The mobile apps also offer pretty much the same set of features, but with the added advantage of letting you track and execute your trades on the move.

WebTrader and the T1Markets mobile apps are all powered by MetaTrader4 (MT4), which is arguably the best e-trading platform around today. MT4 natively hosts an array of cool features such as 30 built-in fundamental and technical indicators (e.g. MA and Fibonacci retracements etc.), charting tools, fast execution of trades, and multiple trading modes.

T1Markets Account Types

Like many of its peers offering online CFDs, T1Markets also brings you three account types to choose from – Silver, Gold, and Platinum. All three of them offer hedging, the same leverage (up to 1:30 for retail users), and the same base currencies. Users of any of these three account types enjoy the same level of access to the T1Markets’ extensive collection of educational content.

However, that’s just about where the similarities end.

Silver account holders don’t miss out on useful features such as a dedicated account manager, but Free VPS, and fifth decimal, are only available to Gold and Platinum account holders. Additionally, spreads also become progressively thinner as you move up the ladder from your Silver account (0.07) to Gold (0.05), and then to Platinum (0.03).

Similarly, while Silver account holders do not get any swap discounts, Gold and Platinum members are eligible to receive 25% and 50% respectively.

Note that apart from these three, there is also a fourth account type. It is reserved exclusively for trading sharks, i.e. professional traders with loads of success and experience to show for.

Signing up on T1Markets

It is basically a five-step process that begins with you filling up a quick form to submit your full name, email, and phone number. Up next, you will require to enter more of your personal and financial details such as the bank account (or any other payment method) you will be using to deposit and withdraw funds.

In the third step, you will receive a questionnaire designed to evaluate your knowledge of trading and CFDs. No need to worry even if you do not have much experience with CFDs. This questionnaire is just for assessing your trading skills and strategy so T1Markets and your dedicated account manager can serve you better.

Next, you will need to submit your identity proof and proof of residence. This is a mandatory step because being a regulated platform, T1Markets has to comply with all KYC and AML guidelines set by CySEC and EU regulators.

Once they verify and approve your documents, you can move on to the fifth and final stage to make a deposit and start trading immediately. Note that to have your account fully verified and functional, you will need to submit the following documents:

- A color copy of a valid passport or any other government-issued ID proof.

- Color copy of a utility bill (proof of residence)

- Proof of Deposit

As you can see, that’s a relatively straightforward process, albeit somewhat time-consuming. But in our opinion, that’s a fair trade-off most traders are content with so long as they have that extra layer of trust and legitimacy only a regulated broker can offer.

Fees and Commissions

T1Markets allows users to deposit funds into their account using credit/debit cards, wire transfers, and Klarna. There are no deposit fees. Adding funds to your account is pretty simple too — just log in to the client portal area and hit the “Deposit” button.

As for withdrawals, you may have to pay a flat fee of 15 EUR while withdrawing funds via wire transfer. Note that you can withdraw funds only to the source accounts that you previously used to fund your T1Markets wallet.

With T1Markets, you do not have to pay any commission on your trades — only swaps and spreads are payable. That’s indeed a good thing, although we also have to keep in mind that most brokers offering online CFD trading also have zero-commission trades.

Also, note that if no discount offer is up for grabs, overnight swap rates can be slightly on the higher side compared to the industry average. You can find the swap values right on the trading terminal under the Specification tab of the instrument you plan on trading.

You may also have to pay a monthly inactivity fee of 160 EUR in case your account remains dormant for 61 days or more. That’s also a bit on the higher side compared to the inactivity fees on competitors..

Online CFD Trading With T1Markets: Pros and Cons

Pros

- As a regulated platform, T1Markets has an obligation to maintain the highest standards for its technological infrastructure and funds management.

- The platform connects you to a variety of global markets and gives you access to more than 350 CFDs on different asset classes.

- No shortage of native analytics and charting tools to try out different strategies specific to individual markets or asset classes.

- At up to 1:30, T1Markets offers decent enough leverage for retail traders.

- At up to 1:500 leverage for professional traders.

- An abundance of tutorials and educational content to help users learn about trading and the platform itself.

- You also gain access to a demo account with virtual money to get familiar with the platform and test your trading strategies without risking real-world money.

Cons

- 1:1 leverage for cryptocurrencies can be a big turn-off for many traders.

- No crypto deposits, although it is not a drawback exclusive to T1Markets only if we consider the broader online CFD market.

- Swap fees and inactivity fees are higher than the industry average.

- Little-to-no presence outside of EU.

Final Thoughts

Overall, T1Markets checks most of the boxes to qualify as a decent platform for online CFD trading.

Because of the inherent nature of the financial instruments on offer, the platform is best suited for traders with prior exposure to CFDs. Although, new users can also benefit from its vast educational resources before dipping their toes into the complex and risk-prone world of CFDs.

- Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor account lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the Risk Disclosure Statement

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.