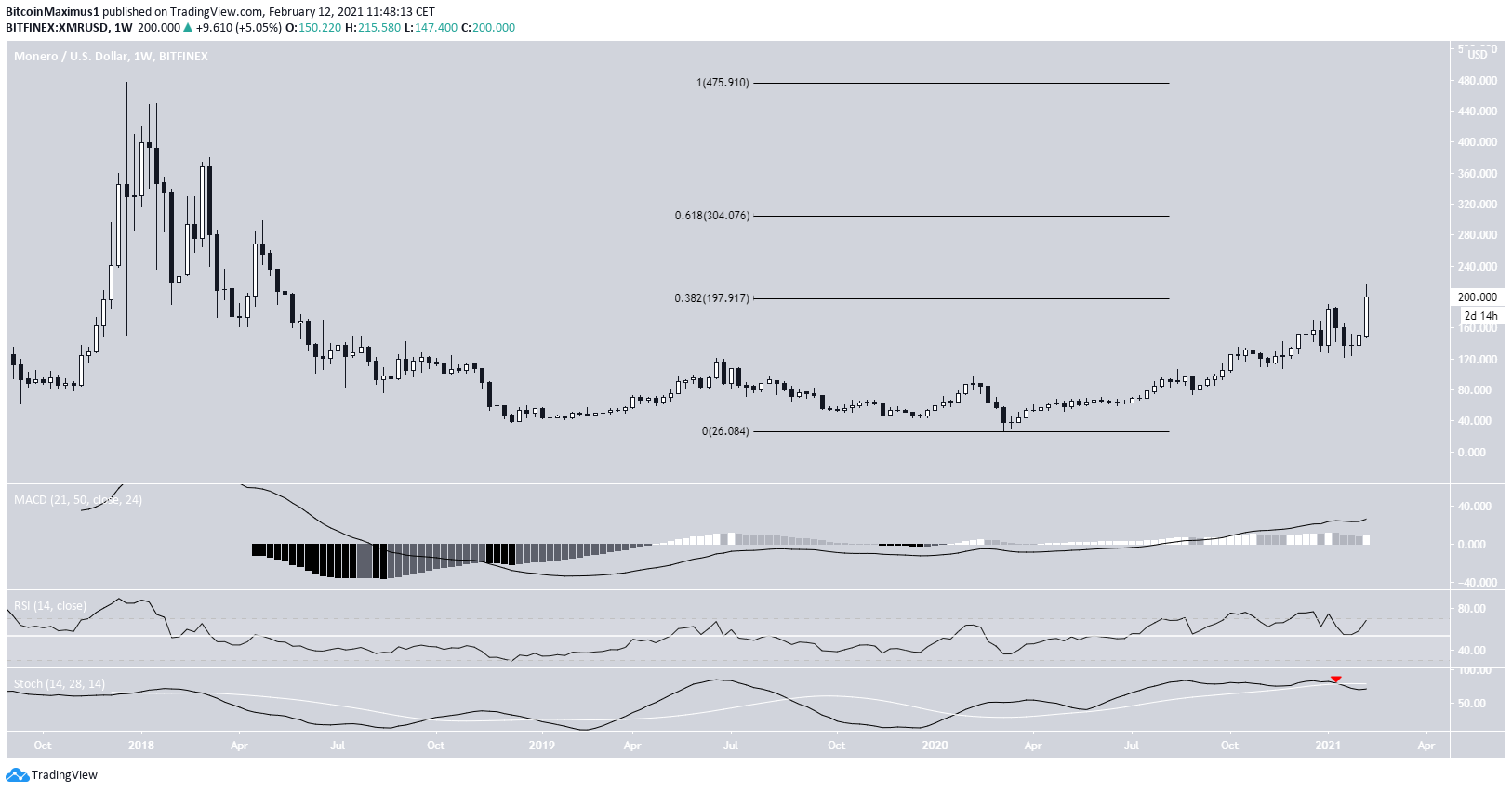

The Monero (XMR) price is currently in the process of moving above a long-term Fib resistance level at $200.

Monero is expected to move above this level and gradually increase towards $305.

Monero Long-Term Resistance

At the beginning of January 2021, XMR reached a high of $190 but was almost immediately rejected.

Despite the drop, XMR began another upward movement and is currently trading at $200.

This area is important since it’s the 0.382 Fib retracement level measuring from the all-time high price of $475 from December 2017.

If XMR were to break out above this level, the next important resistance area would be found at $305 (0.618 Fib retracement level).

However, technical indicators are undecided. While the MACD and RSI are both bullish, they are losing momentum. The Stochastic oscillator has made a bearish cross.

Therefore, a closer look at lower time-frames is required in order to determine the direction of the trend.

Current Movement

The daily chart shows that the previous resistance area is found at $187, and XMR is trading considerably above it.

In addition, technical indicators are bullish. The Stochastic oscillator has made a bullish cross and the RSI has just moved above 70.

Therefore, as long as XMR is trading above the $187 area, the trend is considered bullish and XMR is expected to move higher.

