November 2020 has been a record-smashing month for crypto. From coin derivatives, to flat-out Bitcoin (BTC) price, the roller coaster keeps climbing up. With power behind Bitcoin like never before, the next few months look exciting.

All-Time Higher and higher

So the golden price of $20,000 for 1 BTC never happened, but $19,725 was not half bad. Cryptocurrencies are having another year to remember, and November was perhaps that most exciting month yet.

According to Coingecko’s monthly report, November saw plenty of highs. The crypto market cap reached $554 billion. Bitcoin reached $19,725 on Nov. 30 or Dec. 1, depending on where you live. That was just above the previous high of $19,665, but a record nonetheless. Open interest on Bitcoin perpetual swaps reached $3.1 billion and exchanges saw an unprecedented trade volume of $348 billion.

That is not to mention the return of some altcoins as well as the pounding of some DeFi projects. DeFi protocol hacks accounted for $70 million in losses in November (whether the bad actors will ever be able to sell their stolen coins is another matter).

Driving this are a number of factors, including large corporations. DBS Bank is supporting its own exchange, while Square and Paypal continue to support payment adoption with crypto. Norway even has a public investment fund that owns some BTC.

A non-zero sum game

Another metric also stood out this month: non-zero balance Bitcoin wallets hit an all-time high. This suggests that users are interacting with the network and that interest in the general public, as well as in large companies, is growing.

And it’s not just Bitcoin. Ether wallets have also seen an all-time high with 50,476,989 having non-zero balances. Those wallets with positive balances are seeing exponential growth (while wallets containing one or more BTC are seeing only linear growth).

Increasing interest in Bitcoin as a reserve asset and the launch of Ethereum 2.0’s beaconchain are possible drivers of these metrics.

An alternative story

Besides all the ETH and BTC hullabaloo, some altcoins have been shining. AAVE and YFI, two DeFi coins which had seen plummets after their epic take-offs, increased over 150% during November.

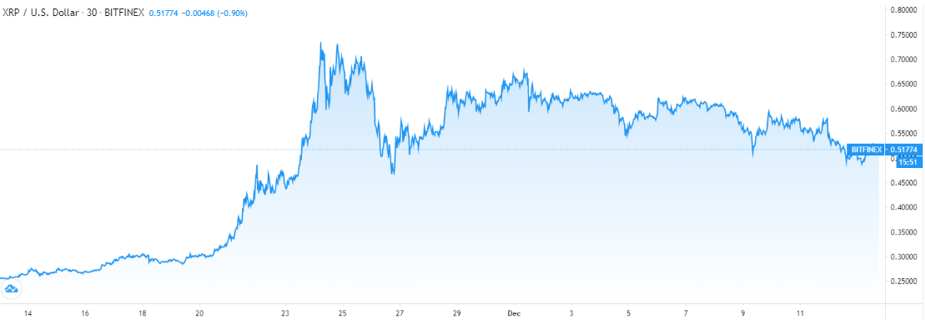

Another such coin of interest is XRP. Ripple’s XRP had been curiously quiet during the last few months of growth, until November. But in November XRP saw its USD price practically triple to nearly 80 cents.

Not surprisingly, this matched up (somewhat) with the airdrop of the Spark token to every XRP holder. The snapshot taken for that airdrop occurred on Dec 12, 2020, and with it came speculation. Would XRP rally right up to the last second of the snapshot? Would it dump the moment after?

Well XRP dumped… a little. And rebounded to levels not seen for three whole days. In the medium-term, XRP’s price is still mountains above what it was even in mid-November.

What is worth noting is that the media interest in Bitcoin does not quite seem to be what it was in 2017’s bull run. This has some traders hopeful that prices will run away once the true news of cryptocurrency’s return breaks through to the mainstream.