Multi-chain strategies need to be developed for the long-term, says Diane Dai of DODO.

When it comes to 2022 crypto trends, interoperability is the name of the game. It’s what binds the interlocking puzzle of DeFi, NFTs, metaverse and utility use-cases.

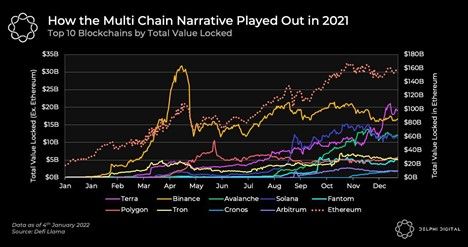

Indeed, the sheer volume of new users, assets, and platforms that have appeared in the blockchain world over the past few years has made it clear that no one chain will ever rule them all. The ecosystem is simply so large and diverse that no single blockchain can provide all of the necessary tools to support it, much less scale to accommodate it. And yet, not all blockchains are created equal. It’s certainly possible – even likely – that many of them will not exist in the future.

Therefore, decentralized application (dApp) builders that are taking a long-term approach to development need to be smart about how, when, and where they choose to deploy. However, there’s a fine line between being prudent and being overly discriminating. Builders need to strike the right balance between being discerning and prioritizing inclusivity.

Therefore, it is unwise to prematurely rule out any blockchains based on perceived ideological differences or apparent compatibility. For instance, as the interoperability narrative develops, two distinct camps are emerging: Ethereum Virtual Machine (EVM)-compatible and non-EMV-compatible chains (in other words, chains that are capable of running dApps intended to operate on Ethereum, and chains that are not).

To create the best long-term growth strategies, developers must take a “both/and” approach to their multi-chain deployment – one that is inclusive of chains that belong to both of these groups. Still, it’s important to examine what’s happening in the short term when it comes to the development and use of these blockchains.

Examining Growth Patterns in EVM and Non-EVM Spheres

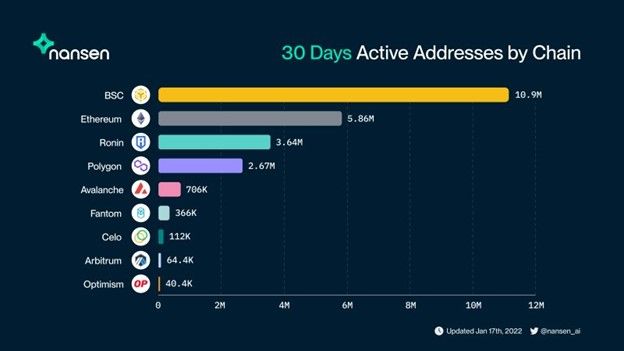

Comparing these two factions side-by-side, it may seem on the surface that Ethereum and EVM-compatible chains are “winning” the innovation competition.

The prevalence of EVM-compatibility means that dApp creators can easily reach larger groups of people, and Ethereum has the largest and most active group of developers of any blockchain. However, looking closer at the behavior of users and dApp developers on Ethereum and EVM-compatible chains raises some questions about how sustainable this activity will be over the long term.

Indeed, EVM-compatible chains face two challenges that could slow their growth and viability in the future. These challenges relate to technical depth and user loyalty.

dApps and Developers

dApps that are written using Solidity – Ethereum’s smart contract-based programming language – can be easily deployed onto EVM-compatible chains. Because dApps are open-source, developers can easily borrow pieces of code from one another to create new kinds of platforms.

This fluidity between EVM-compatible chains – coupled with the ease-of-access to tools for developers – arguably makes innovation happen more quickly in the EVM “camp.”

However, this level of flexibility comes at a cost. Because dApps are so easy to create and deploy across the EVM ecosystem, it is easier for people to essentially copy-and-paste code. This can encourage the development of a “move fast and break things” culture in which platforms, users, and value appear quickly – and disappear even faster.

Indeed, some EVM dApp creators build specifically for short-term gains: they promise substantial APYs, which attracts scores of liquidity providers (LPs). Seeking financial gains, these LPs move quickly from one platform to another, triggering huge bouts of transient activity. In this way, the system both creates and encourages “yield chasers”: people who move from platform to platform seeking high returns, with no commitment to long-term growth on any of them.

While the multi-chain expansion is still very much underway, it’s clear that there’s not going to be one clear winner. And that’s a good thing, as it aligns with the web3 ethos that drives DeFi.

Growth and Development on Non-EVM Chains

This culture of yield-chasing has a negative impact on the overall profitability and economics of DeFi protocols. This is because of the prevalence of rented capital: to maximize their profits, yield chasers rent capital for the short term. But when unfavorable market conditions occur (as they inevitably do), many users pull out. This creates a downward spiral, causing those operating on loaned capital to pay more “rent” to its owners. As a result, all of the rich liquidity and user activity that was created in more favorable conditions can vanish in an instant. This fragile market depth is not conducive to an ecosystem that offers a rich diversity of use cases.

Non-EVM chains, by contrast, do not typically face challenges associated with yield-driven transience. Rather, they tend to develop and attract both users and developers that stick around for the long term. On the other hand, they are not as flexible as their EVM counterparts, and do not currently support efficient portability between chains.

The primary reason behind all of these differences has to do with the way non-EVM chains are designed. Because each of them has a unique technical stack, developers that want to build dApps on top of them must learn each chain’s unique language and technical idiosyncrasies.

The investment in time and effort that this requires encourages loyalty and long-term building – and ultimately, we believe that the non-EVM sphere will give way to new kinds of blockchain infrastructures. These new solutions will enable new use cases, including different models that can be composed together into new technical stacks. Imagine systems that efficiently combine multiple blockchains within single applications: one chain for liquidity, one for consensus, one for storage, and so on. The possibilities are endless.

Multi-Chain Strategies: What Does This All Mean for Developers?

When dApp creators are developing their multi-chain deployment strategies, they are best positioned to balance the short-term activity in the EVM-compatible blockchain sphere with the long-term technical potential of the non-EVM world.

This is the approach that DODO has taken toward multi-chain deployment. The team prioritizes Layer-1 (L1) chains in both domains, seeking networks that have robust teams and strong communities of users and developers. This enables DODO to establish itself as the native DEX in L1s across both EVM and non-EVM domains.

This kind of “maximalist” approach is suitable for all dApp developers seeking to build for the long-term future. There will never be one chain to rule them all – instead, many chains will reign together.

Got something to say? Write to us or join the discussion in our Telegram channel.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.