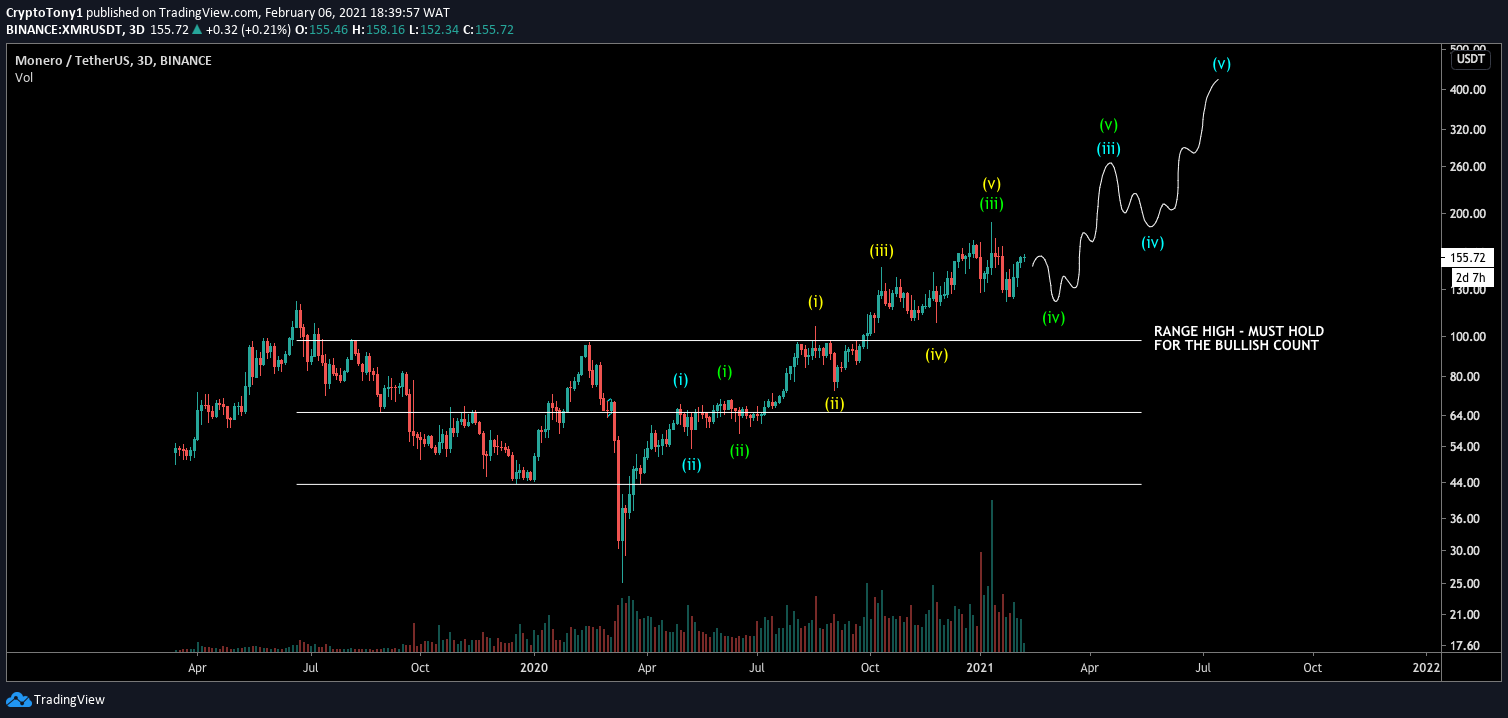

Wave Count

Cryptocurrency trader @CryptoTony_ outlined an XMR chart, stating that it looks to be in a long-term wave three, and could gradually increase above $400.

The wave count does suggest that XMR is in a long-term wave three (white) of a bullish impulse that began in March 2020. Wave three seems to have extended.

The most likely target for the top of this move is found at $305, which would give waves 1:3 a 1:1.61 ratio. Furthermore, it would coincide with the long-term 0.382 Fib retracement resistance.

The sub-wave count is shown in orange, indicating that XMR is in sub-wave three.

XMR/BTC

The XMR/BTC chart shows a completed double bottom pattern, which has also been combined with a bullish divergence in the RSI. Furthermore, the Stochastic oscillator has made a bullish cross and the MACD is increasing.

Therefore, XMR/BTC is expected to continue moving upwards towards the closest resistance area.

When zooming out, we can see that XMR has bounced at the ₿0.0037 area, which previously acted as resistance back in 2016. However, there is strong resistance at ₿0.0062, the previous breakdown level.

Until XMR/BTC manages to reclaim this area, we cannot consider the long-term trend bullish.

Technical indicators are undecided. While the RSI has generated a bullish divergence, the Stochastic oscillator has made a bearish cross.

Therefore, while an upward move towards ₿0.0062 is likely to occur, we cannot yet determine if XMR will break out.

Conclusion

Monero is likely in wave three of a bullish impulse and is expected to increase to $305.

While XMR/BTC is expected to increase towards ₿0.0062, we cannot yet determine if it will break out above this area.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.