Until the advent of cryptocurrencies, “cleaning” illicit funds was a much more complex process. In recent years, crypto money laundering has made it easier.

Money laundering involves illegally converting proceeds from criminal activities into legitimate funds. Traditionally, this was done by running illegally obtained money through legitimate businesses. The aim is to avoid detection and disguise the illicit funds as lawful profits.

Criminals, however, are increasingly turning to crypto. Cryptocurrencies possess two characteristics that make them a highly attractive option for criminal organizations. Firstly, the decentralized nature of cryptocurrencies allows for a certain degree of anonymity, which can make it more difficult for law enforcement agencies to track transactions.

Secondly, the convenience of cross-border transfers is useful for those looking to move significant amounts of money quickly and discreetly. As a result, cryptocurrencies have become a preferred choice for criminal organizations looking to move large sums of money without being detected.

2022 Was A Record Year For Crypto Money Laundering

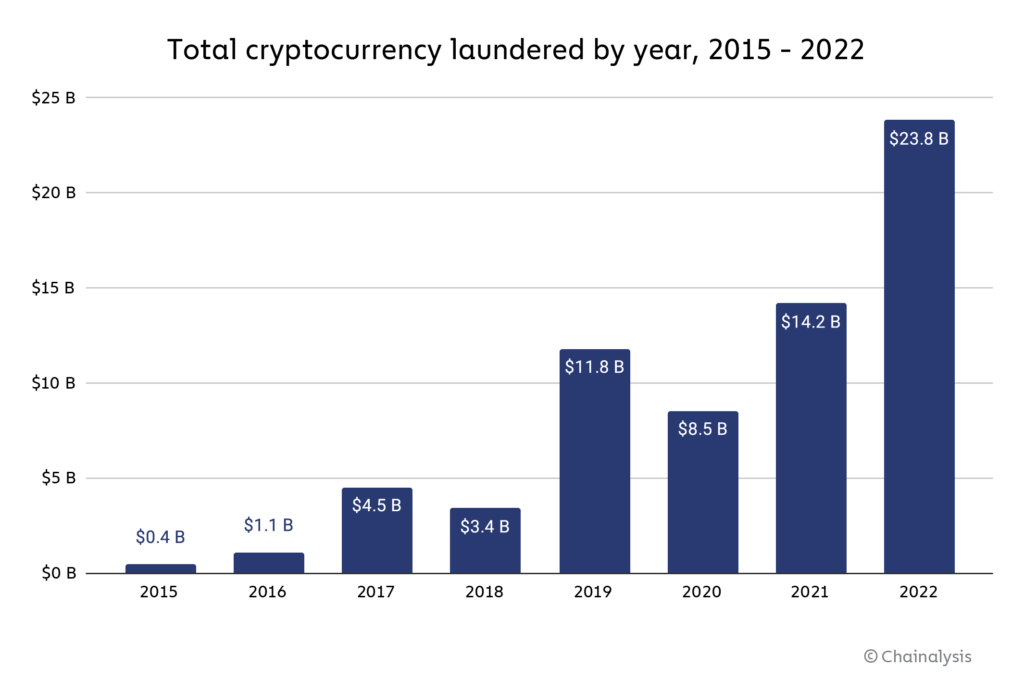

According to Chainalysis, 2022 was the biggest year yet for crypto money laundering. In 2022, illicit addresses transferred about $23.8 billion in cryptocurrency, a 68.0% rise from 2021.

Mainstream centralized exchanges received almost half of the total illicit funds, despite having compliance measures to report suspicious activity and take action against offenders. This is noteworthy because these exchanges are where illegitimate cryptocurrency is converted into cash. They are also the most watched by law enforcement.

Recent findings from Elliptic, a blockchain analytics company, indicate that RenBridge, a specific cross-chain bridge, has laundered at least $540 million in cryptocurrency linked to criminal activity since 2020. Of this amount, $153 million was associated with ransomware payments. Hackers use RenBridge after infiltrating corporate networks and extorting payments from companies to retrieve their stolen data. Elliptic asserts that RenBridge plays a crucial role as an enabler for ransomware groups with connections to Russia.

According to Martin Cheek, the managing director of SmartSearch, which provides anti-money laundering (AML) and Know Your Customer (KYC) services, cryptocurrency has been a popular way to launder money for criminal organizations since the mid-2010s.

“As cryptocurrencies gained in popularity and value, criminals were provided a largely unregulated method to launder money and conceal illicit activities, he says. “Over time, as cryptocurrencies have come under scrutiny by regulators, their use for money laundering has become more difficult.

“However, criminals continue to find new ways to use crypto for money laundering. As a result, it remains a challenge for law enforcement agencies and financial regulators to detect and prevent money laundering in the crypto space.

85% of Crypto Firms Failed UK FCA Standards

Earlier this year, Britain’s Financial Conduct Authority (FCA) failed to pass 85% of all crypto firms applying for registration. Many of their requirements were related to anti-money laundering and anti-terrorism rules. (These are the same rules that apply to the traditional financial system.)

In most cases, Cheek believes this is down to a lack of expertise and internal process. “The registration process is not impossible, The Financial Conduct Authority does provide feedback and clear expectations. Last month the FCA reported that 41 had been approved by the regulator from the 300 applicants received. There is an opportunity to reapply, so it is important for firms to reach the required level and then evolve with the latest FCA guidelines and regulations to prevent exposing their businesses to the fraud, financial crimes, and Ponzi schemes that have made a mockery of out the market.”

In a few cases, the financial regulator identified possible financial crimes or direct links to organized crime. Law enforcement agencies were notified of suspected cases by the FCA.

Decentralized exchanges, which offer a higher level of anonymity, are increasingly being used to “clean” dirty cash. Sheek believes that smaller exchanges aren’t doing nearly enough to prevent money laundering on the scale that is needed. “By adopting cutting-edge electronic verification (EV), a small crypto exchange can check the identity of a user, safeguard assets, and enforce accountability. Common practices such as requesting an ID document are no longer sufficient. Not only do they not meet know-your-customer (KYC) and AML standards, but they can also leave the door open for identity theft.”

Law Enforcement Are Closing In

One of the law enforcement agencies focusing on crypto money laundering is the National Crime Agency. They are often considered Britain’s answer to the FBI. Along with its international colleagues, it uses better crypto knowledge and blockchain analysis tools to catch criminal activity.

Founded in 2013, its remit includes tackling serious and organized crime in the UK and across international borders. It recently announced it was recruiting for a new dedicated team based with the National Cyber Crime Unit, which will specifically deal with money laundering. The NCA plans another dedicated group for the Complex Financial Crime Team.

Speaking to BeInCrypto, we were told that crypto is being used across all crime types in the UK. Including “an increased use for money laundering.” However, this was “low in comparison to legitimate usage.”

A spokesperson told BeInCrypto that: “Cryptoassets are more frequently being reported as an enabler to serious and organized crime. Though, overall, the volume of crypto-related money laundering is still low when compared to the wider economy.”

“The threat lies with the exponential adoption of cryptocurrencies, and the criminal activity that we will inevitably encounter through that. It is therefore imperative that our response in this space continues to adapt and evolve, working closely with partners, internationally and across sectors.