The price of First Neiro on Ethereum (NEIRO) surged to a record high of $0.0025 during early Friday trading. Although it has since retraced, the meme coin still shows potential for further gains.

A combined analysis of NEIRO’s technical indicators and on-chain data suggests that investors might anticipate additional growth. BeInCrypto highlights that the altcoin’s current setup could pave the way for higher price targets in the near term.

First Neiro on Ethereum Bulls Take Charge

NEIRO’s whales or large holders have displayed confidence in its sustained growth by increasing their holdings over the past week. IntoTheBlock’s data has revealed a 266% uptick in the meme coin’s large holders’ netflow in the past seven days.

Large holders, defined as those controlling over 0.1% of an asset’s circulating supply, significantly influence market dynamics. The netflow of these investors tracks the difference between the amount they buy and sell over a given period.

A rising netflow indicates that whale addresses are accumulating more of the asset, signaling increased buying pressure. This accumulation trend is considered bullish, suggesting a potential price surge as demand outpaces supply.

Read more: What Are Meme Coins?

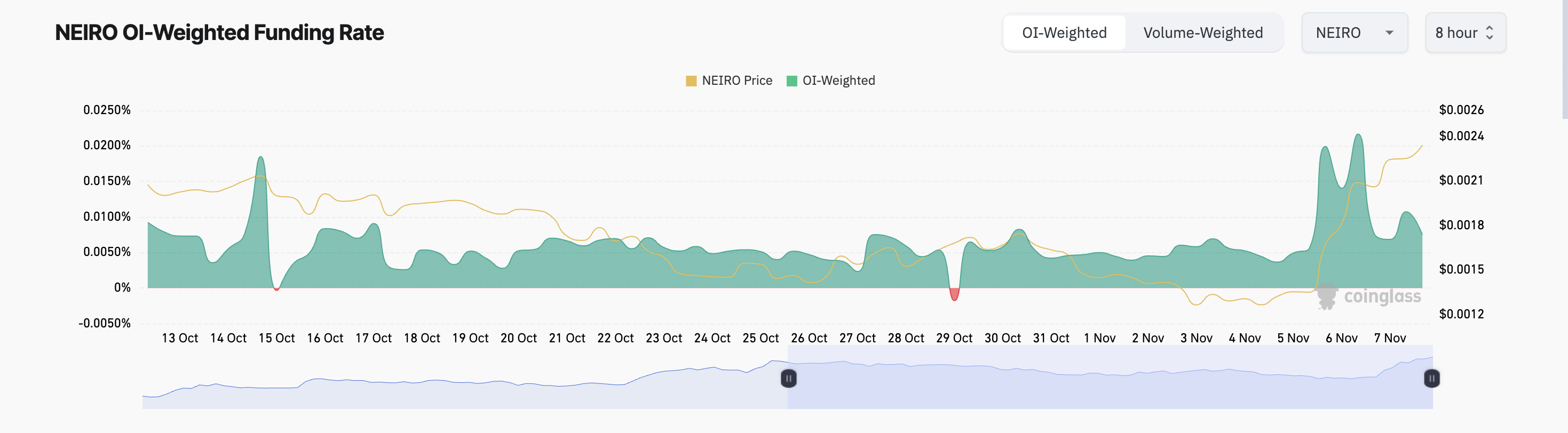

Further, NEIRO’s positive funding rate, which stands at 0.0075% as of this writing, reflects the bullish bias that the meme coin currently enjoys.

The funding rate is a mechanism used in perpetual futures contracts to maintain the contract’s price close to the spot price of the underlying asset. When it is positive, it indicates a high demand for long positions, as more traders are willing to bet on the asset’s price rising.

During a price rally, as in NEIRO’s case, a positive funding rate suggests that market sentiment is bullish, with traders largely expecting the price to continue climbing.

NEIRO Price Prediction: Profit-Taking Has To Stop

NEIRO is currently trading at $0.0023. Should the recent sell-off ease and renewed demand for the meme coin emerge, it could reclaim its all-time high of $0.0025 and potentially rally past it.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, ongoing profit-taking may push the token’s price further from this peak. Increased selling pressure could potentially make NEIRO’s all-time high unachievable in the near term. This could drive it down toward the support level, which would be formed at $0.0012.