The NEO price has been moving downwards after it was rejected by an important Fib resistance level on Nov. 25.

The breakdown from a short-term pattern suggests that the price will continue falling towards the support levels outlined below.

NEO Takes a Dive

NEO has been moving upwards since Nov. 5, when it reached a low of $12.94. The upward move culminated in a high of $21.91 on Nov. 25. Since then, it has been moving downwards.

The high served to validate the 0.618 Fib retracement level of $21.10 as resistance, leaving two upper wicks in place. The rally stopped right at this resistance level making it likely that the upward movement was corrective.

At the time of writing, NEO was trading just below the $18.60 resistance area with the closest support at $16.10.

Long-Term Levels

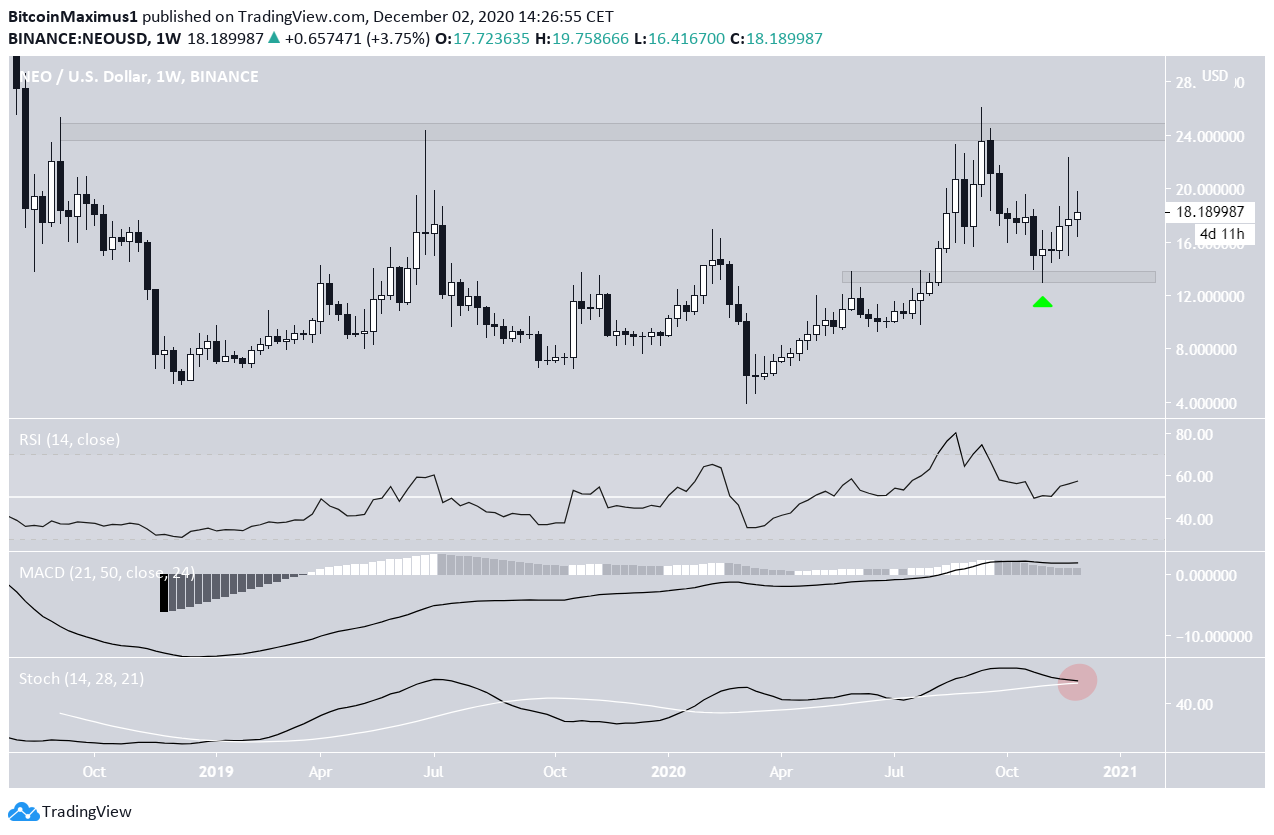

Cryptocurrency trader @Cryptodude999 outlined a NEO chart that shows a long-term breakout above an important level and a retest of support.

The previous level is at $13.40 and the price has indeed retested it as support after breaking out (shown with the green arrow below).

However, there is another important long-term resistance level at $24, below which NEO has been trading since Oct 2018. A breakout above would likely trigger a very sharp upward move.

Technical indicators are neutral since while the RSI is above 50 and increasing, the MACD is moving downwards. Meanwhile, the Stochastic Oscillator has made a bearish cross.

Therefore, there is no clear trend direction. This and daily time-frame readings suggest that ranging will most likely occur between these two levels.

Short-Term Breakdown

The shorter-term two-hour chart shows that NEO has broken down from a parallel ascending channel and validated it as resistance afterward (red arrow).

The presence of the channel suggests that the increase was corrective, while the breakdown confirms it.

Therefore, NEO is likely to fall towards the previously mentioned $16.10 support area.

However, if the move since Nov. 25 is an A-B-C structure, which looks likely due to the rejection from the 0.618 Fib (black), the downward move could take NEO even lower.

If the A:C waves have a 1:1 ratio, NEO would decline all the way to its Nov. 5 levels near $13.50.

NEO Conclusion

To conclude, the NEO price should decline in the short-term and reach at least one of the support areas at $16.10 and $13.50.

For BeInCrypto’s latest Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.