MicroStrategy CEO Michael Saylor fired back at MSCI’s review of the company’s classification, framing his firm as a hybrid operating business, not an investment fund.

The clarification comes amid a formal consultation on how digital asset treasury companies (DATs) should be treated in flagship equity indexes, a decision that could have major market consequences for MSTR.

Michael Saylor Draws the Line: “MicroStrategy Is Not a Fund or Trust” Amid MSCI Scrutiny

In a detailed post on X (Twitter), Saylor emphasized MicroStrategy is not a fund, not a trust, and not a holding company.

“We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital,” he articulated.

The statement positions MicroStrategy as more than a Bitcoin holder, with Saylor noting that funds and trusts hold assets passively.

“Holding companies sit on investments. We create, structure, issue, and operate,” Saylor added, highlighting the company’s active role in digital finance.

This year, MicroStrategy completed five public offerings of digital credit securities: STRK, STRF, STRD, STRC, and STRE. These total more than $7.7 billion in notional value.

Notably, Stretch (STRC) is a Bitcoin-backed treasury instrument that offers variable monthly USD yields to both institutional and retail investors.

Saylor describes MicroStrategy as a Bitcoin-backed structured finance company that operates at the intersection of capital markets and software innovation.

“No passive vehicle or holding company could do what we’re doing,” he said, stressing that index classification does not define the company.

Why MSCI’s Decision Matters

MSCI’s consultation could reclassify firms like MicroStrategy as investment funds, making them ineligible for key indexes such as MSCI USA and MSCI World.

Exclusion could trigger billions in passive outflows and heighten volatility in $MSTR, which is already down roughly 70% from its all-time high.

The stakes extend beyond MicroStrategy. Saylor’s defense challenges traditional finance (TradFi) norms, asking whether Bitcoin-driven operating companies can maintain access to passive capital without being labeled as funds.

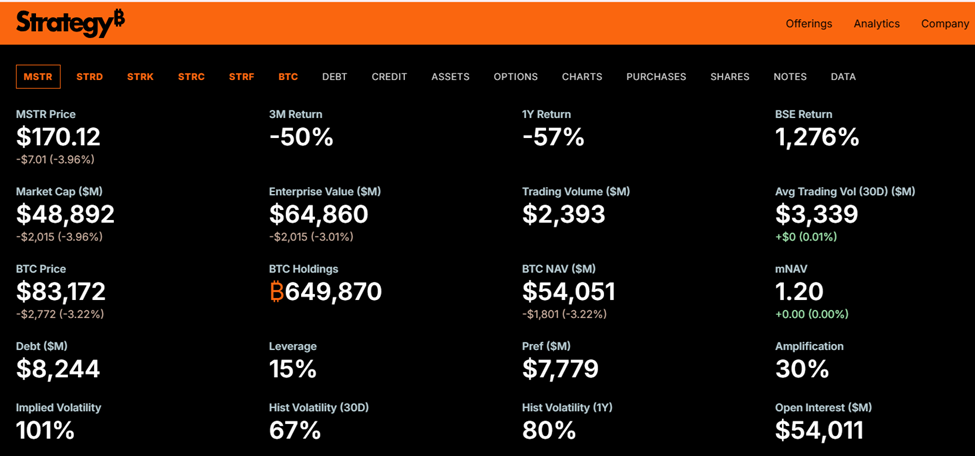

MicroStrategy holds 649,870 Bitcoin, with an average cost of $74,430 per coin. Its enterprise value stands at $66 billion, and the company has relied on equity and structured debt offerings to fund its Bitcoin accumulation strategy.

The MSCI ruling, expected by January 15, 2026, could test the viability of such hybrid treasury models in public markets.