Nigeria’s Central Bank (CBN) recently revoked its stringent anti-crypto measures that barred banks from handling crypto-related transactions for almost two years. This move coincides with collaborative efforts among Nigerian banks to introduce a new stablecoin named cNGN.

CBN noted that global interest and adoption of cryptocurrencies prompted a rethink of the severe restrictions imposed in 2021.

CBN Reveals Strict Requirements

The Nigerian regulator revealed revised guidelines establishing standards and prerequisites for banking relationships and account openings for virtual asset service providers (VASPs).

Among these, banks are mandated to collect the Bank Verification Number (BVN) of the management members of crypto businesses before initiating account setups. The CBN further stipulated that crypto firms must obtain licensing from the Nigerian Securities and Exchange Commission. Additionally, these firms must register with the country’s Corporate Affairs Commission before gaining account access.

These guidelines fortify risk management protocols within the banking sector, specifically concerning licensed VASPs’ operations. The regulator stressed that financial institutions cannot hold cryptocurrency, trade, or conduct transactions using their own accounts.

In February 2021, the CBN banned traders from utilizing traditional banks for crypto-related transactions and instructed banks to promptly identify and close accounts associated with cryptocurrency trading.

Nigerian Banks Unite for cNGN

Meanwhile, major local banks — Access Bank, Sterling Bank, Providus, Korapay, First Bank, Interstellar, Interswitch, Budpay, and Convexity — are collaborating to develop the cNGN stablecoin.

cNGN will be backed by and pegged to the Nigerian naira, the country’s fiat currency. This stablecoin complements the eNaira, Nigeria’s central bank digital currency (CBDC). The Nigeria eNaira has encountered challenges in gaining widespread adoption since its launch.

“The major reason why the CBN allowed banks is because they want the financial system to support/facilitate blockchain technology and they know the cumbersome processes [the Nigerian] SEC designed to operate a digital service,” Olumide Adesina, a journalist, explained.

Read more: A Guide to the Best Stablecoins in 2024

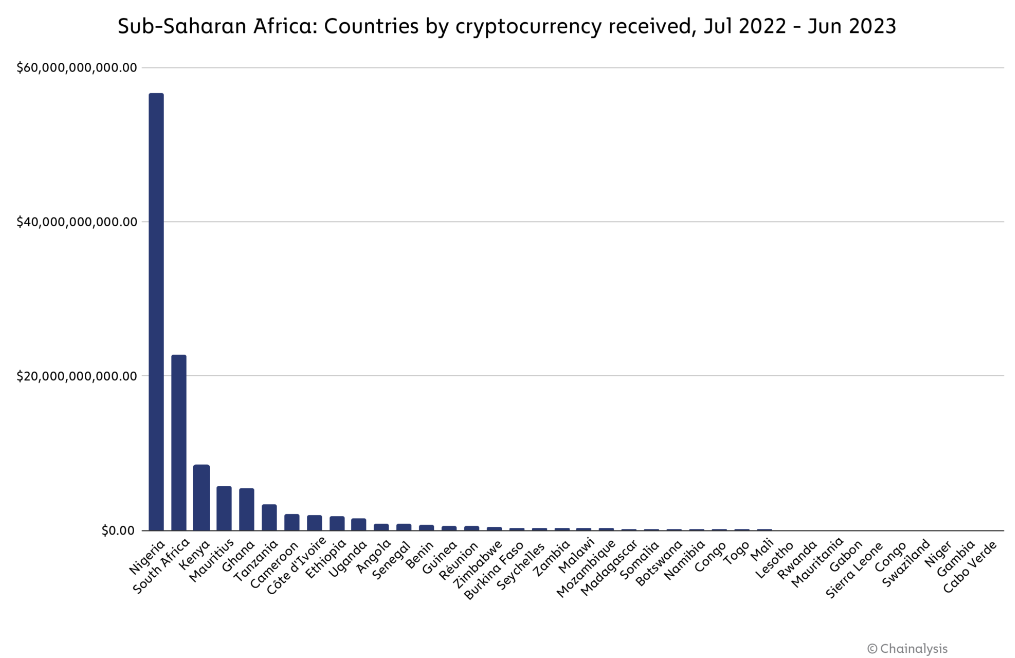

Nigeria stands out as one of the most crypto-friendly jurisdictions globally. According to Chainalysis, the country ranks second on its Global Crypto Adoption Index. Additionally, Nigeria leads the African region in raw transaction volume.

“Given Nigeria’s economic uncertainties, many citizens are exploring financial alternatives, enhancing the cryptocurrency’s value proposition,” Chainalysis noted.