NOT, the token that powers the Telegram-based game Notcoin, has seen a spike in its price since July 6. Trading at $0.016 at press time, the altcoin’s price has since surged by 60% since then.

An assessment of some of the token’s key technical indicators reveals that the bulls have regained market control, hence the price rally.

Notcoin Bulls Make an Entry

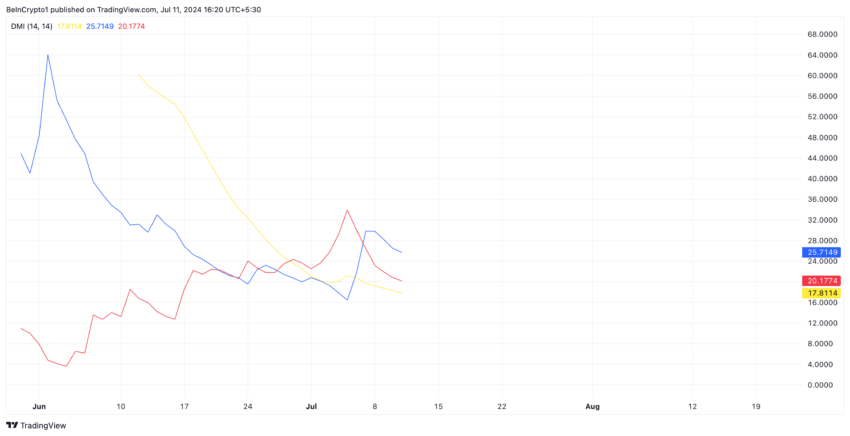

Readings from Notcoin’s (NOT) Directional Movement Index (DMI) indicator confirm the resurgence in bullish bias toward the altcoin.

The indicator measures an asset’s price trend and direction. It consists of the Positive Directional Indicator (+DMI), the Negative Directional Indicator (-DMI), and the Average Directional Index (ADX).

The +DMI measures the strength of upward price movements, while the -DMI measures the strength of a price downtrend.

NOT’s +DMI line crossed above its -DMI on July 7. This crossover is regarded as a bullish signal because it indicates that the asset’s price uptrend is becoming stronger than its downward movements. It often signals a shift in momentum towards a price rally.

Read more: 5 Top Notcoin Wallets in 2024

On the same day, NOT’s price crossed above its 20-day exponential moving average (EMA) and 50-day small moving average (SMA).

An asset’s 20-day EMA measures its average price over the past 20 trading days, while the 50-day SMA tracks the average closing price of an asset over the past 50 days.

When an asset’s price rises above these key averages, it indicates bullish momentum. It suggests the asset is experiencing an uptrend and positive sentiment among traders.

NOT Price Prediction: The Bulls Maintain Their Grip

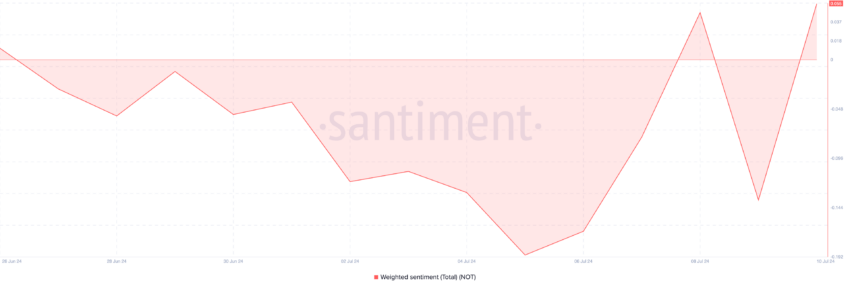

As of this writing, the token’s weighted sentiment is above the zero line at 0.05. This metric tracks the overall mood of the market regarding an asset. It considers the sentiment trailing the asset and the volume of social media discussions.

When the value of an asset’s weighted sentiment is above zero, most of its discussions on social media platforms are fueled by positive emotions.

If NOT continues to enjoy this positive bias, its price might rally to exchange hands at $0.017.

Read more: Tap-to-Earn: What to Know About the Crypto GameFi Trend

However, if market participants commence profit-taking activity at this current price level, the token’s value might be down to $0.014.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.