The price of First Neiro on Ethereum (NEIRO) has increased by 2779% in the last 30 days. This development has led an entity that once made $145 million from Shiba Inu (SHIB) to buy the meme coin.

The crypto whale in question initially bet big on Neiro Ethereum (NEIROETH), but after holding it at a loss, they liquidated for the other NEIRO, which has been performing better. This analysis examines the significance of the whale’s position, and everything else is going on with NEIRO

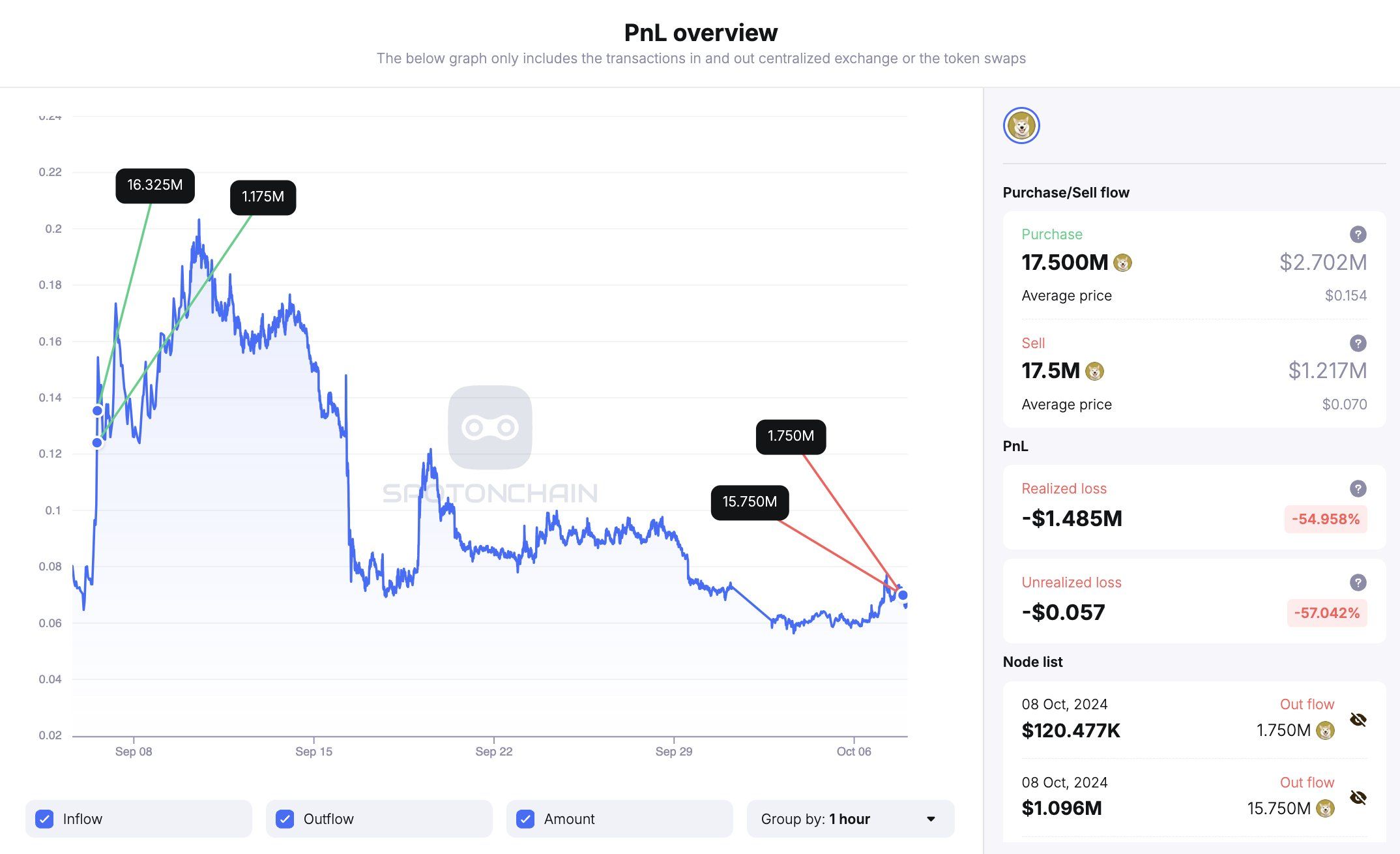

Whale Takes 55% NEIROETH Loss to Gain $2.67 Million

Initially, the whale invested in 17.5 million NEIROETH, only to sell it at a 55% loss — a move that cost them $1.49 million. However, they have