The fate of digital asset ownership remains bleak in Nigeria as regulators continue to clamp down. Many local crypto enthusiasts are jumping on social media to express their dissatisfaction over the development.

On Feb. 8, 2021, the Central Bank of Nigeria (CBN) released an official statement on its hardline stance against crypto. The circular came in response to an announcement it made on Feb. 5, 2021.

The apex bank prohibited all financial institutions, including fintech startups, from providing on and off-ramp crypto services. It ordered the immediate closure of all regulated institutions operating as crypto exchanges within the country’s jurisdiction. The ban even threatened to close the account of anyone using a crypto exchange.

An Attack On Crypto Users

The follow-up letter attempted to explain the central bank’s position, which surprised many Nigerian citizens. It stated that the ban was not new as it had warned all banks to distance themselves from any crypto-related activity.

The central authority tried to justify its actions by saying that only unregulated and unlicensed entities issue cryptocurrencies. However, the circular highlighted that it was not against any Central Bank Digital Currency (CBDC) since recognized bodies issued these.

Local banks promptly put pressure on crypto users in an attempt to comply with the CBN. Some were already in the process of prosecuting digital currency users with threats to close accounts.

Many crypto proponents took to social media to express their dissatisfaction with the recent developments. Some interpreted this as a possible ulterior motive.

One social media influencer blamed the banking system.

An African journalism platform, Stears Business, also condemned the actions of the government. It accused the government of seeking desperate measures to salvage its depleting dollar reserves for remittances.

Playing Ping-pong With Regulation

Meanwhile, the CBN’s action appears contradictory to a prior statement from the country’s Security and Exchange Commission (SEC). A Sep. 2020 announcement stated that all crypto assets fell within its purview.

It formalized all cryptocurrencies as securities, acknowledging them to be within the government’s regulatory framework. The Nigerian government’s sudden u-turn could become a significant drawback for the country’s thriving crypto community.

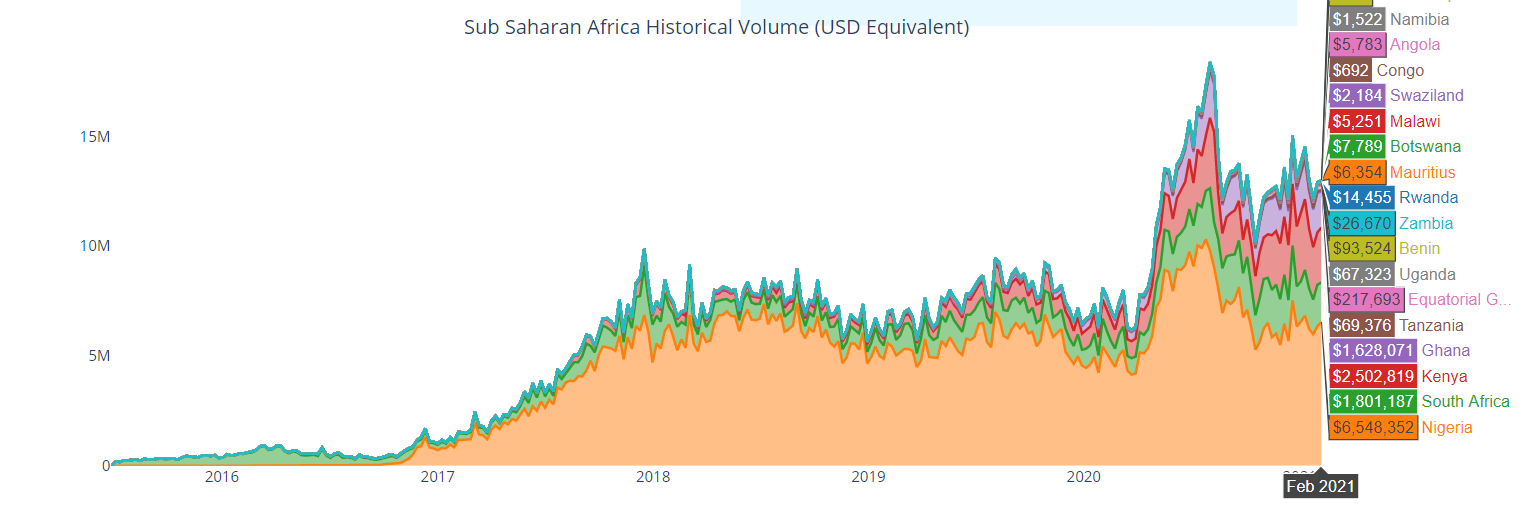

The country is the biggest market for digital currency in Africa. Data from Useful Tulip reveals that it has the highest traded volume in Africa, followed by Kenya and South Africa. Trading volumes in these countries sit at about $6.5 million, $2.5 million, and $1.8 million, respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.