OKX is attempting to position itself as the “transparent” exchange as it upgrades its Proof of Reserves (PoR) to include full liability tree disclosure and zero-knowledge proofs (ZKP) for PoR solvency verification. Lennix Lai speaks exclusively to BeInCrypto about this news.

OKX is using its position as the number two crypto exchange to set a new standard for transparency, its Managing Director, Lennix Lai, told BeinCrypto.

Transparency is an “ongoing project” at OKX, he says. “After FTX, we made it one of the top priorities in the organization. We’ve added to that by allowing all of our users to verify our reserves. I think to achieve transparency within our industry, we need to use our very own piece of technology, specifically blockchain. So if blockchain can make it happen, we should allow our users to enjoy those benefits.”

According to Cryptorank.io, OKX is the world’s second-largest cryptocurrency exchange by adjusted volume in the spot market. In the spot market, cryptocurrencies are traded for immediate delivery, meaning the actual asset is bought or sold at the current market price.

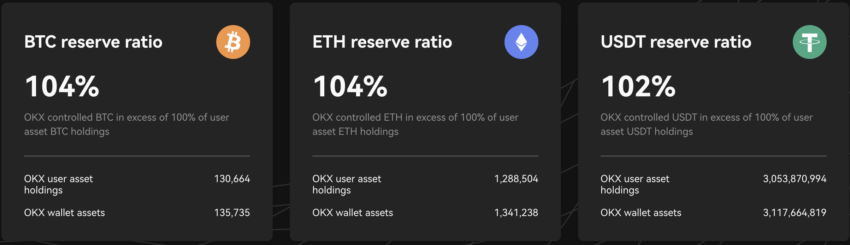

OKX announced on Thursday has announced that it will upgrade its Proof of Reserves (PoR) system in the coming months. The upgrades aim to enhance transparency while maintaining customer privacy. The exchange has been publishing monthly Proof of Reserves reports since the implosion of FTX. The most recent showed USD 8.6 billion held by the exchange in BTC, ETH, and USDT.

The Upgrade Will Keep User Privacy While Disclosing Total Liability

According to their announcement, the first upgrade, effective in the upcoming March PoR report, will include full liability tree disclosure. This upgrade will enable anyone to download the full liability Merkle tree, enhancing transparency. Meanwhile, it will split and shuffle every user’s balance into several segments, ensuring privacy regarding account balances.

The second, most interesting upgrade, effective in the coming months, will involve using zero-knowledge proofs (ZKP). This cryptographic method guarantees solvency by comparing the net equity of user assets to exchange reserves and allows users to verify their funds exist.

In simple terms, this would confirm that all the money deposited by the users is accounted for. It also ensures that the exchange has enough money to pay everyone if they want to withdraw their funds. “We want to disclose the total liability without disclosing the individual balance of their user,” Lai tells BeInCrypto.

Verifying whether your Bitcoin has been deposited into an OKX-branded public address will be possible by checking the blockchain. “We basically allow a user to check all the time, any time, whether your Bitcoin exists in your addresses,” says Lai. “If your Bitcoin does not exist, meaning OKX, or the exchange, moved it so they can do something else, that is not good. We want to have a transparency level that is better than an audit.”

Haider Rafique, their Chief Marketing Officer, said the company wanted to “exceed market expectations for transparency.”

Where Was The Transparency Before?

The recent developments in transparency have undoubtedly been good for the industry. The FTX debacle, which cost the crypto market billions of dollars, could have been avoided if these safeguards had been in place before. The public only became aware of FTX’s leverage and solvency concerns after CoinDesk reported them.

Why hasn’t there been a greater focus on transparency in the past? Lai says that the industry was preoccupied with the usual business concerns. “Everyone was focused on growth, marketing, and proof of concept with different tokens.”

After the FTX incident, two positive developments happened within the industry, according to Lai. Regulators were pressured to provide more clarity, and “the fact is the user, the client, demanded more clarity and transparency. Otherwise, they won’t trade with us.”

There has been a growing sense of trust within the industry, which is a positive development, says Lai. “OKX is doing a very simple job and providing a very simple exchange service. We don’t have any other business. [The users] are starting to understand this value.”

OKX Is Spending A Lot More Time On Compliance

Lai tells BeInCrypto that the company is speaking more to regulators post-FTX. “They also have a lot more questions than before,” he says. “Our compliance team has grown a lot.”

Each product team must have a compliance function, which entails building features into a well-designed product while considering the regulatory framework of each jurisdiction. Lai tells BeInCrypto that they aim to develop products that satisfy all regulatory requirements in a single attempt.

Based on this work, “In 12 months, we hope to apply for many licenses simultaneously.”

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.