FTX and its related debtors sought back donations made to the Metropolitan “Met” Museum of Art in a motion before Delaware’s Bankruptcy Court.

West Realm Shires Services, the operator of FTX’s U.S. arm, gave the Met $300,000 and an extra $250,000 in separate donations last year.

FTX Donation Clawback, Debtors Seek Protection While Addressing Losses

The FTX debtors, who filed for bankruptcy protection, have made a claim on $550,000 in donations that the now-defunct exchange sent to The Met.

The court document states the parties reached a deal stipulating that the Met would reimburse the full donation sum.

The FTX debtors request that the court accept this arrangement and grant related relief, including the full return of $550,000 without costs. They argue the stipulation is fair, logical, and beneficial for their bankruptcy estates.

For a full overview on the collapse and contagion fallout from the FTX exchange, read BeInCrypto’s guide here!

They also request the waiver of the 14-day stay imposed by bankruptcy laws to expedite the procedure. If such arrangements are in the best interests of the debtor’s estate and its creditors, the court can approve them. The Debtors assert that the proposed settlement falls within the range of reasonableness and should receive approval.

Related debtors Alameda Research and West Realm Shires (WRS) filed a lawsuit against Sam Bankman-Fried and other FTX officials earlier last month. Before the exchange crashed, they were accused of rigging trades and misusing funds. John J. Ray III, the current CEO of FTX and a renowned expert in recovering money from bankrupt enterprises, filed the action.

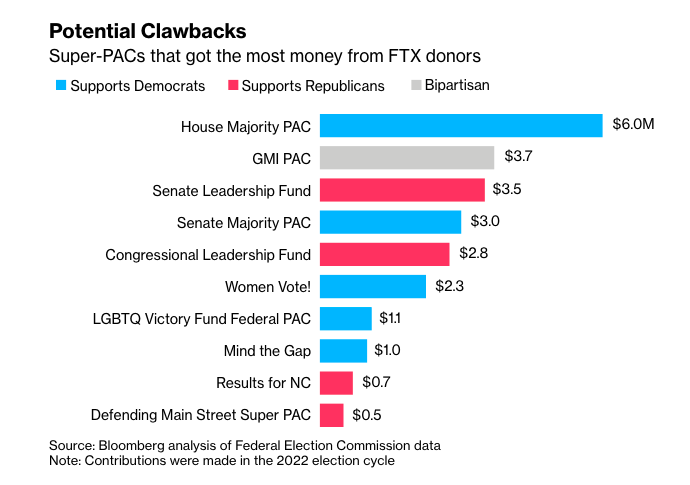

BeInCrypto previously reported that the bankrupt cryptocurrency exchange also requests the reimbursement of political contributions to recover misused funds. Former CEO Sam Bankman-Fried stands accused of exploiting customer funds for personal benefit and making political donations.

Lawsuits and Collateral Damage Stemming from the Collapse

After FTX declared bankruptcy in the last quarter of 2022, many businesses suffered. BlockFi, another defunct cryptocurrency lender, submitted a disclosure statement in May. The platform described how it was trying to get money back from FTX and Alameda. The Internal Revenue Service (IRS) is also pursuing $44 billion in tax claims in the FTX bankruptcy case. The agency is claiming priority over all other creditors.

Genesis is yet another FTX collapse collateral. Recently, FTX filed a document to oppose Genesis’ assertion that it has no right to make any claims.

FTX debtors have objected to Genesis’ claim that they are owed nothing, citing their exclusion from the mediation process and lack of prior notification. Under bankruptcy laws, FTX requested roughly $4 billion from Genesis, and the matter is set for court this month.

In the meantime, Sam Bankman-Fried’s legal team has asked for the dismissal of criminal accusations against the exchange’s founder. They argue the case is a civil matter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.