The NANO price increased significantly at the beginning of January 2021 but has failed to clear a crucial long-term resistance area.

While the longer-term trend seems to be bullish, the lack of structure and ambiguity in technical indicators makes the direction of the short-term trend unclear.

NANO Long-Term Levels

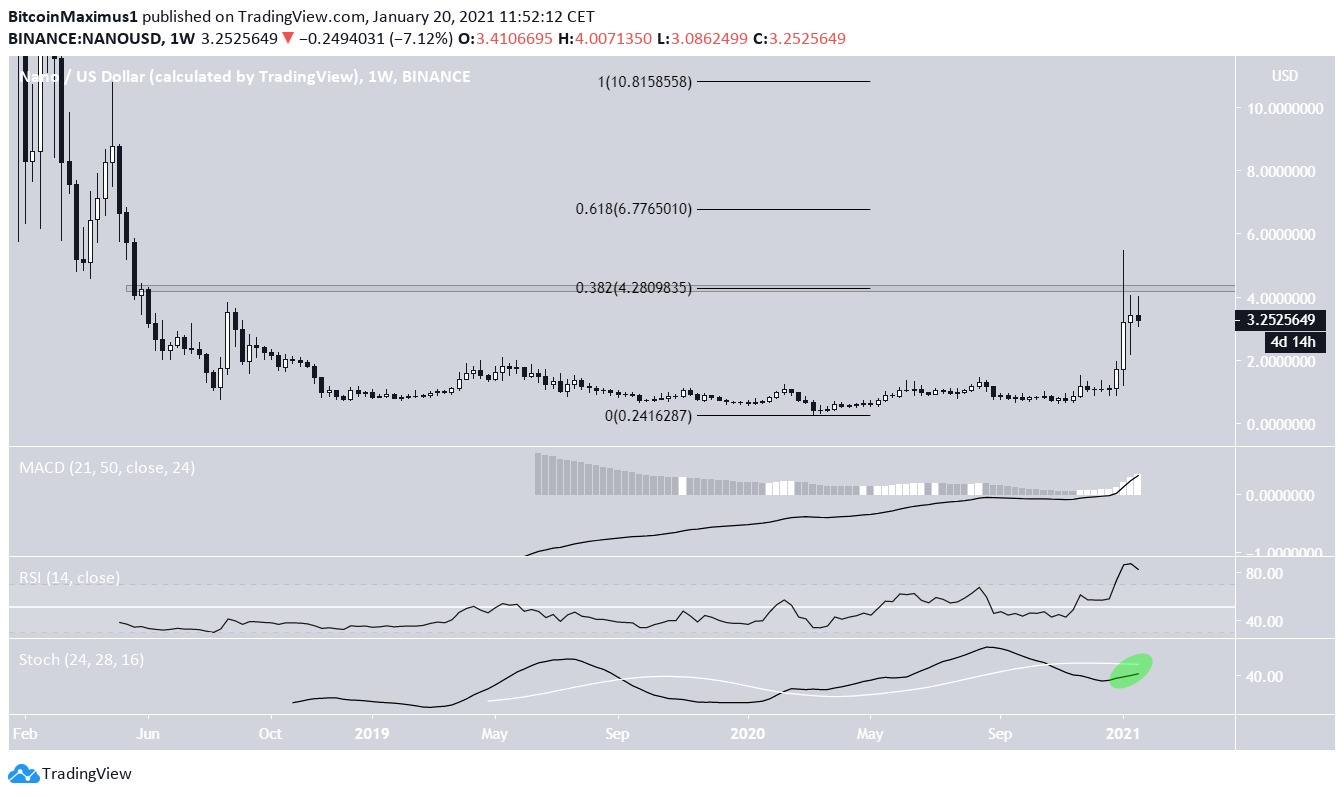

NANO began a significant upward move in the final week of December 2020, concluding with a high of $5.49 on Jan. 7, 2021.

However, the higher prices could not be sustained, and NANO decreased after creating a long upper wick. It fell below the $4.28 resistance area, which is the 0.382 Fib retracement level of the entire downward movement.

Despite the decrease and the fact that NANO is still trading below resistance, technical indicators are bullish. These factors support the continuation of the upward movement.

A bullish cross in the Stochastic oscillator (green circle in the image below) would likely confirm that the trend is bullish, especially if NANO were to increase above $4.28.