since purchased 841.6 million NEIRO for $1.45 million, bringing their total holdings to 3.85 billion tokens valued at $6.51 million. Despite their earlier loss, the whale now enjoys $2.67 million in unrealized gains, reflecting a 67% increase.

The decision to choose NEIRO over NEIROETH could be linked to their recent individual performance. While Neiro on Ethereum came into the spotlight before First Neiro on Ethereum, the latter’s Binance listing gave it the upper hand.

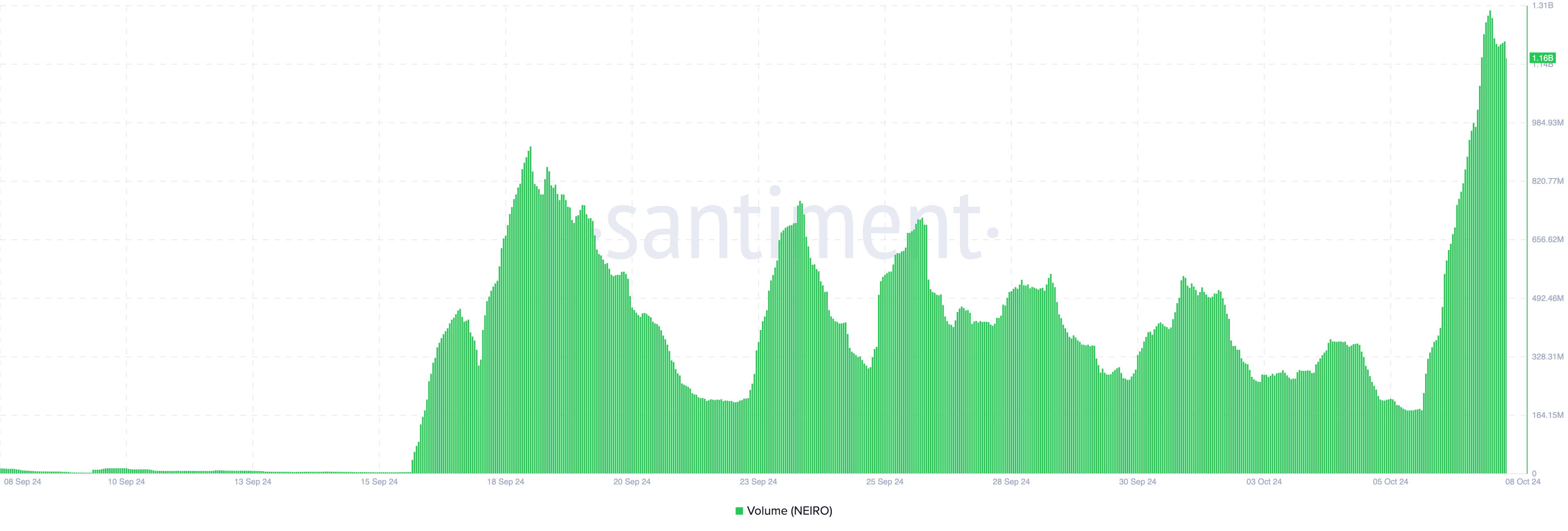

As a result, NEIRO’s price have been soaring while the former continues to hit new lows. Meanwhile, a look at the meme coin’s volume shows that it has exceeded $1 billion for the first since its launch.

