The Monero (XMR) price has broken out from a long-term resistance area and validated it as support and is expected to continue moving upwards towards $125.

At the beginning of August, XMR broke out from a descending resistance line that had been in place for over a year.

Afterward, the price broke out above the March highs at $88 and validated the area as support after. The next resistance area is found at $126.

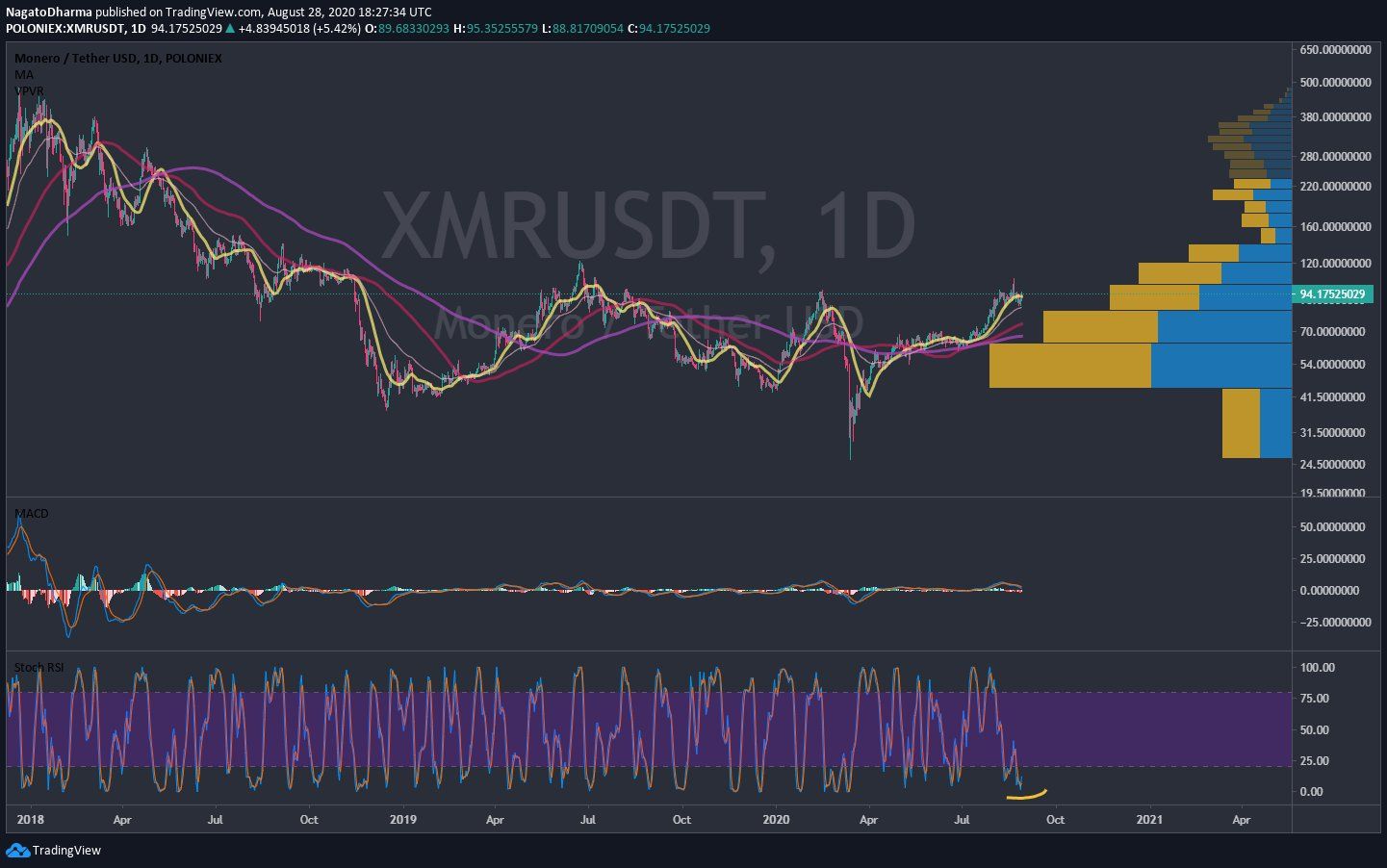

Technical indicators show that the rally is overextended but still appears bullish. Both the RSI and Stochastic RSI are increasing, even though they are both overbought. There is no bearish divergence for the time being.

Ripe For Continuation

Cryptocurrency trader @nagatodharma outlined an XMR chart which shows oversold conditions in the RSI, indicating that the price is expected to move upwards.

