NFT liquidity has taken a dive as marketplaces fight fiercely for a smaller pooler of traders and investors. In response to the trends, some marketplaces are offering incentives to keep traders on their platforms. Will it work?

NFT liquidity refers to the ease and availability of buying and selling non-fungible tokens (NFTs) in the market. When NFT liquidity is high, willing buyers and sellers are plentiful, facilitating smooth and active transactions. On the other hand, low liquidity signals a drop in trading activity and a challenge in finding counterparties for trades.

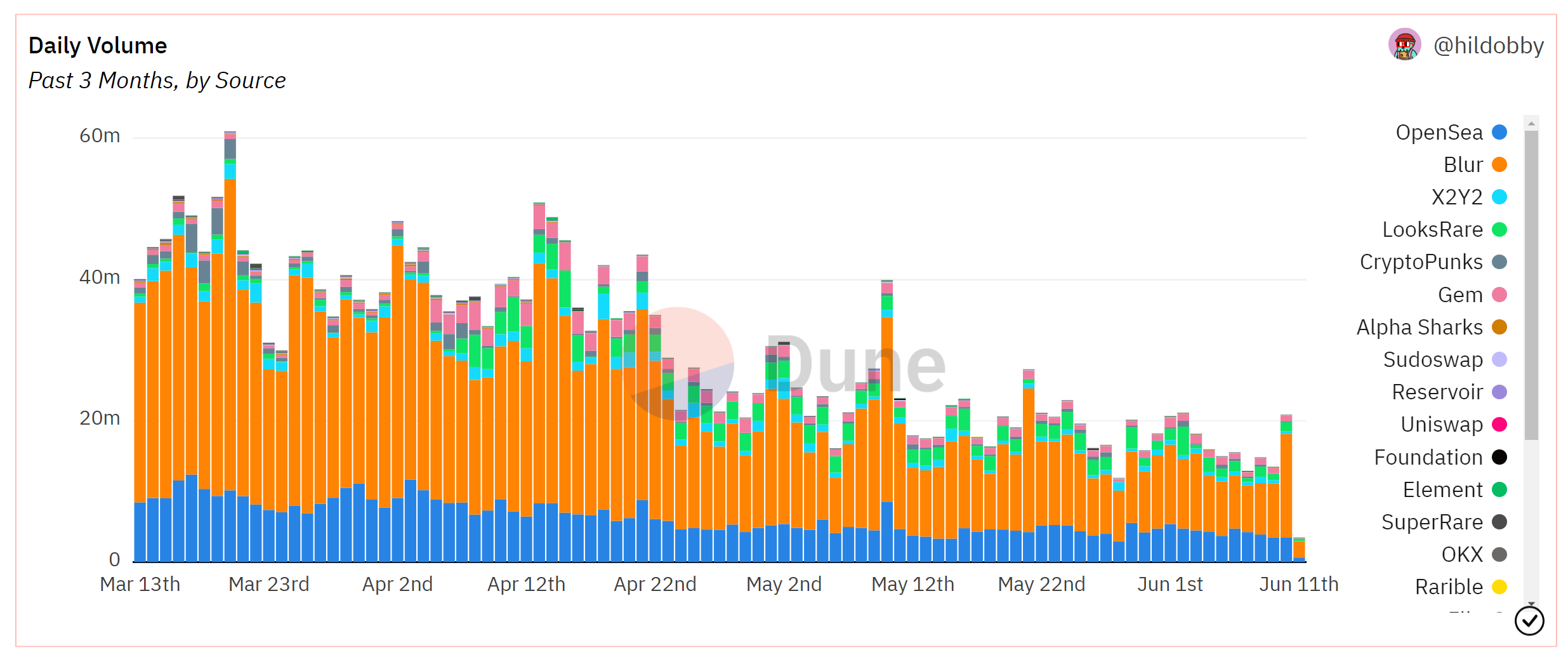

SponsoredNFT Daily Trade Volume Continues to Fall

According to data from Dune, daily trades have been steadily falling for the past 3 months. On March 13, approximately 44,000 NFT trades took place. However, on June 12, that number was closer to 25,000.

According to the recent DappRadar report, In May 2023, NFT sales might have fallen below $1 billion for the first time this year. Although the full story isn’t quite so simple.

In the report’s analysis, active wallets associated with NFT activities witnessed a 27% increase in May. The growth was attributed to the Miladys NFT collection, which received a significant boost from Elon Musk.

Embark on your NFT trading adventure today and master the fundamental principles: How To Start NFT Trading: A Step-by-Step Guide

To combat declining trading activity, NFT marketplaces are enhancing incentives for traders, as Samuel Haig observed in The Defiant on Tuesday.

On June 7, Blur, the NFT marketplace, announced updates to its incentive system for NFT traders. In its statement, Blur emphasized rewarding bidders who take real risks with the highest number of Bidding Points.

The platform will now allocate $BLUR rewards to users who genuinely contribute to Blur’s growth, according to a Twitter thread. However, certain underhand tactics will no longer be effective, including transferring NFTs for loyalty, engaging in wash trading, and spoofing bids.

LooksRare Launched Its Own Rewards Season

LooksRare, whose daily volume once reached hundreds of millions of dollars, experienced a decline since May 2022. Now its activity is consistently below $10 million. However, LooksRare wants to reclaim its former glory by announcing its own rewards “season” on June 1.

Not deterred by low amounts of trading, earlier this month, Kraken launched its own NFT trading platform, only further crowding out the market.

As of mid-May 2023, Blur is still the largest NFT marketplace, according to DappRadar. It boasts of an impressive 62% market share, while OpenSea lags behind at 26%.

Even so, OpenSea maintains the largest number of traders, with 104,882 active users in the week running up to the DappRadar report’s release, surpassing Blur’s 12,747.