Trend Research, one of the largest Ethereum whales, is approaching a critical liquidation threshold amid ETH’s recent downward trajectory.

The stakes for the company mirror those of Tom Lee’s BitMine, whose Ethereum Supercycle bet is proving fatal as prices decline.

Ethereum Whale Trend Research Approaches $1.33 Billion Liquidation Threshold as Prices Slide

Blockchain monitoring by @ai_9684xtpa reveals that the firm currently holds 618,246 ETH across six addresses. It has $1.33 billion in WETH posted as collateral and $939 million in stablecoins borrowed.

A sustained decline in Ethereum could trigger multi-billion-dollar liquidations, potentially reverberating across broader crypto markets.

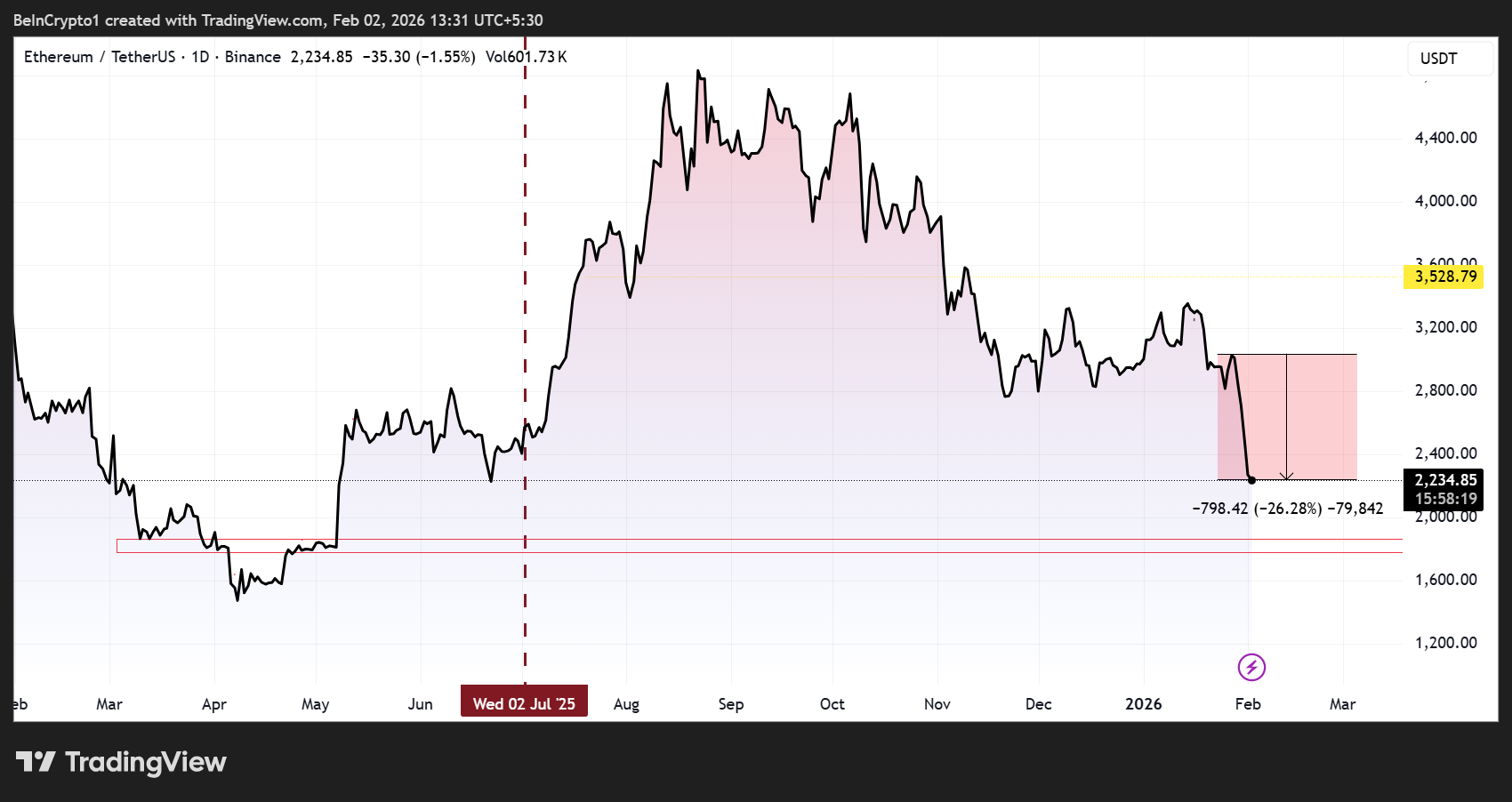

As of this writing, Ethereum was trading for $2,226, down by almost 8% in the last 24 hours. Meanwhile, the liquidation range for Trend Research’s holdings is $1,781.09 to $1,862.02 per ETH, assuming no margin top-ups or position reductions.

Individual address thresholds illustrate the scale of risk:

- TOP1: 169,891 ETH collateral, $258 million borrowed, liquidation at $1,833.84

- TOP2: 175,843 ETH collateral, $271 million borrowed, liquidation at $1,862.02

- TOP3: 108,743 ETH collateral, $163 million borrowed, liquidation at $1,808.05

- TOP4: 79,510 ETH collateral, $117 million borrowed, liquidation at $1,781.09

- TOP5: 43,025 ETH collateral, $66.25 million borrowed, liquidation at $1,855.18

- TOP6: 41,034 ETH collateral, $63.23 million borrowed, liquidation at $1,856.57

In what appears to be a proactive move, Trend Research recently deposited 20,000 ETH (approximately $43.88 million) into Binance, signaling efforts to manage risk amid volatility.

Whales Shift to Deleveraging Amid ETH Volatility, Highlighting Short-Term Risk Management

This follows a broader trend among Ethereum whales, with BitcoinOG and Trend Research collectively dumping $371 million in ETH over 48 hours to repay loans on the DeFi lending platform Aave.

Trend Research alone withdrew $77.5 million in USDT to repay nearly all (98.1%) of its Aave debt, reflecting a strategic deleveraging rather than panic selling.

The current environment starkly contrasts with late 2025, when whales, including Trend Research and BitMine Immersion Technologies, were aggressively accumulating ETH during price dips.

At that time, Trend Research had amassed 580,000 ETH ($1.72 billion) at an average entry of ~$3,208, treating weakness as a buying opportunity. BitMine similarly added tens of thousands of ETH to its holdings, signaling strong institutional conviction.

The ongoing volatility reflects the dual pressures large ETH holders face to balance aggressive accumulation strategies with risk management in leveraged positions.

While Trend Research remains a major accumulator, the current price slide—ETH is down approximately 26% in the past week—has increased the urgency of managing potential liquidations.

Aave’s resilience has so far prevented systemic disruption. According to founder Stani Kulechov, it handled $140 million in automated liquidations smoothly on January 31.

Notwithstanding, a continued Ethereum price slide toward the $1,781–$1,862 range could trigger forced liquidations, potentially amplifying market stress.

Trend Research’s moves show that even whales with bullish long-term views are adopting risk-off behavior in the short term. This means:

- Leveraging deposits

- Margin management, and

- Stablecoin repayment to safeguard multi-billion-dollar positions.

The interplay between whale activity and market sentiment is likely to determine near-term price trajectories.