This increase indicates rising investor interest in the token. Alongside the volume, NEIRO’s price, which is $0.0017, increased by 16.67% within the last 24 hours. Should the volume continue to rise with the price, then NEIRO could climb higher in the short term.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in October 2024

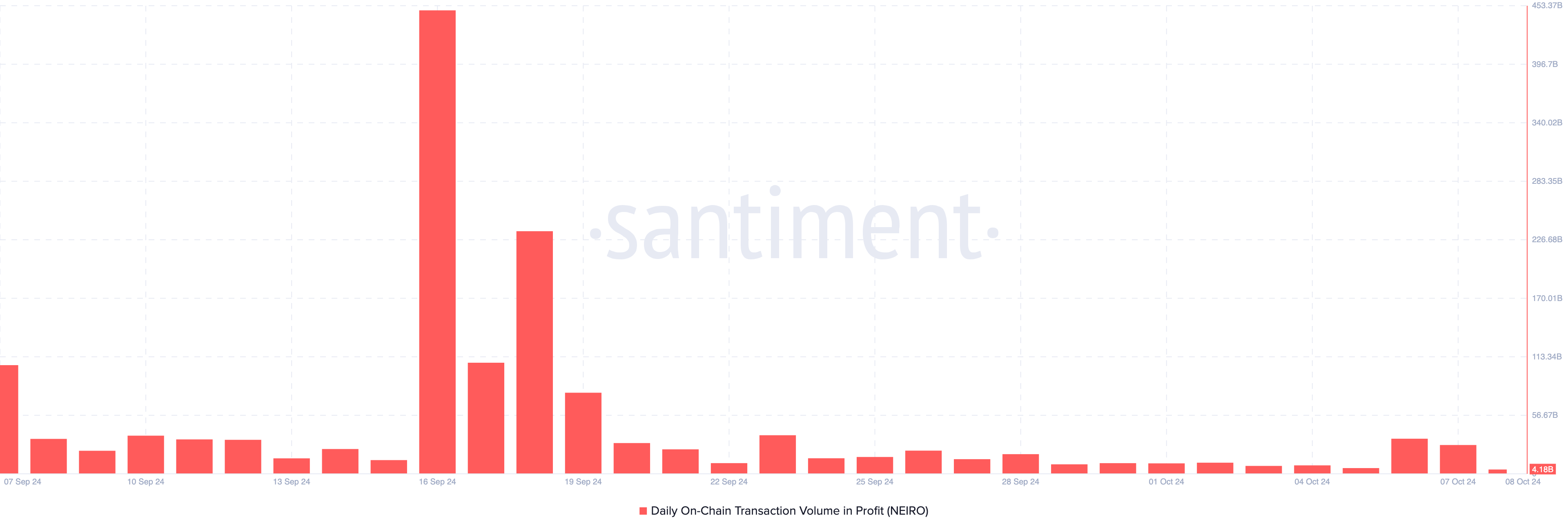

Despite the surge in price, on-chain data from Santiment shows that holders have yet to realize large profits. On September 16, the token’s daily on-chain transaction volume in profit was 448.98 billion. Today, that figure is less than 5 billion, indicating that NEIRO is facing less selling pressure and has a higher chance of appreciating.

NEIRO Price Prediction: Higher Highs

From a technical point of view, the Moving Average Convergence Divergence (MACD) is positive. The MACD uses the difference between the 12 and 26-period Exponential Moving Average (EMA) to measure momentum

When the indicator’s reading is positive, and the blue line is above the orange lines, momentum is bullish, and the price can increase. On the other hand, a negative reading indicates bearish momentum, which could lead to a pullback.

On the 4-hour chart, NEIRO appears to be facing resistance at $0.0017. However, considering the current momentum, it could breach the zone. Once that happens, the NEIRO’s price could climb past $0.0018 and rally beyond $0.0020.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

Meanwhile, this prediction might be invalidated if the token finds it challenging to break past $0.0018. In that scenario, the meme coin’s value could sink to $0.0015.