Wave Count

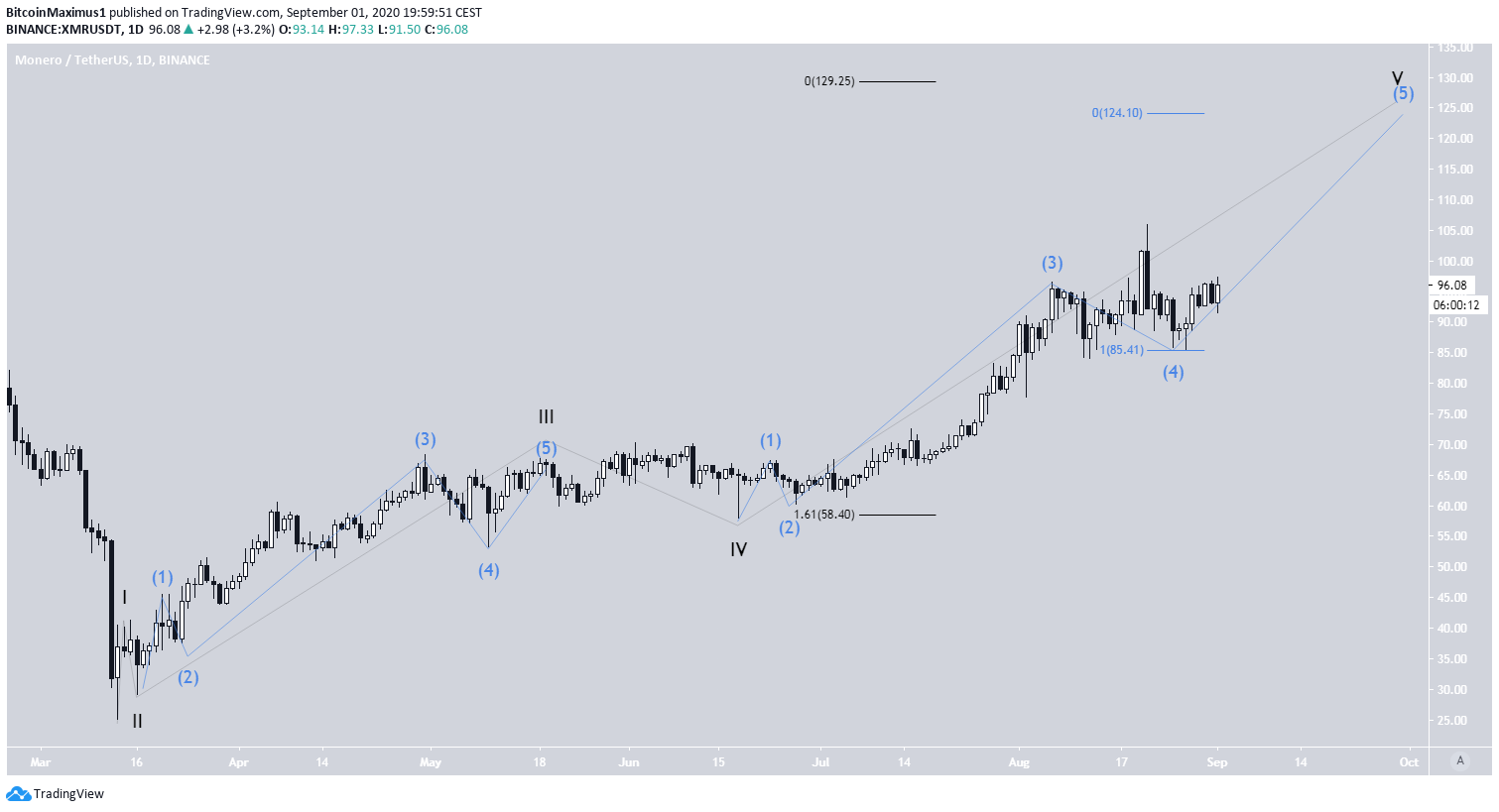

Since the beginning of March, the XMR price has likely begun a five-wave formation (shown in black below), which is expected to end between $124-$129, inside the resistance area outlined in the previous section. At the time of press, XMR was trading inside the fifth sub-wave (blue) of this formation. The target shown below is the 1.61 Fib level of waves 1-3 (black) and the 1 Fib level of sub-waves 1-3 (blue). A decrease below the sub-wave 4 low at $85.41 would invalidate this particular wave count.

XMR/BTC

The XMR/BTC pair looks similarly bullish. It has been consolidating near the 0.0065 satoshi support area since October 2019. Throughout this time, the RSI has generated considerable bullish divergence. Furthermore, the stochastic RSI has made a bullish cross and is moving upwards. If the price continues increasing as expected, it is likely to reach the closest long-term resistance area at ₿0.014.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored