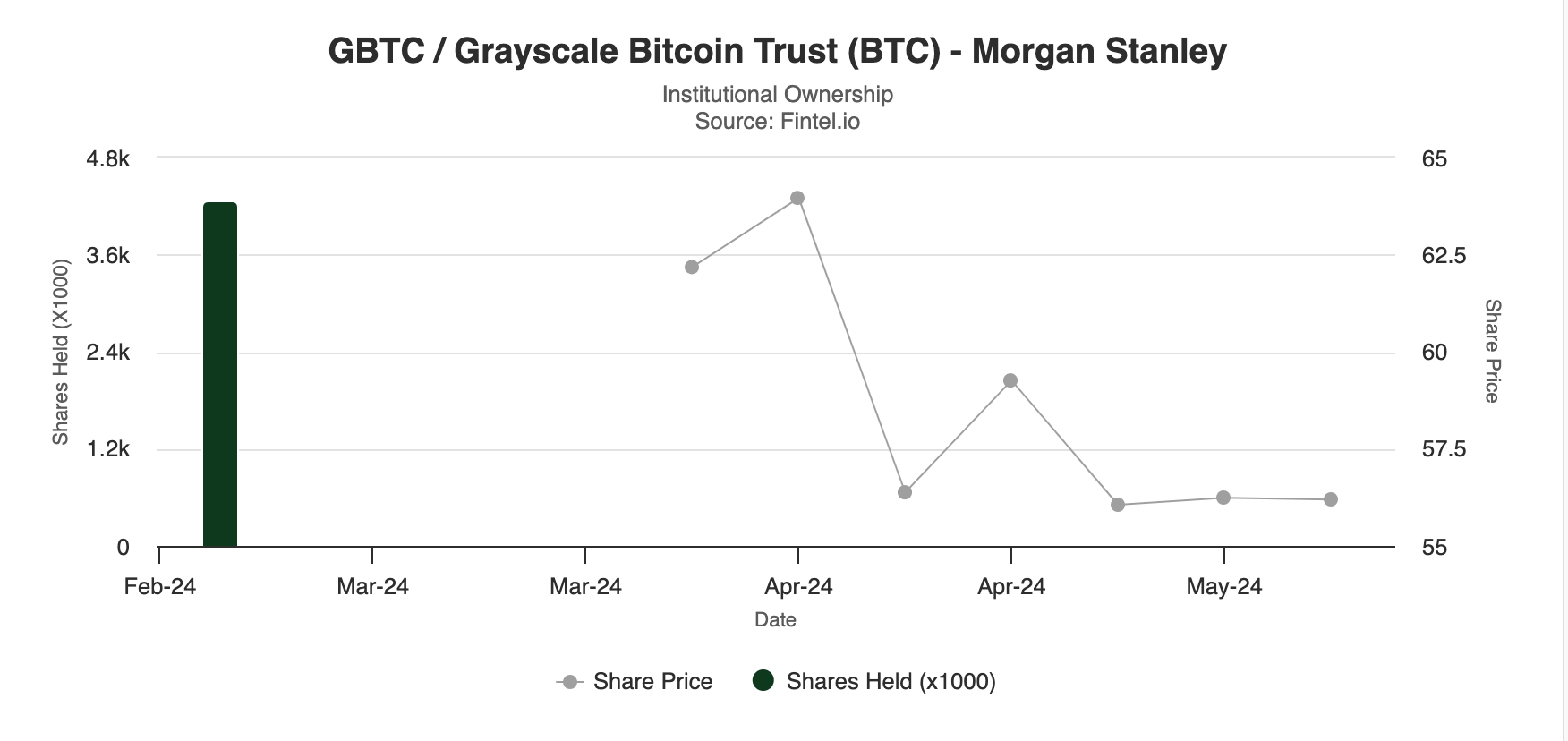

Morgan Stanley invested $269.9 million in Grayscale’s GBTC, as disclosed in their first quarter 13F filing.

This makes Morgan Stanley one of the top holders of GBTC, second only to Susquehanna International Group, with a $1.0 billion investment.

Morgan Stanley Becomes a Major Player in Bitcoin ETFs

The allocations were reported during the first-quarter 13F filing deadline, marking the end of the initial period for investors to buy most spot Bitcoin ETFs. Bitwise CIO Matt Hougan highlighted the importance of these investments, estimating that over 700 professional firms purchased nearly $5 billion in BTC ETFs by May 15.

Institutional investors’ interest in BTC is generally considered an extremely positive phenomenon. Yet, some experts believe that it has another side.

“It’s a double-edged sword, bringing both benefits and new challenges for the market. This influx of institutional money can enhance liquidity, reduce volatility, and provide a more structured investment environment. However, it also attracts more regulatory scrutiny as authorities aim to ensure investor protection and market integrity,” Iva Wisher, Co-founder & COO Prom told BeInCrypto.

Continued Entry of Financial Giants into Bitcoin ETFs

Traditional financial institutions’ growing demand for cryptocurrency is gaining momentum. Pine Ridge Advisers, a New York advisory firm, invested $205.8 million in various Bitcoin ETFs, while Boothbay Fund Management revealed a $377 million exposure to Bitcoin ETFs, diversifying holdings across IBIT, FBTC, GBTC, and BITB.

Aristeia Capital Llc disclosed a $163.4 million investment in IBIT. Graham Capital Management reported $98.8 million in IBIT and $3.8 million in FBTC. CRCM Lp and Fortress Investment Group LLC also invested significantly in IBIT.

Read more: What Is a Bitcoin ETF?

Vanguard, however, has taken a different stance on Bitcoin ETFs. Salim Ramji, the incoming CEO of Vanguard, reiterated their decision not to offer the instrument. Ramji emphasized Vanguard’s commitment to consistency in its investment philosophy. He supported CIO Greg Davis’ explanation, aligning with Vanguard’s long-term strategy.

The contrasting approaches between Vanguard and Morgan Stanley regarding Bitcoin ETFs highlight what drives an asset management firm’s decision to either embrace or avoid these cryptocurrency investment vehicles.

“Multiple underlying factors are counted like Investment philosophy, risk tolerance, and client demographics.

Vanguard’s decision aligns with its conservative, long-term investment approach, focusing on broad market exposure and minimizing risk. While Morgan Stanley’s approach reflects a more aggressive strategy, targeting higher returns through newer and potentially riskier asset classes,” Wisher added.