Cryptocurrency exchange OKX has signaled a rapid downturn in the entire crypto market this week, with prices plummeting nearly 50% in a brief timeframe.

OKX announced the news to its 393,100 followers on X (formerly Twitter) that it will aim to resolve the issues with an internal plan.

OKX Aims to Compensate Users by Week-End

The exchange assured its users:

“The platform will fully compensate users for additional losses caused by abnormal liquidation. The specific compensation plan will be announced within 72 hours.”

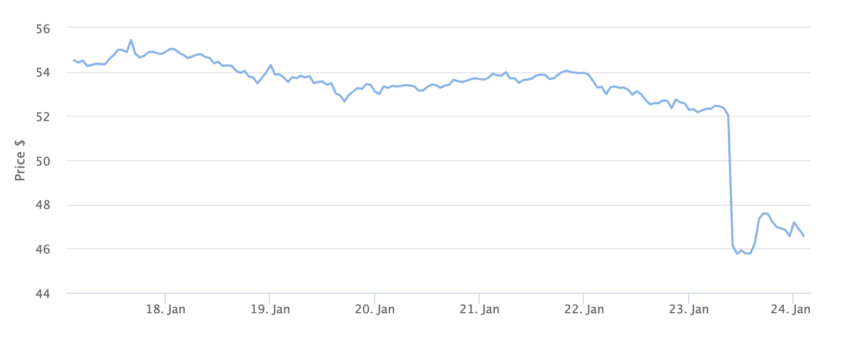

At the time of publication, the OKB price stands at $46.72. Over the past 7 days, it has dropped 14.35%.

However, on January 23, OKB experienced a sharp, brief decline, falling from $52 to $25, approximately 50%, causing significant stress on users’ investments.

Read more: OKX Review 2024: A Comprehensive Guide to the Leading Crypto Exchange

The exchange further explains that it plans to put mechanisms in place to avoid sudden market swings in the crypto markets affecting investors’ large leverage positions:

“We will further optimize spot leverage gradient levels, pledged lending risk control rules, liquidation mechanisms, etc. to avoid similar problems from happening again.”

OKX to Put Mechanisms in Place to Avoid Future OKB Issues

However, users on X expressed skepticism about the situation, with one user highlighting doubts about OKB’s market capitalization of $10 billion and the sale of $10 million, causing OKB’s price to drop 50%

Another user declared that the situation must be rectified quickly, or else the price will probably go down even further. Meanwhile, another user speculated it may be due to a “whale” dumping their holdings.

Read more: Top 12 Crypto Companies to Watch in 2024

A whale refers to someone who has an unusually large amount of a specific crypto token and has the potential to influence the price of that token if they were to sell their entire holdings.

Leveraging is essentially borrowing funds to multiply the potential returns of your crypto investment. It can be very profitable, but at the same time, also very risky.

OKX currently provides 10x and 20x leverage options under full liquidation mode.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.