Short-Term Movement

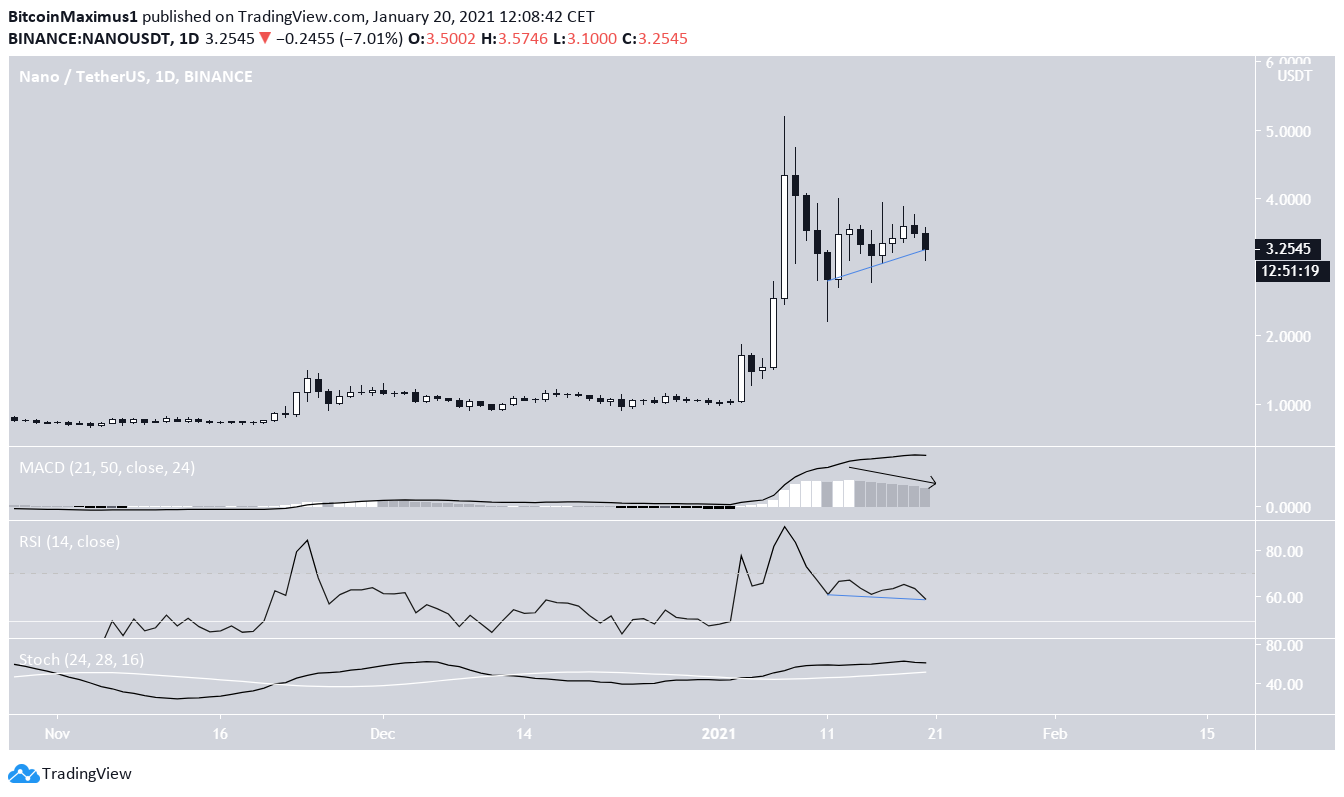

The daily chart provides ambiguous signals.

While the MACD is decreasing, the Stochastic oscillator has made a bullish cross and is moving upwards. Furthermore, the RSI has potentially generated a hidden bullish divergence, though it’s unconfirmed until the daily close.

Furthermore, there is no structure currently in place.

The two-hour chart shows that there is a support area at $2.90, which is the 0.618 Fib retracement level.

While technical indicators are neutral, the short-term trend can be considered bullish as long as it’s trading above this level.

NANO Wave Count

Cryptocurrency trader @Pro0Future outlined a NANO chart, stating that that the next leg up is likely to begin soon.

The wave count suggests that the price is likely in wave 4 of a bullish impulse (shown in white below) that began with the March 2020 lows.

While the exact shape of the wave 4 correction is not clear, a decrease below the wave 1 high of $1.45 (red line) would invalidate this particular wave count.

It’s possible that the correction has taken the shape of a symmetrical triangle since this is a fourth wave. However, the pattern is not confirmed.

A decrease below the C wave low of $2.73 would invalidate the triangle and indicate that the price is still correcting inside a more complex structure.

Conclusion

While the direction of the trend for NANO is not clear, the short-term trajectory is considered bullish as long as it’s is trading above $2.80.

The long-term trend is considered bullish as long as NANO is trading above $1.45.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.